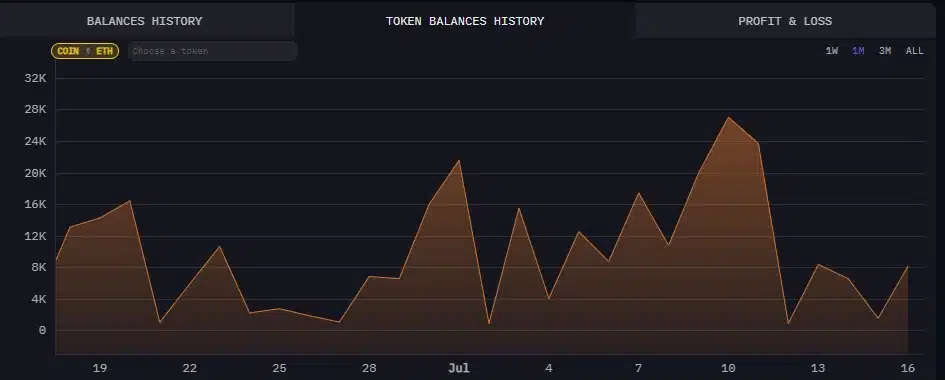

According to Wintermute, the depletion of ETH on OTC exchanges indicates that massive inflows from major institutions are occurring. During this price surge, institutions are focusing heavily on BTC and ETH, while retail investors are gravitating towards meme tokens. Wintermute’s ETH reserves have plummeted from 27,000 ETH to approximately 8,155 ETH, coinciding with ETH surpassing its highest peak since late 2024 and nearing the $4,000 mark.

This phenomenon is not new: whenever whales buy heavily, Wintermute typically sees its reserves deplete. Notably, the market is witnessing quiet accumulation from ETF funds and anonymous whales.

ETH: A Rare Commodity in the Crypto Market

ETH currently has a slight inflation rate of about 0.7% per year, translating to an additional 900,000 ETH since Ethereum transitioned to the ETH 2.0 model. However, nearly 30% of the ETH supply is being staked long-term, making the circulating supply even scarcer. Whales are not only holding ETH but also opting to stake or lend it rather than selling.

Particularly, BlackRock has purchased 159,100 ETH over the past two months, raising its total holdings to over 2 million ETH, a record high. BlackRock’s buying momentum has surged in July, further tightening the ETH supply.

Not only Wintermute but Galaxy Digital has also seen its ETH reserves decrease from 70,000 ETH to around 55,000 ETH. One whale spent $14 million to buy ETH on the spot market, demonstrating that the accumulation trend remains strong.

Related: Bitcoin Consolidation Before a Breakout to $135,000?

Quiet Accumulation and Long-Term Impact

While OTC transactions do not have an immediate effect on prices, they clearly reflect the quiet accumulation activities of institutions and whales. The demand for ETH is further driven by corporate bonds and long-term investors from previous ICOs who continue to hold large amounts of ETH through various market cycles.

With an ever-scarcer supply and strong participation from institutions, ETH is becoming a rare asset in the market.