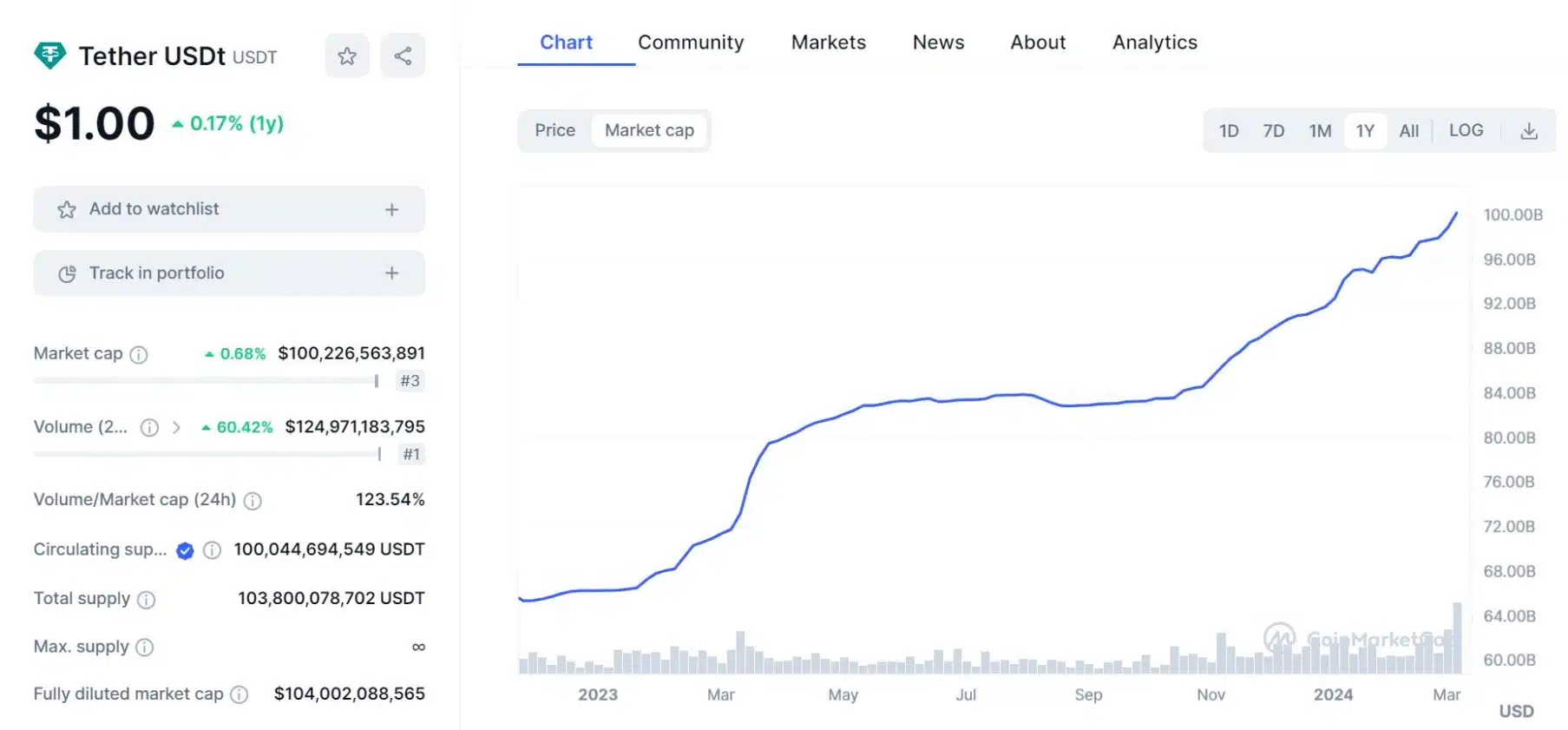

In the context of Bitcoin surpassing the $68,600 mark and nearing the ATH peak at $69,000, another pillar of the cryptocurrency industry, the stablecoin Tether (USDT), has also made history by reaching a market capitalization of over $100 billion for the first time in its 10-year history.

The USDT supply in the past 7 days has increased by an additional $2 billion, officially reaching $100.2 billion this morning, with the latest issuance transactions on the TRON network.

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 1,000,000,000 #USDT (1,001,555,000 USD) minted at Tether Treasuryhttps://t.co/iKQJX5o2BP

— Whale Alert (@whale_alert) March 4, 2024

Thus, since October 2023, when the crypto market began to recover, Tether’s market capitalization has swollen by an additional $17 billion.

