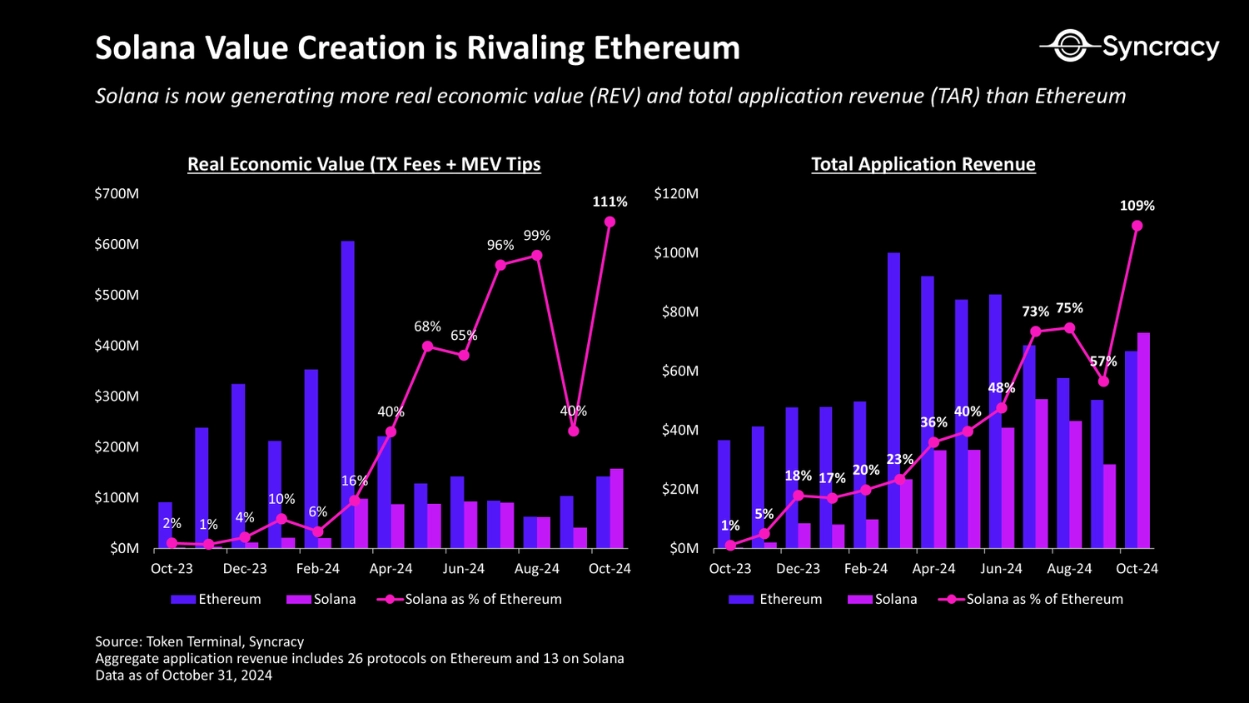

According to the latest report from investment fund Syncracy Capital, published on November 12, Solana is showing strong competitiveness with Ethereum across most key economic metrics, marking impressive growth momentum in recent months.

Specifically, Solana’s Real Economic Value (REV) in October 2024 reached 111% of Ethereum’s—an impressive leap from just 1% in the same period last year. The REV metric, which includes transaction fees and maximum extractable value (MEV) fees paid to validators, provides a true reflection of the network’s economic activity.

Notably, Solana’s Total Application Revenue (TAR)—a measure of fees paid to protocols and applications on the blockchain—also climbed to 109% of Ethereum’s in October 2024, a dramatic rise from 1% last year.

This surge is largely attributed to a wave of memecoins on Solana. For instance, Goatseus Maximus (GOAT) reached a market capitalization of $400 million within just one week of its launch. Many other memecoins also saw impressive gains over the past month: SPX6900 (SPX) rose 379%, Apu Apustaja (APU) increased by 170%, and FWOG climbed by 134%.

