Starting in December, Bitcoin investors on the Sui network will have the opportunity to stake BTC through Babylon, a Bitcoin Layer 2 platform. In return, they will receive LBTC, a liquid staking token issued by Lombard.

According to announcements from Sui and Babylon, this initiative aims to bring Bitcoin liquidity into the Sui ecosystem, fostering DeFi development with LBTC as a collateral asset. At the same time, long-term Bitcoin holders (hodlers) gain greater flexibility in utilizing BTC through LBTC.

LBTC is expected to become a foundational asset in Sui’s DeFi ecosystem, unlocking opportunities for lending, borrowing, and trading. This development leverages Bitcoin’s $1.8 trillion liquidity within the Sui network.

The infrastructure supporting the deposit, issuance, staking, and transfer of Bitcoin to Sui will be developed by Cubist, a blockchain technology company.

Jacob Phillips, co-founder of Lombard, stated:

Despite having a market capitalization of $1.8 trillion, Bitcoin has yet to reach its full potential. Cubist is working towards a future where Bitcoin holders can fully participate in next-generation blockchain financial ecosystems while maintaining safety and liquidity.

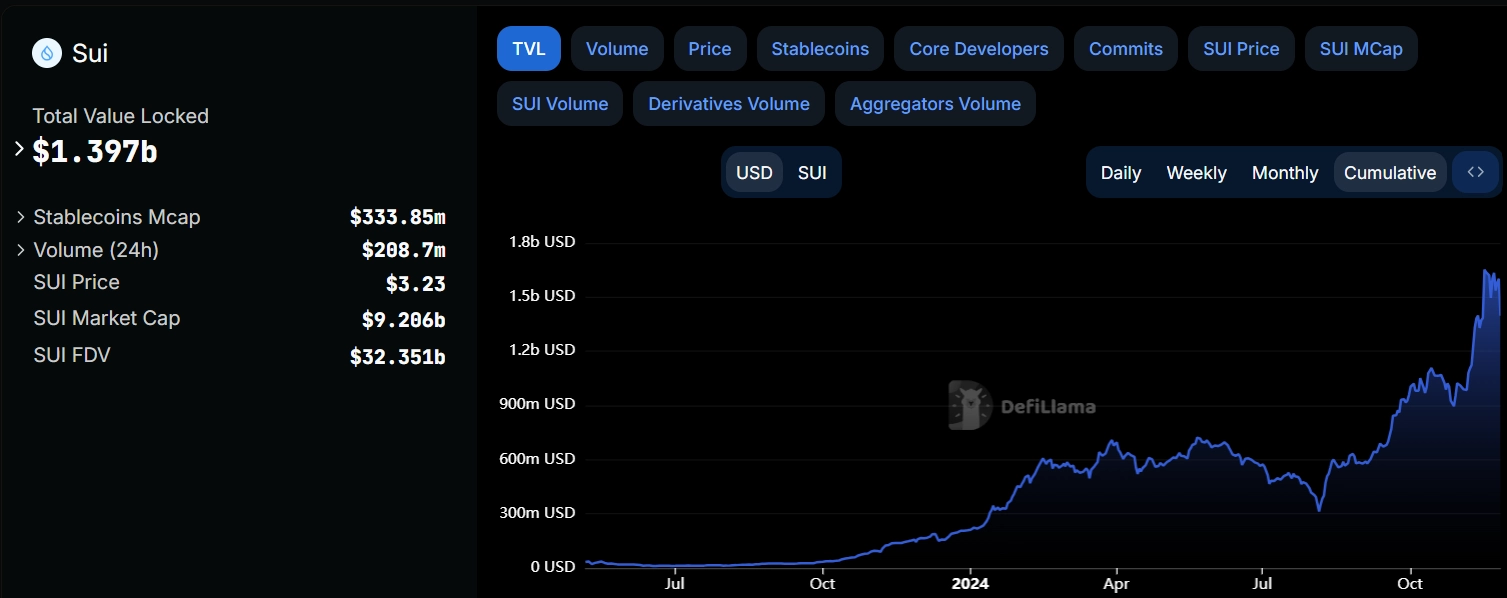

Launched in 2023, Sui has rapidly attracted $1.4 billion in total value locked (TVL), according to DefiLlama. Often referred to as a “Solana competitor,” Sui focuses on high-performance decentralized applications (DApps).

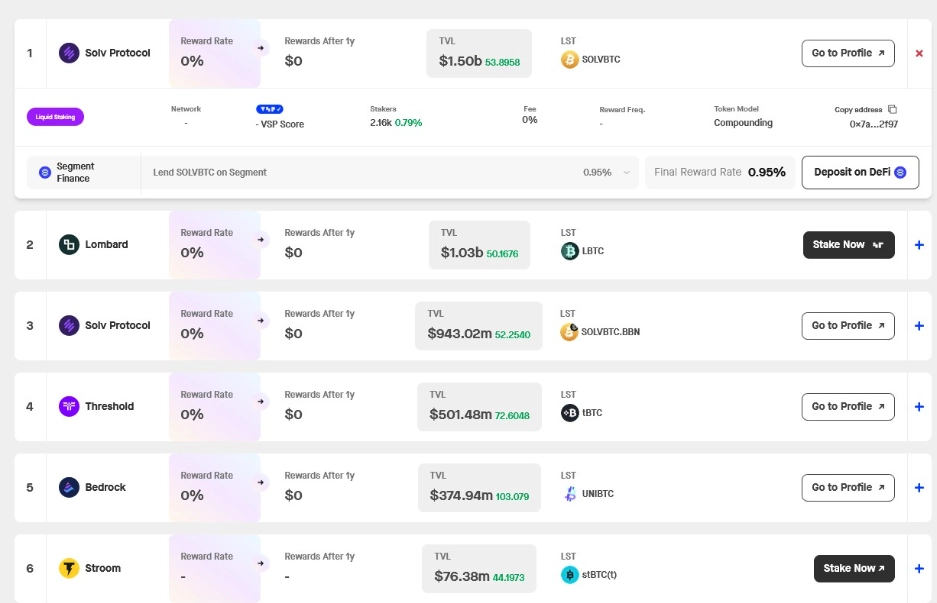

As reported by StakingRewards.com, the total TVL of liquid staking tokens (LSTs) for Bitcoin is currently around $4.5 billion. SolvBTC leads with approximately $1.5 billion in TVL, followed by Lombard with nearly $1 billion.

Bitcoin LSTs are tokens representing staked Bitcoin on Layer 2 platforms such as CoreChain and Babylon. These tokens allow holders to stake their Bitcoin without losing ownership while earning rewards from the staking process.

LBTC from Lombard is currently the largest LST on Babylon, even before staking rewards have begun distribution. Meanwhile, other Bitcoin LSTs, such as SolvBTC, already provide returns, with an approximate staking yield of 1.2% APR on CoreChain.

Related: Layer-1 Sui Integrates with Google Cloud to Combat Fraud and Support Gaming

Notably, on October 17, Solv Protocol introduced Bitcoin LSTs on Solana, aiming to attract Bitcoin holders amid increasingly diverse earning opportunities for the cryptocurrency.