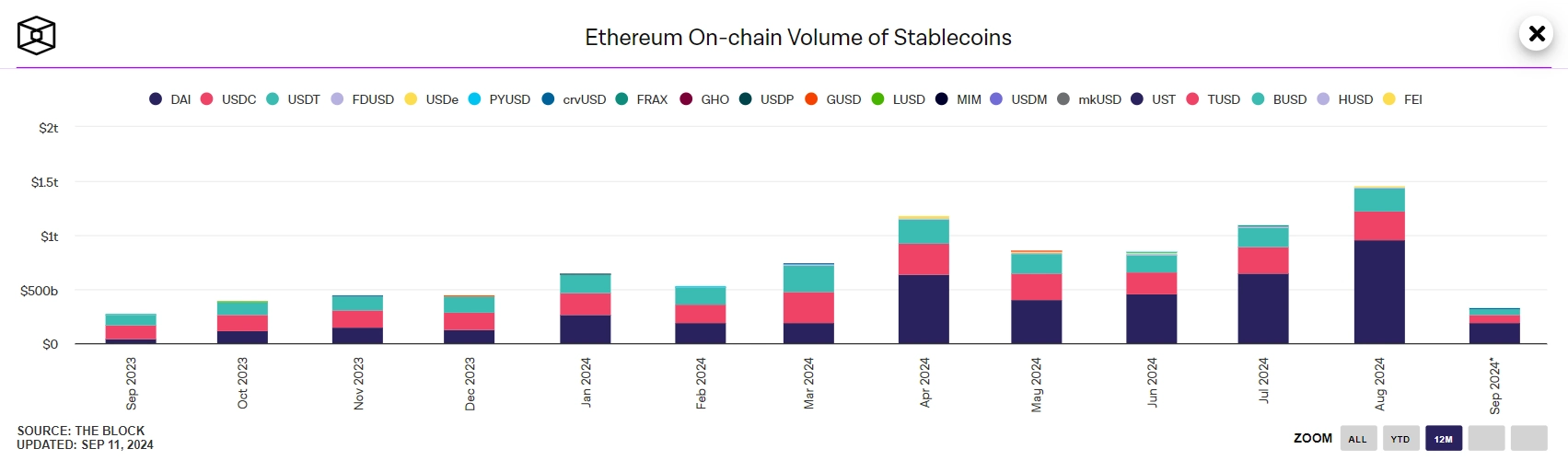

In the first three quarters of 2024, the cryptocurrency market witnessed a remarkable phenomenon: stablecoin trading volume on the Ethereum network skyrocketed, surpassing the $1.46 trillion mark. This figure not only more than doubled from the $650 billion recorded at the beginning of the year but also set a new all-time record, despite the market’s challenges.

Most notably in this race was DAI, a decentralized stablecoin, with a total trading volume reaching $960 billion. This strong growth reflects the increasing demand for decentralized financial solutions and trust in algorithm-based stablecoins. However, it is worth noting that DAI’s high volume might be influenced by the phenomenon of “wash trading” — a tactic that creates the illusion of liquidity and artificial market activity.

Meanwhile, PYUSD, a new entrant issued by PayPal, witnessed spectacular growth from $500 million to $2.4 billion. This success was not only driven by attractive incentive programs but also highlights the trend of traditional financial institutions gradually entering the world of cryptocurrencies.

Despite fierce competition, USDC and USDT have maintained their strong positions, continuing to serve as the foundation for much of the DeFi ecosystem. The robust development of stablecoins has not only improved market liquidity and minimized slippage but also enhanced the overall efficiency of the crypto ecosystem.

Notably, since mid-last month, the total stablecoin market capitalization has surpassed the peak set in early 2022, despite transaction fees on Ethereum dropping to record lows. This indicates growing investor confidence in the role of stablecoins in managing increasing market volatility.

Related: What Price Targets Does the Community Expect for Bitcoin, Ethereum, and Solana?

As blockchain activity continues to surge, stablecoins are gradually asserting their pivotal role, helping users navigate the ups and downs of the cryptocurrency market. Could this be a sign of a strong market resurgence in the near future? Only time will tell for sure.