According to the latest data from DefiLlama, the total market capitalization of stablecoins (excluding algorithmic stablecoins) reached a new record over the past weekend.

Specifically, the market capitalization of stablecoins increased by 0.93% over the past 7 days, surpassing $168.29 billion. This figure breaks the previous record of $167.2 billion set in March 2022.

After reaching its previous peak, the stablecoin market cap experienced a sharp decline, dropping to around $120.9 billion in August 2023 and fluctuating around this level until the end of the year. Notably, this decline occurred right after the collapse of Terra (LUNA – UST) in May 2022.

However, since the beginning of 2024, the stablecoin market cap has begun to recover and regain momentum. For the first time in a long period, this figure exceeded the $160 billion mark a month ago and has now set a new record high at $168.29 billion.

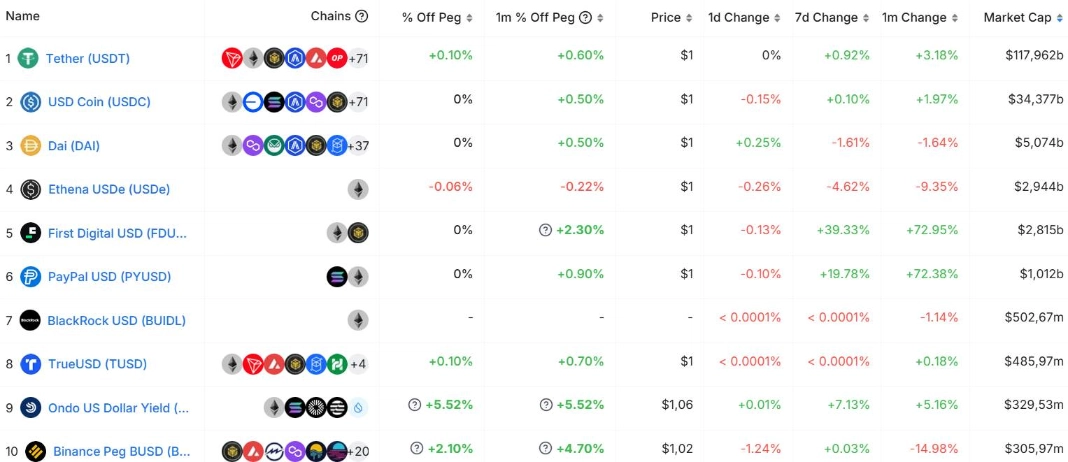

Of the total $168.29 billion, Tether’s USDT holds a dominant share of 70.09%, equivalent to $117.96 billion. This solidifies Tether’s position as the leading stablecoin issuer in the cryptocurrency market since March 2024. Following USDT are Circle’s USDC and MakerDAO’s DAI, with market capitalizations of $34.37 billion and $5.07 billion, respectively.

Despite experiencing some volatility in market capitalization after the collapse of Silicon Valley Bank in March 2023, USDC has also seen an upward trend since the beginning of this year, with its market cap rising from $23.8 billion to $34.3 billion at the present time.

Most market analysts agree that the increase in stablecoin market capitalization is a positive sign, indicating that cryptocurrencies are increasingly attracting capital inflows from investors, particularly large institutions.

Related: Tether Surpasses Other Stablecoins in Market Capitalization

The primary reason for this is that stablecoins are being increasingly used by institutional investors as a bridge between traditional finance (TradFi) and the world of cryptocurrencies. This “highlights a broader trend towards integrating stable digital assets into long-term investment portfolios.”

Rachael Lucas, a cryptocurrency analyst at BTCMarkets, remarked:

Traditionally, in times of market uncertainty, the demand for stability has driven investors towards stablecoins as a safe haven. Moreover, the rise in stablecoin market capitalization could reflect growing confidence in the cryptocurrency market, especially from the perspective of institutional investors.