Telegram Raises $1.5 Billion from BlackRock, Mubadala, and Citadel

According to the Wall Street Journal, Telegram – the messaging platform with over 1 billion monthly users – is nearing completion of a bond issuance deal worth at least $1.5 billion. This bond has a five-year term, a yield of 9%, and allows investors to convert it into equity at an attractive discount if Telegram goes public in the future.

Major players such as BlackRock, Mubadala (the UAE’s sovereign wealth fund), and Citadel – one of the world’s leading hedge funds – are among the investors in Telegram.

The funds raised will be used to buy back a portion of bonds issued in 2021, which are set to mature in March 2026. Previously, Telegram spent $400 million in cash to redeem some old bonds.

TON Appoints Former Visa Executive to Strengthen Payment Strategy

At the same time, the TON Foundation – the organization behind the Telegram Open Network (TON) blockchain – has recruited Nikola Plecas, former director of Visa’s crypto division, as Vice President of Global Payments.

Plecas will lead TON’s comprehensive payment strategy, from collaborating with Telegram applications, optimizing on-ramp/off-ramp processes, to building infrastructure to support transactions between fiat and crypto.

TON CEO Max Crown stated, “We expect payments to become a cornerstone of the TON ecosystem, connecting decentralized services with mainstream users.”

Related: Telegram Dismantles the Largest Darknet Marketplace Ever Existed

Telegram Reports Impressive Financial Results

In 2024, Telegram achieved remarkable growth with revenues of $1.4 billion and profits of $540 million, completely reversing the $173 million loss from 2023. It is projected that in 2025, revenue could reach $2 billion, with profits exceeding $700 million.

Telegram’s main revenue sources come from advertising, the bot ecosystem, in-app payments (like sending gifts using “star” tokens), and partnerships with developers building applications on the platform. The number of paid users has also doubled, surpassing 15 million from the previous year.

Despite achieving impressive financial milestones, 2024 was still a tumultuous year for Telegram and CEO Pavel Durov. The Russian billionaire, with a net worth of over $15 billion, is facing one of the high-profile criminal investigations in the tech industry.

In August 2024, Durov was arrested in France on charges related to criminal activities conducted through the messaging platform. If convicted, he could face up to 20 years in prison. However, by March 2025, French authorities returned Durov’s passport, restoring his freedom of movement after a period of restriction.

According to Forbes, Pavel Durov’s net worth is currently estimated at $15.5 billion. The Telegram founder has invested in Bitcoin for the past 10 years and has recently integrated cryptocurrency into the app, supporting the TON blockchain, crypto wallets, and various Web3 mini games.

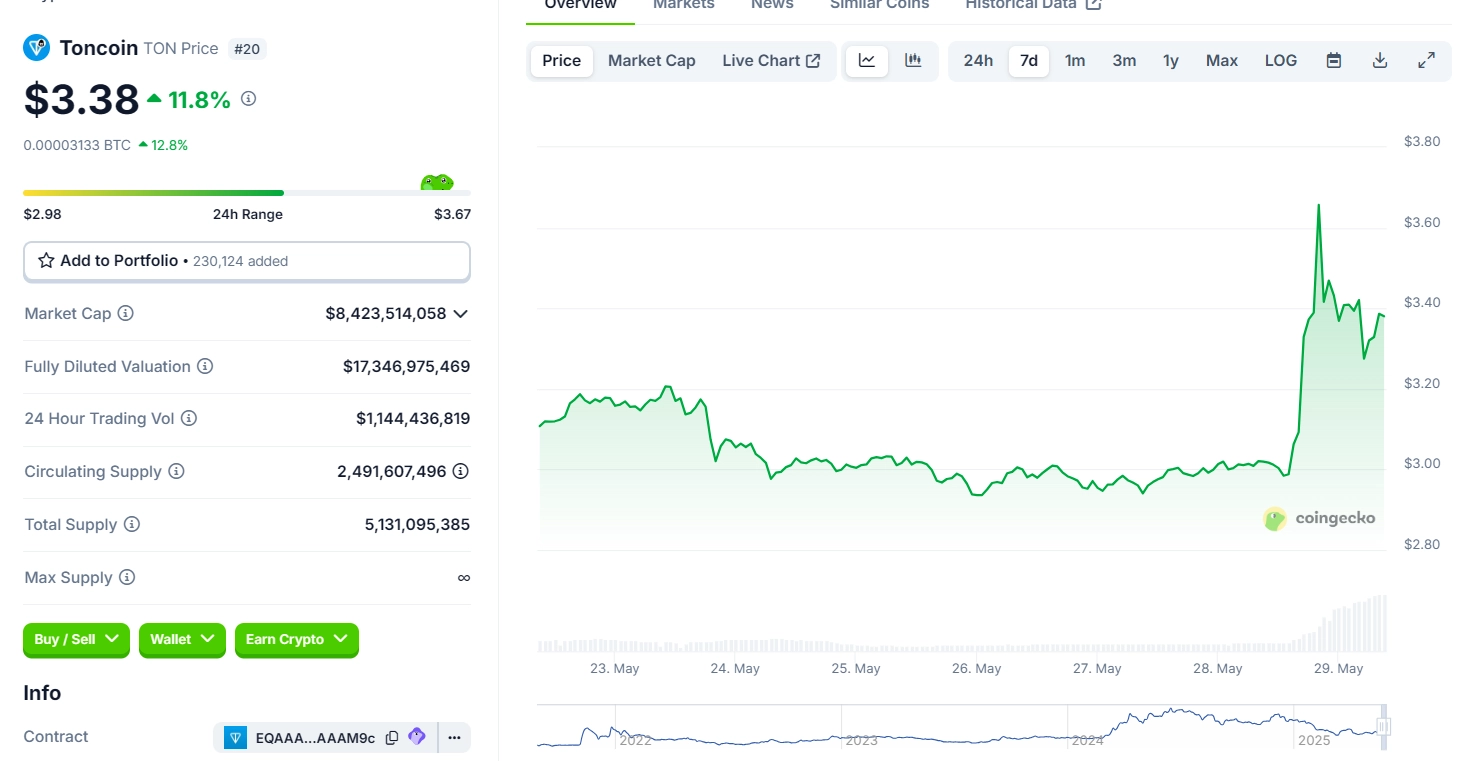

Currently, the TON token is trading around $3.15, up nearly 6% after positive news, with a market capitalization of approximately $7.7 billion, promising to become the most integrated payment infrastructure in the global chat application ecosystem.

Telegram Partners with Elon Musk’s xAI

Alongside the bond issuance, Telegram announced a $300 million partnership with xAI, Elon Musk’s company. According to CEO Pavel Durov, the two parties have signed a contract for the distribution of Grok AI services on the Telegram platform for one year.

Telegram will receive $300 million in cash and equity, as well as 50% of the revenue from Grok subscriptions made through the app. Durov described this as a “mutually beneficial relationship,” marking an important step in integrating AI into user experience.

The agreement with xAI and the plan to raise $1.5 billion have driven the TON token price to surge over 20%, from around $3 to above $3.60 in less than six hours.

However, in a surprising turn of events, early on May 29, 2025, Elon Musk commented under Pavel Durov’s post, stating that the two parties “have not yet signed a formal agreement.” Durov quickly responded, confirming that they had agreed to collaborate but were still finalizing the details.