BlackRock’s Chief Investment Officer, Samara Cohen, confirmed that the company does not plan to launch a Solana (SOL) ETF in the near future.

Cohen explained that BlackRock’s decision is based on the investment criteria the company applies to assets considered for ETFs. Currently, Bitcoin and Ethereum meet these criteria, while Solana does not.

“We really look at the investability – what meets the criteria, what meets the bar to be delivered in an ETF,” she stated.

The success of BlackRock’s Bitcoin ETF, iShares Bitcoin Trust (IBIT), is notable, with nearly $20 billion in inflows since its launch on January 11. Similarly, BlackRock’s Ethereum ETF quickly accumulated $440 million in assets. These achievements highlight BlackRock’s focus on established cryptocurrencies with strong market positions.

While BlackRock holds off on a Solana ETF, other asset management firms are moving forward with plans for Solana. VanEck has filed for a Solana ETF, arguing that SOL, like Bitcoin and Ethereum, functions as a digital commodity. Franklin Templeton has also hinted at the potential for a Solana ETF, reflecting the growing interest in expanding investment options within the crypto space.

Related: What Price Targets Does the Community Expect for Bitcoin, Ethereum, and Solana?

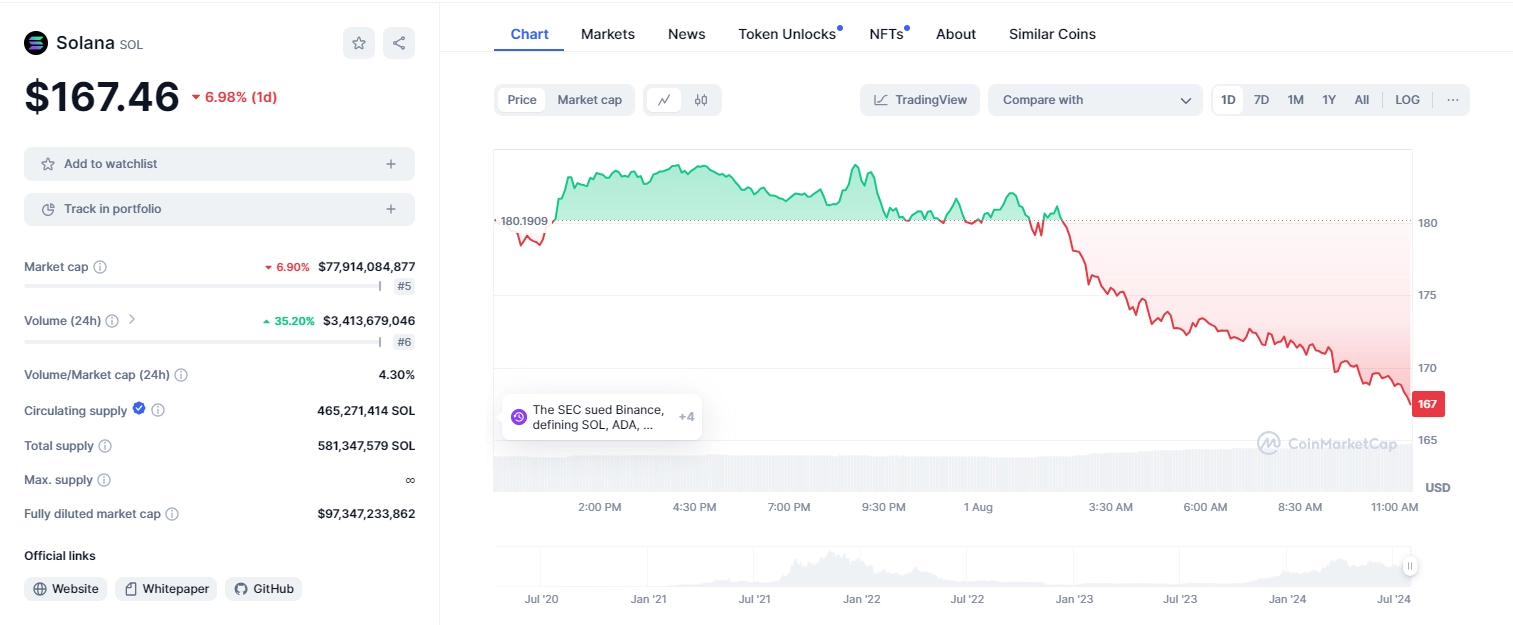

Solana (SOL) Price Fluctuations

This news, combined with unfavorable market movements, has caused Solana’s (SOL) value to drop below $170, a 6% decrease from yesterday’s value.

komolafeoluwagbemiga8@gmail.com