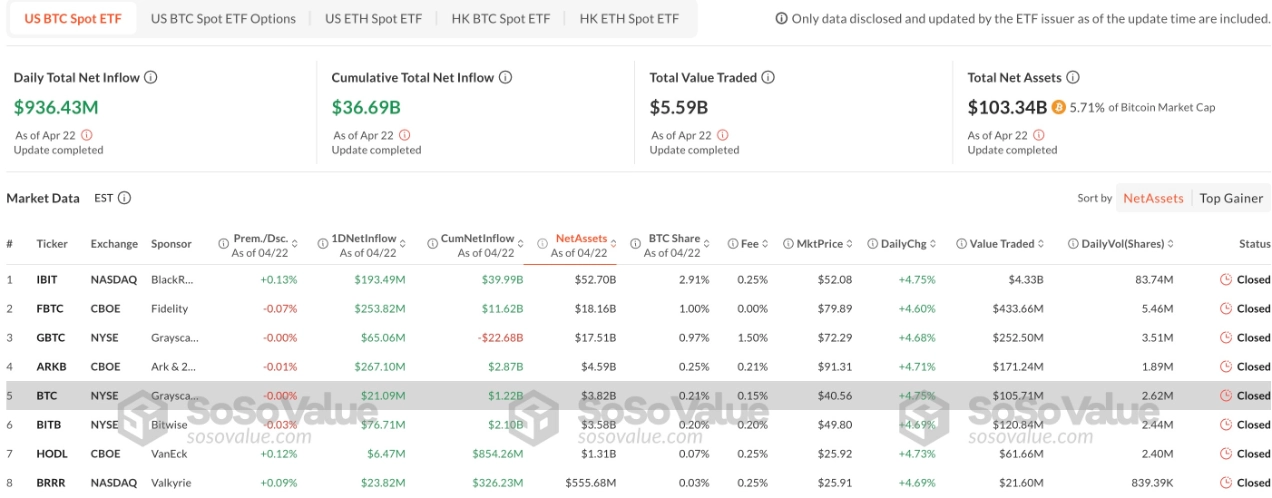

On Tuesday, U.S. spot Bitcoin ETFs saw a net inflow of $936 million — the highest single-day amount since January 17.

All 10 spot Bitcoin ETFs recorded positive investment inflows, with the top three being:

-

Ark & 21Shares: $267.1 million

-

Fidelity (FBTC): $253.8 million

-

BlackRock (IBIT): $193.5 million

According to data from SoSoValue, over the past three consecutive days, total net inflows into U.S. Bitcoin funds have surpassed $1.4 billion.

Rachael Lucas, an analyst at BTC Markets, commented:

“The strong capital inflows into ETFs reflect a structural shift in the market. Institutions are returning to crypto investments, driven by macroeconomic uncertainty, favorable supply conditions, and the growing acceptance of Bitcoin as a strategic asset.”

Related: Bitcoin Market Sees Sharp Rebound Despite Weak Demand

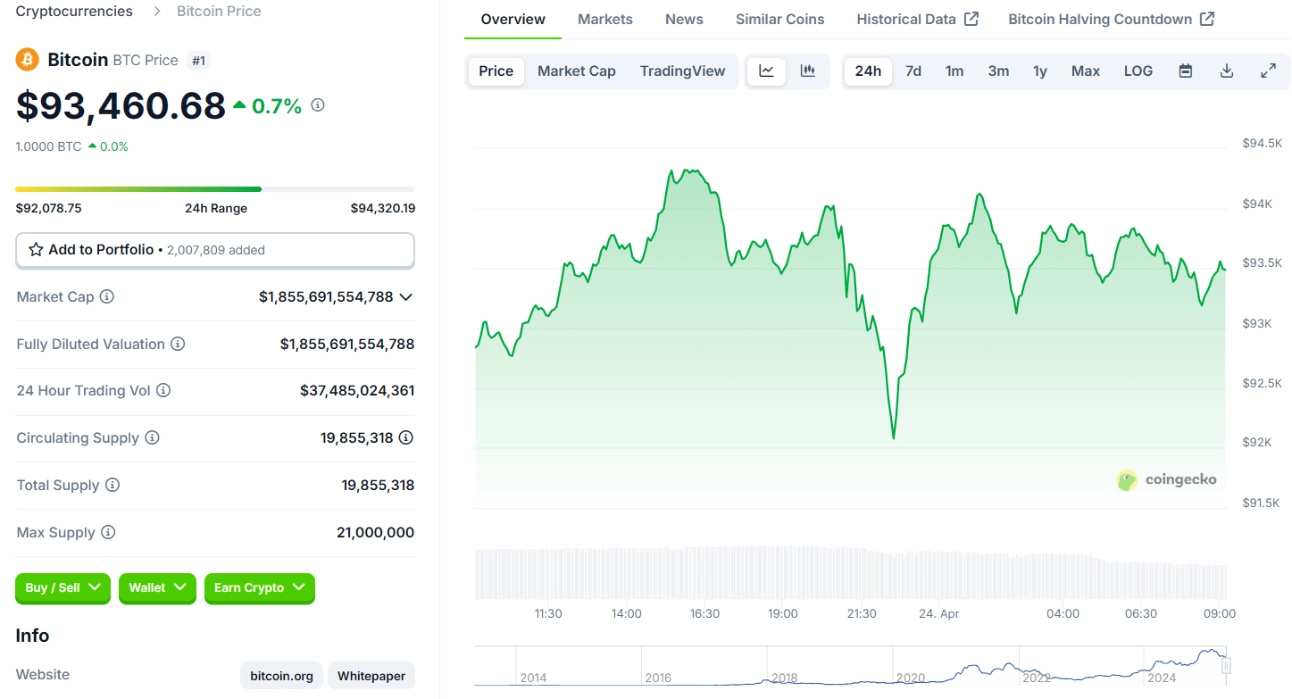

Bitcoin is showing remarkable strength amid global market volatility. According to Lucas, Bitcoin’s appeal is also fueled by a weakening U.S. dollar, prolonged inflationary pressure, and expectations that the Fed may ease monetary policy.

“Spot Bitcoin ETFs currently hold over $103 billion worth of Bitcoin, reducing circulating supply and creating sustainable upward price pressure,” Lucas added.

Despite tariff policies under President Trump putting pressure on the markets, investors remain hopeful that U.S.-China tensions may ease. As of the morning of April 24, 2025, Bitcoin is trading around $93,500 after a strong rally in recent days.