SEC Accuses HyperFund Group of Fraud

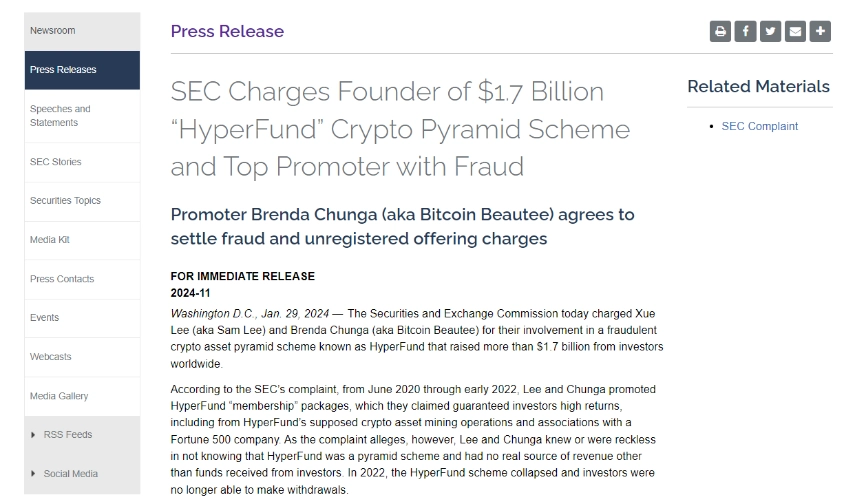

The U.S. Securities and Exchange Commission (SEC) has recently announced criminal charges against individuals operating the $1.7 billion Ponzi scheme model of HyperFund.

The press release is posted on the SEC’s website.

According to the indictment, Xue Lee and Brenda Chunga, also known as Sam Lee and Bitcoin Beautee, raised over $1.7 billion from global investors since June 2020.

During that time, the two individuals promoted HyperFund as an investment channel with attractive returns. However, in reality, the company operated as a disguised multi-level marketing scheme. By 2022, the project had unraveled, and investors seemingly suffered significant losses.

Gurbir S. Grewal, the head of SEC’s enforcement division, stated:

Today’s case is yet another example of non-compliance in the crypto space, promoting get-rich-quick schemes without providing investor protections required by federal securities laws.

SEC has filed a complaint in the Maryland District Court, accusing Lee and Chunga of violating anti-fraud and registration provisions of federal securities laws. The Maryland U.S. Attorney’s Office has also criminally charged these individuals.

Related: Ripple Accuses SEC of Misrepresenting Facts in Lawsuit

As of now, Chunga has pleaded guilty and agreed to pay civil penalties as determined by the court.

HyperFund is one of the smaller brands in the network of fraudulent companies, alongside HyperCapital, HyperVerse, and HyperTech. Earlier this month, the U.S. government ordered the arrest and indictment of Rodney Burton, who embezzled over $7 million through a fraudulent investment program in HyperVerse.

The founders of HyperTech, including Lee and Ryan Xu, also established the company Bitcoin Blockchain Global in Australia. It is reported that this company is burdened with a debt of $58 million.