In a shocking political development, South Korean President Yoon Suk-yeol declared martial law on December 3, 2024. This decisive action is seen as an exceptionally strong move to counter forces deemed “pro-North Korea” and “anti-state,” while imposing strict controls on parliamentary and press activities.

Speaking on YTN, President Yoon officially announced the enforcement of martial law from 11:00 PM local time (14:00 UTC) the same day. He emphasized that this was a necessary measure to protect national security from North Korean threats and to uphold constitutional order and the nation’s freedoms.

The political tension escalated further as President Yoon sharply criticized the opposition Democratic Party, which holds a parliamentary majority. He accused the party of impeaching senior prosecutors and rejecting the government’s budget proposals. In his view, these actions not only “rob the people of their freedom and happiness” but also paralyze governmental functions and allow opposition leaders to “evade justice.”

The decision sent shockwaves through South Korea’s financial landscape, particularly in the digital asset market. Major South Korean cryptocurrency exchanges, such as Upbit and Bithumb, experienced significant declines in trading pairs with the Korean won (KRW). Bitcoin fell to $66,500, while XRP plummeted to $1.16. The situation worsened as the KRW-pegged stablecoin USDT lost its stability, dropping nearly 30% to $0.73.

Panic spread as users rushed to exchanges to adjust their portfolios, causing system overloads. Within four hours of the announcement, the total liquidation value of derivatives positions exceeded $300 million, wiping out the day’s gains for many major cryptocurrencies.

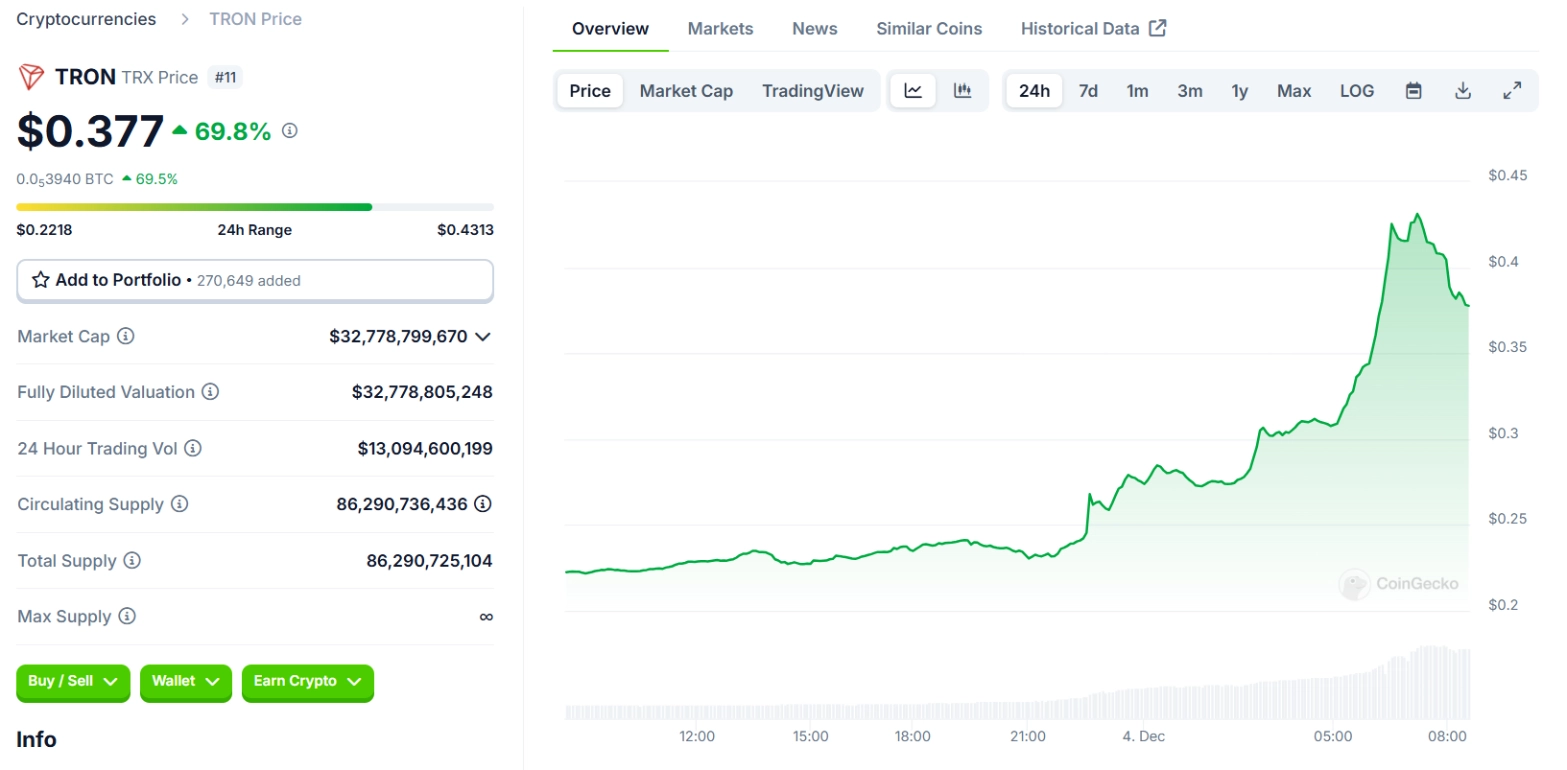

Despite the turmoil, the cryptocurrency market demonstrated remarkable resilience. Notably, Justin Sun’s TRX token surged over 100% shortly after the crash, showcasing the volatility and unpredictability inherent in the market

Related: South Korea Channels $19 Billion into Crypto and Stock Markets