According to the Wall Street Journal, U.S. federal investigators are scrutinizing Tether (USDT) over allegations of violating financial sanctions and anti-money laundering regulations.

Specifically, prosecutors at the Manhattan U.S. Attorney’s Office, part of the Department of Justice, are gathering evidence on the potential misuse of Tether by third parties to facilitate criminal activities such as drug trafficking, terrorism financing, cyberattacks, and money laundering related to these acts.

In the past, Tether has frequently collaborated with U.S. authorities to combat criminal activities, leading to the freezing of assets totaling hundreds of millions of dollars in December 2023. However, in 2021, the company was fined a total of $61 million by the Commodity Futures Trading Commission (CFTC) and New York state authorities for deficiencies in the collateralization of its USDT stablecoin.

The news of an investigation into Tether comes as the stablecoin company is rumored to be planning a move into traditional finance to expand its business activities. This follows an extremely successful first half of 2024, during which Tether earned a record profit of $5.2 billion through its investment strategy in U.S. Treasury bills, making it the 18th largest holder of U.S. Treasuries globally. Recently, USDT’s market capitalization surpassed the $120 billion mark, helping the cryptocurrency market to recover significantly.

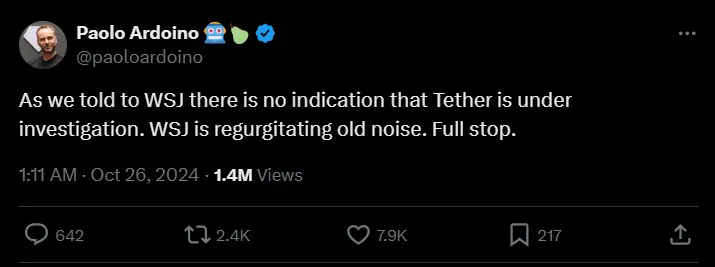

The cryptocurrency market reacted swiftly to these news. Bitcoin’s price initially dropped to $65,600/BTC, then rebounded to around $66,800/BTC after Tether’s CEO clarified the situation.