SoFi, a financial services platform that launched cryptocurrency trading in 2019, has been gradually scaling back its business in this area since December 19.

🚀 We’re welcoming @SoFi members to the https://t.co/0DZyULb31t community! 🌐 Your crypto journey is evolving seamlessly, backed by 12 years of trust and security. Enjoy advanced trading, DeFi Wallet access, and a wealth of educational resources. 📚🔒https://t.co/ExfBnMNvxb pic.twitter.com/unJgTwK1Nn

— Blockchain.com (@blockchain) November 29, 2023

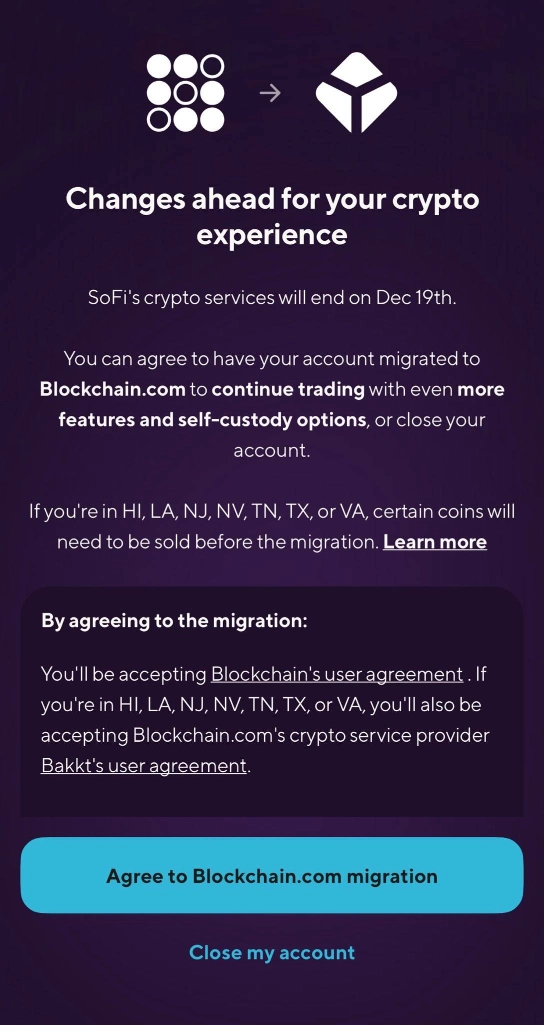

The platform has suspended new account registrations, and existing users are being given three weeks to transfer their accounts to Blockchain.com before they are automatically liquidated.

Notice from SoFi to its customers. Photo: user shared on Twitter

The platform also imposes some geographical restrictions, for example, users in some states must sell unsupported tokens such as AVAX and SUSHI. Also, residents of New York State will not be allowed to transfer accounts to Blockchain.com.

According to the Q3/2023 financial report, SoFi currently holds nearly 140 million USD in cryptocurrency, of which mainly 75 million USD in Bitcoin (BTC) and about 47 million USD in Ethereum (ETH).

SoFi’s decision to withdraw from the cryptocurrency sector is the result of the “nightmare” imposed on the industry by the US government’s tightening of regulations. According to regulations, they must have regulatory approval for two years, renewable up to three times per year, for cryptocurrency services.

In its annual financial report filed with the SEC, SoFi admitted its reasons for shrinking its crypto business:

“While we are engaged in discussions with the Federal Reserve to find a way to comply with the Bank Holding Company Act, there can be no certainty that such efforts will be successful or that an extension will be granted. Ultimately, We were forced to end that activity in a short time.”

Cryptocurrency trading has been “launched” since 2019, but SoFi has never achieved significant revenue from this activity. In the third quarter, the company only earned 6 million USD from brokerage fees (including cryptocurrency fees), while the referral program brought them up to 9 million USD.

Related: Bitcoin Surges to $40K USD Amidst Strong Signals

From the end of last year until now, the cryptocurrency field has witnessed the failure of many big and small names, including the collapse of the FTX empire and the $4.3 billion fine that the US government imposed on Binance recently. However, legal pressure is still a constant problem, especially in the context of clashes between the US Securities Commission (SEC) and many cryptocurrency companies such as Binance, Coinbase, and Kraken.