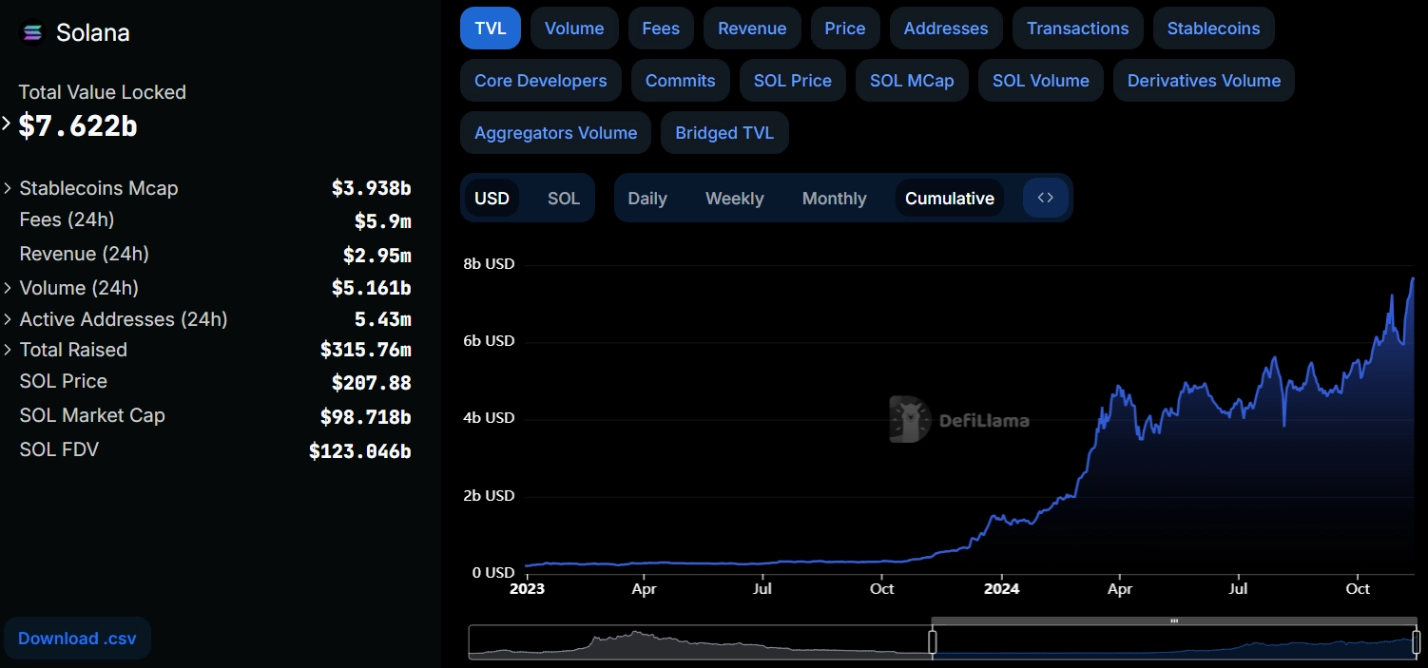

This wave has driven significant increases in transaction volume, fees, and total value locked (TVL) on Solana. According to DefiLlama, Solana’s TVL hit a two-year high, surpassing $7.6 billion.

Related: Canary Capital Officially Files for Solana ETF

The 2024 memecoin trend on Solana is similar to Ethereum’s DeFi boom in 2020

While the memecoin trend has sparked debate about its sustainability, Syncracy Capital views it as an important test of network reliability. They commented:

“This speculative phenomenon is similar to Ethereum’s DeFi boom in 2020. In both cases, what’s crucial is that experiments are conducted and the infrastructure is stress-tested.”

Solana has experienced several outages since its launch in 2020, the most recent being a five-hour incident in February 2024. However, it is increasingly attracting decentralized physical infrastructure network (DePIN) protocols—blockchain projects that reward users for participating in the construction and operation of real-world infrastructure.

The report also highlights that among Solana’s unicorns, four projects—Helium, Render, IoNET, and Grass—are non-financial DePIN ventures. Solana is currently home to nine unicorn companies, compared to Ethereum’s 18.