Despite Bitcoin recently hitting an all-time high (ATH), recent analyses indicate that retail investors have yet to return to the market. However, current positive signals suggest that a wave of retail investment may soon emerge. Is this the right time to invest in Bitcoin now that prices have surpassed the six-figure mark?

Should You Apply DCA Strategy for Bitcoin Now?

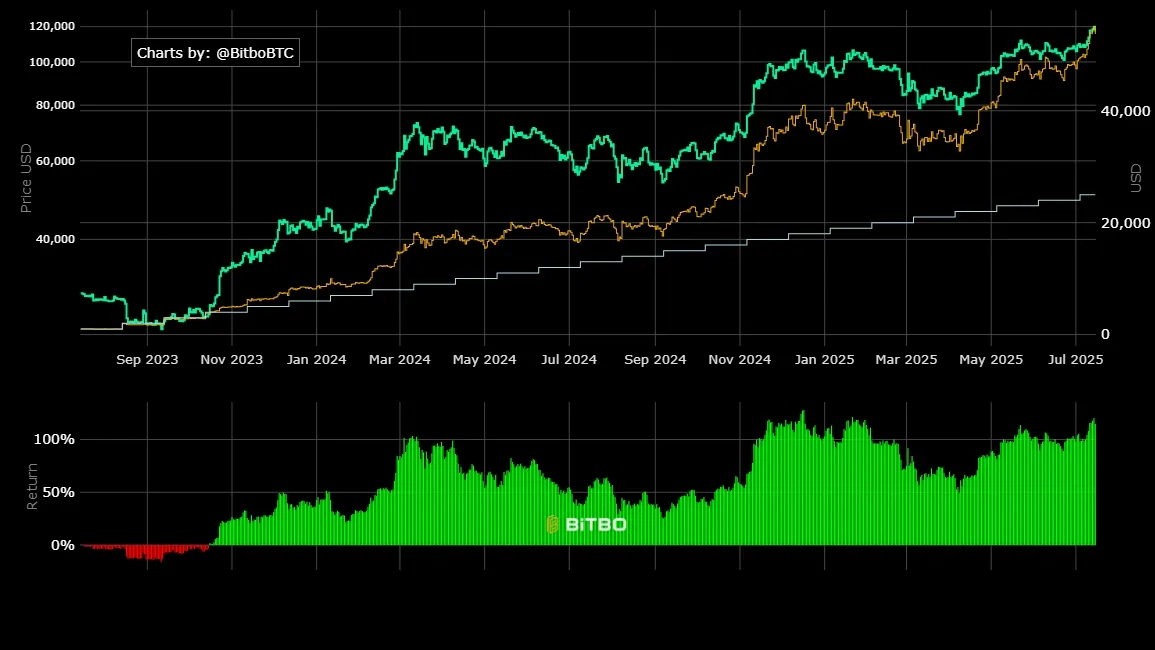

The Dollar-Cost Averaging (DCA) strategy is popular among retail investors. According to Bitbo, if an investor had put $1,000 into Bitcoin each month over the past two years, they would have accumulated about 0.4588 BTC, yielding a profit of 114.8%. This demonstrates that Bitcoin remains attractive to long-term investors despite market volatility.

Jake Claver, Director of Digital Ascension Group, argues that applying DCA at this point may not be optimal. He believes the market is at a “cycle peak,” with potential gains of only 10% before entering a bear market. He suggests that DCA is more effective when the market is at the bottom.

Claver also advises:

“The process of exiting Bitcoin has begun. Opting for other altcoins may be better before the altcoin season.”

Conversely, renowned investor Udi Wertheimer warns against the mistake of not buying Bitcoin at $120,000, especially if one previously sold at lower prices (like $30,000).

He shares:

“I once sold Bitcoin at $100 and only bought back at $500–$1,000. Do you think I lost sleep over that? Ignore the regret and stick to your long-term strategy.”

Related: Impressive Figures of Binance After 8 Years of Operation

Is This the “Final Dance” Before the Peak?

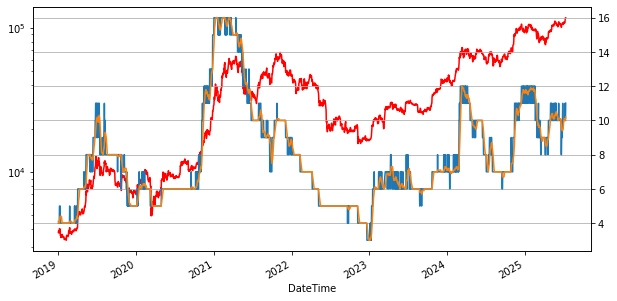

According to CryptoQuant, Bitcoin has not yet entered the euphoric phase characteristic of previous market peaks. Analyst Joohyun Ryu believes the market is in the “final dance” phase, a period of rapid growth before a new peak. The “greed” index is currently moderate, significantly lower than in 2021. The rHODL ratio, reflecting long-term holding behavior, stands at only 32%, indicating that individual investors remain cautious and have not yet poured in capital like in previous euphoric phases.

While the current market conditions show potential for a surge in retail investment, caution is advised. Investors must weigh the risks and consider strategies like DCA, understanding the broader market context to make informed decisions.