On January 27th, Orbiter Finance announced its plan to develop its own layer-2 solution named Orbiter Rollup, aiming to become a “meta layer” based on zero-knowledge proof technology. The tweet attracted over 426,600 views and more than 1,900 interactions.

🛸”The Orbiter Evolution: From Bridge to Rollup, Reshaping the Ethereum Ecosystem”

🚀🚀🚀

Orbiter Finance is set to launch another satellite into the Ethereum galaxy!

Today, we are thrilled to announce Orbiter Rollup—a pioneering #ZK-powered instant omni meta-layer that brings…— Orbiter Finance 🛸 (@Orbiter_Finance) January 27, 2024

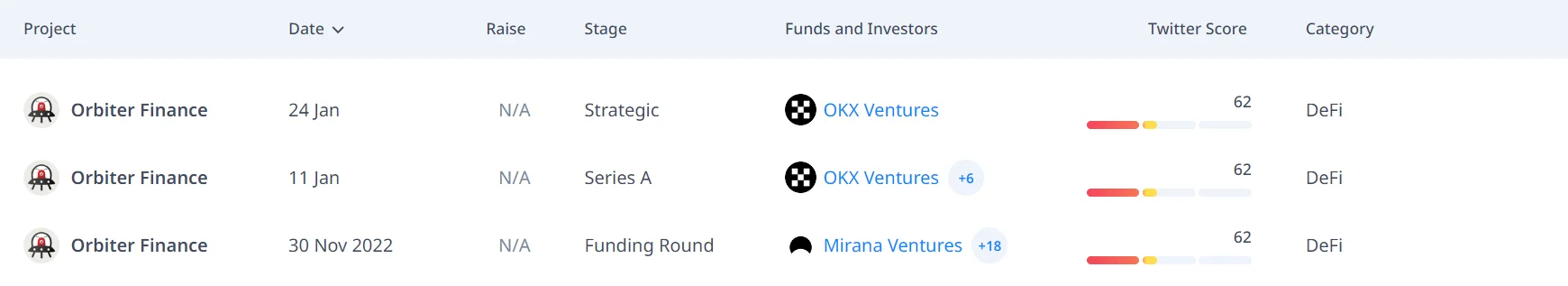

As of now, Orbiter Finance’s cross-chain solution has served the asset transfer needs of over 3 million users. Additionally, the recent protocol secured a strategic funding agreement from OKX Ventures, although the specific investment details were not disclosed.

Orbiter stated in the announcement:

Orbiter Rollup is preparation for a future omni-connection. This means that by accessing the interface, users can not only transfer assets but also all data across all layer-2.

Through Orbiter Rollup, the protocol hopes to become a central hub connecting with all other layer-2 solutions. Accordingly, Orbiter’s new solution will compete with ZK layer-2 projects such as Manta Pacific, zkSync, and Polygon zkEVM.

In the end, we believe that in the overall layer-2 landscape, users will only need an EVM-compatible account to explore the entire Ethereum ecosystem.

Related: Manta Pacific Becomes the Fourth-Largest Layer-2

As of now, Orbiter has not made any statements regarding the release of its own token. “Orbiter Finance’s main focus is on product development and enhancing the user experience,” the project’s website notes.