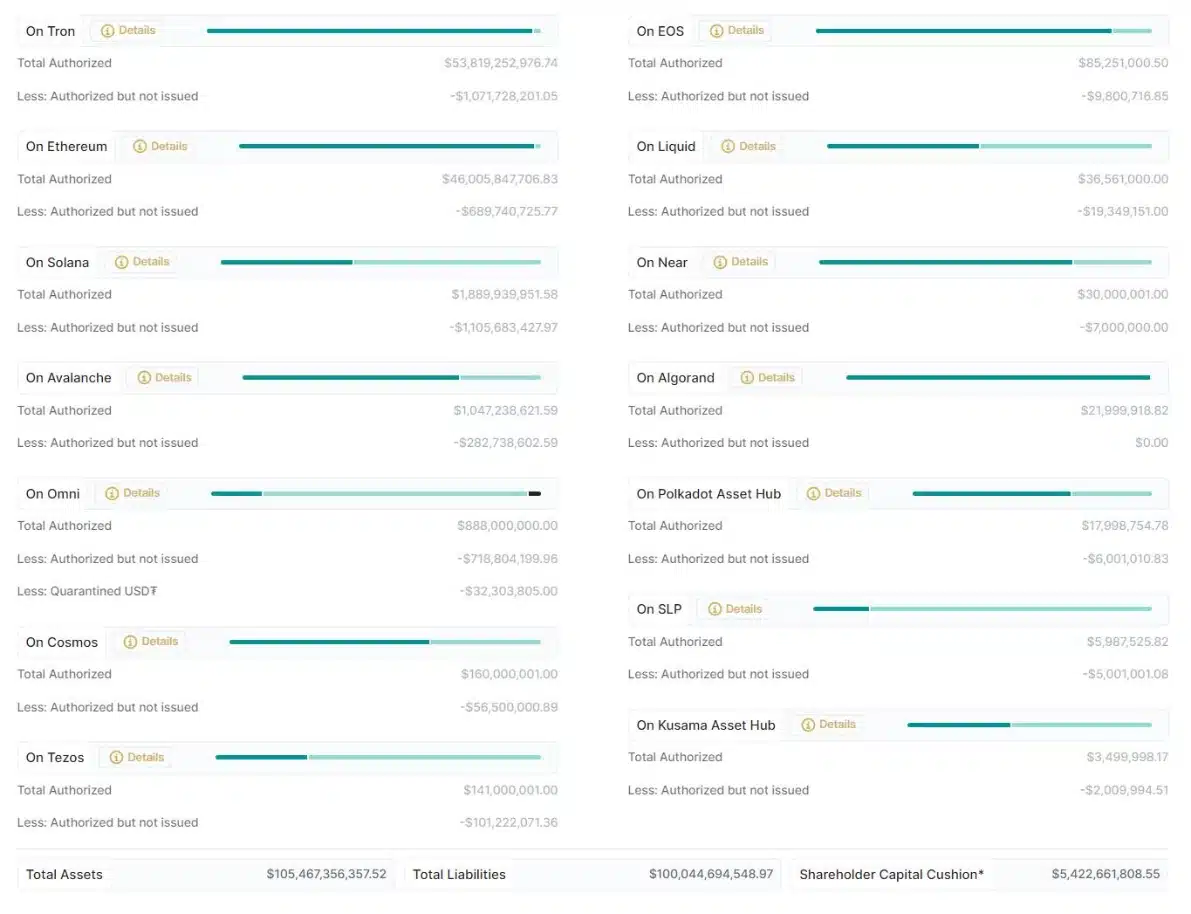

According to the latest data updated on the Tether website, over half of the USDT supply is concentrated on TRON with $53 billion USDT, followed by Ethereum with $46 billion, and other blockchains with much lower quantities.

Currently, Tether commands over 69% of the stablecoin market share, far ahead of USDC (20.5%), DAI (3.4%), and FDUSD (2.2%).

In the previous market cycle, Tether’s market capitalization reached its peak at $83 billion in April 2022, just before the LUNA-UST crash occurred. By 2023, this stablecoin attracted a significant market share as its main competitors, USDC and BUSD, encountered issues with depegging and legal obstacles, respectively.

Tether also had a highly successful year in 2023 due to its strategy of investing a large amount of assets backing USDT into US Treasury bonds, yielding up to $6.2 billion. The company then used the profit to create surplus reserves for USDT, as well as investing in Bitcoin, gold, and other initiatives.

All of Tether’s US Treasury bond holdings are held at Cantor Fitzgerald, an asset management company based in New York (USA). Responding to the media in January 2024, Cantor Fitzgerald CEO Howard Lutnick stated that Tether has enough assets to guarantee the value of USDT, expressing confidence in the stablecoin company’s operating model.

Related: USDT Spearheads the Recent Resurgence in Stablecoins

Tether (USDT) Market Cap Surpasses $100B

Source: CoinMarketCap

Very good 👍👌