As previously predicted, the SEC has finally approved the Ethereum spot ETF proposals, making ETH the second cryptocurrency after Bitcoin to have a spot ETF.

Specifically, the ETFs from 21Shares (CETH), Bitwise (ETHW), BlackRock (ETHA), Fidelity (FETH), Franklin Templeton (EZET), VanEck (ETHV), and Invesco Galaxy (QETH) have all been allowed to commence trading from July 23 (US time). The Grayscale Ethereum Mini Trust (ETH) and Grayscale Ethereum Trust (ETHE) have not yet received official approval from the SEC, but experts predict they will be approved soon.

Except for the ETHE fund from Grayscale, which has an annual management fee of up to 2.5%, the other funds are fiercely competing on fees, offering very low fees from 0.15-0.25%, along with an initial fee waiver for 6 to 12 months.

In the press release, a representative from BlackRock, the world’s largest asset management company, emphasized:

The allure of Ethereum lies in its decentralized nature and its potential to drive digital transformation in finance and other sectors.

BlackRock has also updated its website to promote this new product.

Similarly, other Wall Street giants have started releasing introductory information for investors following the SEC approval of the ETH ETFs.

Since the Bitcoin ETFs were launched in January 2024, market attention has shifted to Ethereum ETFs. The US Securities and Exchange Commission has swiftly changed its stance in recent months.

From remaining silent on Ethereum ETF proposals and even threatening to investigate ETH on securities charges, to preliminarily approving 8 ETH ETF proposals in just a few days in mid-May, and finally requiring issuers to complete their paperwork for the official approval today.

Related: Vitalik Buterin Reveals Major Ethereum Update

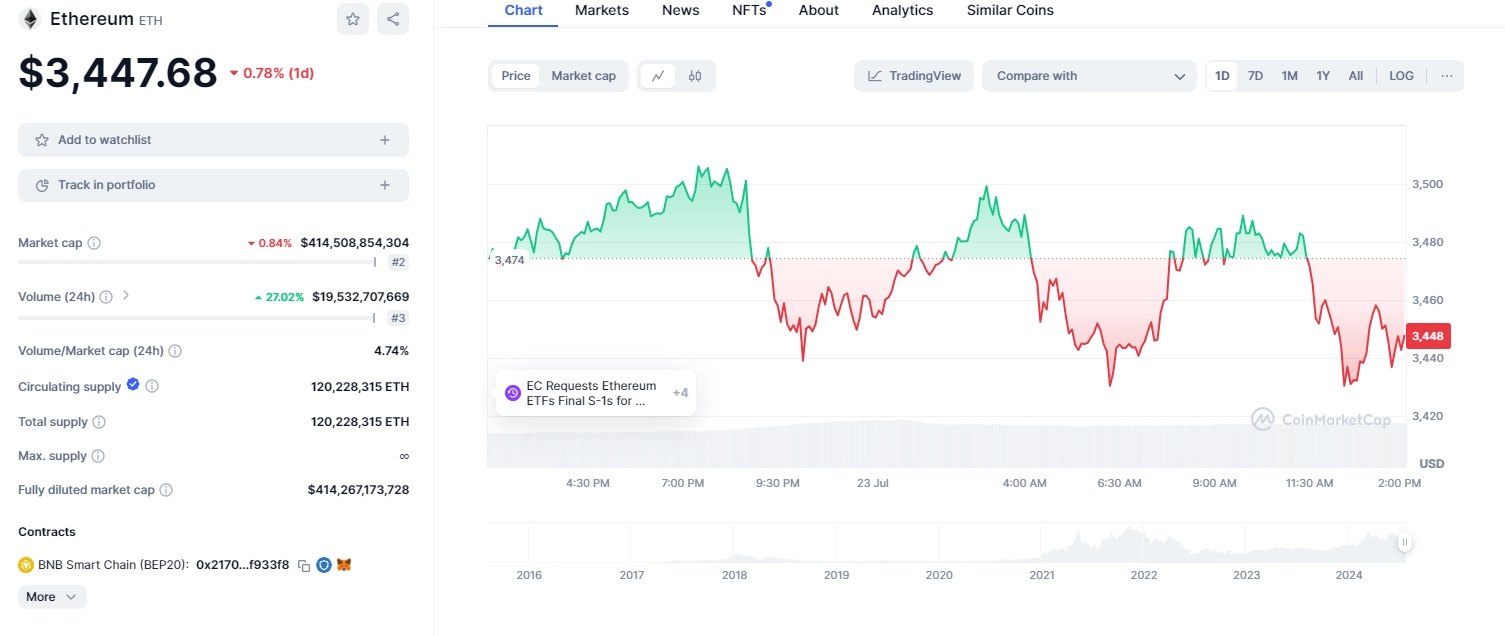

ETH Price Fluctuations

After the information that Ethereum spot ETFs would begin trading was released, ETH prices showed little reaction and are currently trading around 3440.