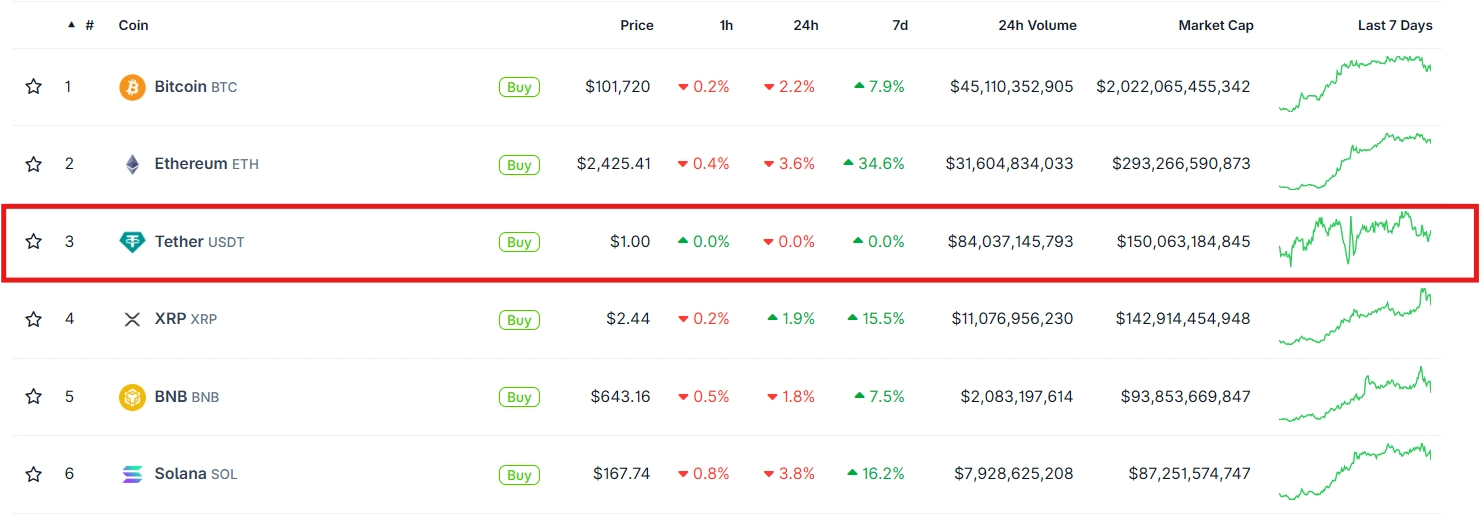

Tether, the issuer behind the world’s largest stablecoin USDT, has hit a new milestone as the total USDT in circulation surpasses $150 billion — the highest level ever recorded. CEO Paolo Ardoino confirmed this achievement on X earlier this week, following Tether’s latest update. In Q1 2025 alone, Tether posted over $1 billion in profits, continuing its impressive growth streak since late 2022.

Tether’s investment portfolio in Q1 2025 revealed nearly $120 billion in U.S. government bonds, including direct holdings, money market funds, and reverse repurchase agreements. The majority of USDT reserves are backed by short-term U.S. Treasury bills — highly liquid, safe assets offering stable returns amid rising interest rates.

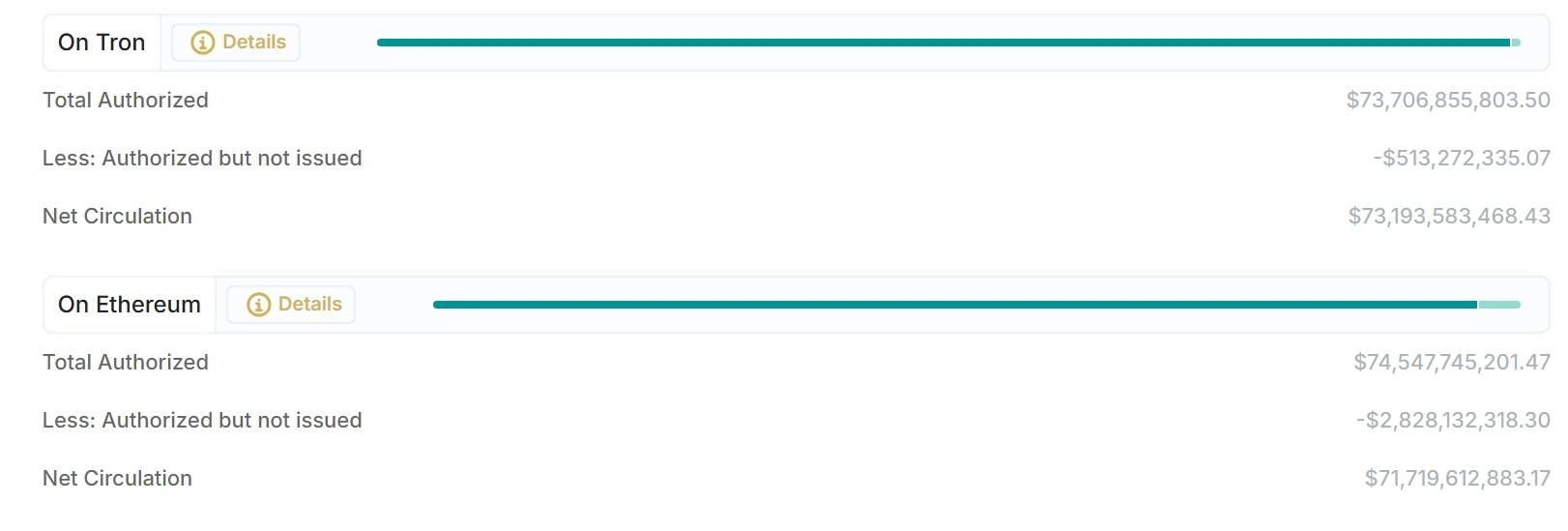

TRON Overtakes Ethereum in Circulating USDT

On the blockchain infrastructure front, Tether recorded a significant shift: over $73 billion in USDT has now been issued on the TRON network, surpassing Ethereum for the first time in terms of circulation. This trend reflects growing user and institutional preference for TRON, thanks to its low fees, fast transaction speeds, and particular advantages in DeFi, peer-to-peer trading, and cross-border payments. While Ethereum remains critical to Web3, it’s gradually losing its stablecoin dominance to cost-efficient networks like TRON.

Related: American Youth Dive into Memecoins Amid Financial Stalemate

Tether Dominates the Stablecoin Market

Tether continues to lead the stablecoin race by a wide margin. Circle, the issuer of USDC, has only $60 billion in circulation — less than half of Tether’s supply. New stablecoins like USDS (Sky), USDe (Ethena), and USD1 (a project tied to the Trump family) each remain under the $10 billion mark, highlighting the vast gap in scale and adoption.

With $150 billion USDT in circulation, over $1 billion in quarterly profits, a $120 billion U.S. Treasury portfolio, and a strategic shift toward TRON, Tether is cementing its position as the undisputed king of stablecoins — poised for a new phase of promising growth.