Philippine Congressman Migz Villafuerte has officially filed Bill HB 421 in Congress on August 22, proposing the establishment of a National Strategic Bitcoin Reserve. Under the proposed plan, the Bangko Sentral ng Pilipinas (BSP) will purchase 2,000 Bitcoin annually for five consecutive years.

Upon completion of this program, the Philippines would hold a total of 10,000 Bitcoin and commit to maintaining these digital assets for at least 20 years. This is seen as a bold move to enhance national security, reduce dependence on public debt, and strengthen long-term financial foundations.

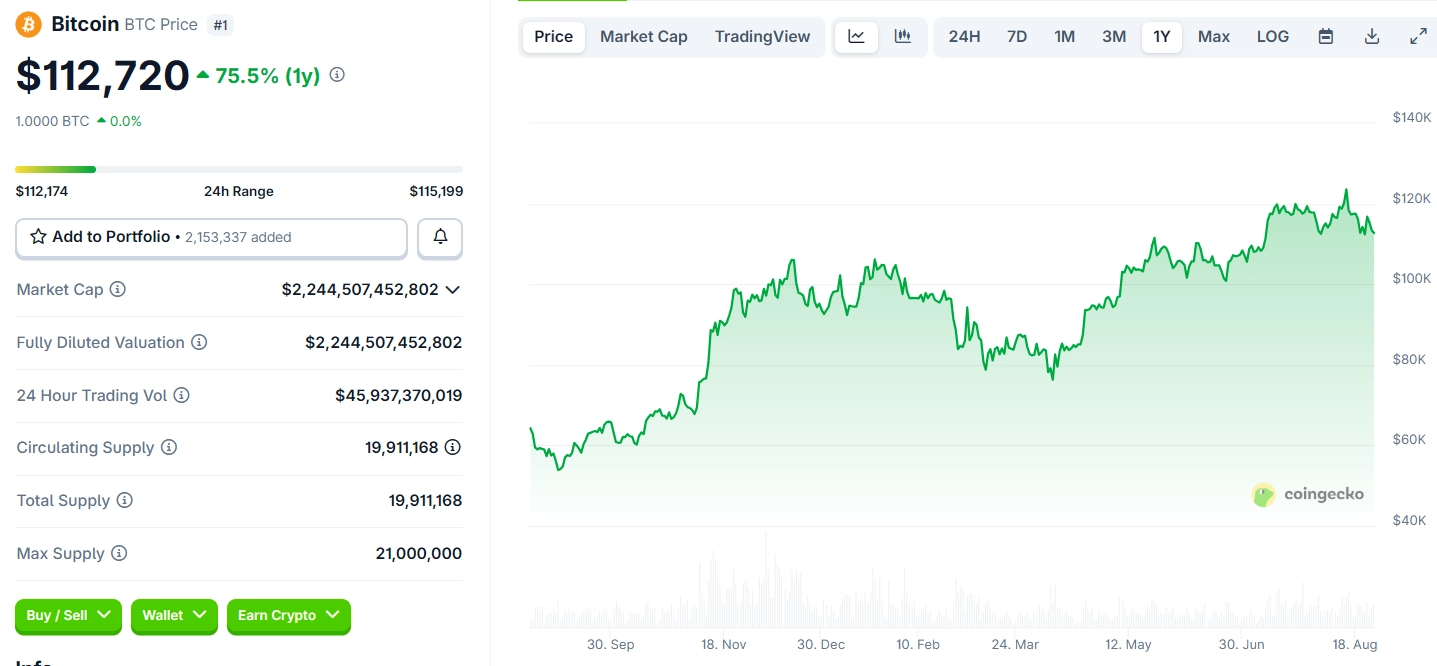

This proposal comes at a time when the global cryptocurrency market is experiencing a strong recovery. Bitcoin prices have been on the rise since the beginning of 2025, driven by a more cryptocurrency-friendly stance from the U.S. government under President Donald Trump after his re-election at the end of 2024.

The new policy from Washington is believed to be motivating other countries, particularly in Asia, to consider integrating Bitcoin into their national financial strategies. As many nations look to diversify their foreign exchange reserves, the Philippines aims to take a proactive step in the digital asset race.

Related: Chainlink Surges 38% in August, Echoes 2024 Rally

The idea of incorporating Bitcoin into national reserves is not unprecedented. El Salvador became the first country to legalize Bitcoin as official currency in 2021 and has actively purchased Bitcoin to bolster its national reserves.

If the Philippines pursues this path, it could not only strengthen its financial position but also attract additional international investment into the blockchain technology and digital asset sectors.

The proposal for the National Strategic Bitcoin Reserve is currently awaiting discussion in the Philippine Congress. If approved, it could mark a significant turning point in reshaping the financial policy and economic security strategy of the Philippines over the next decade.