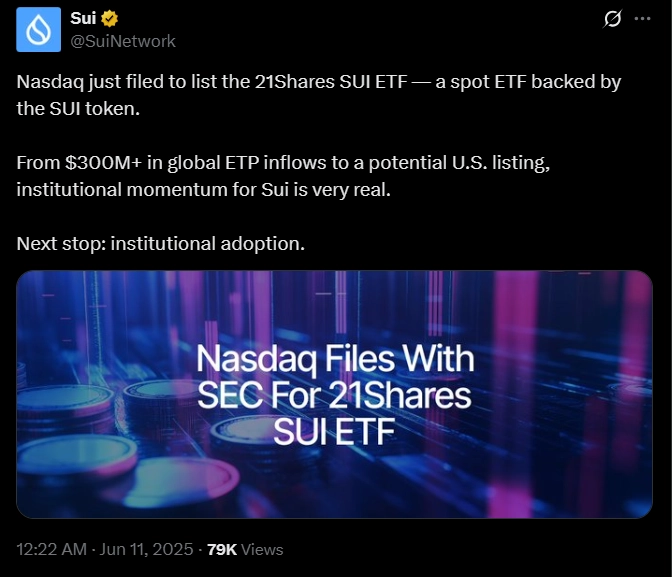

On June 10, 2025, the Nasdaq stock exchange submitted a 19b-4 application to the U.S. Securities and Exchange Commission (SEC) on behalf of 21Shares, proposing to list the first SUI spot ETF in the U.S. If approved by the SEC, Nasdaq will take on the role of listing and managing the SUI spot ETF managed by 21Shares. This move follows 21Shares’ S-1 filing in April 2025 and marks a significant step as the company operates ETP products based on SUI at Euronext Paris and Amsterdam, with total assets under management exceeding $300 million.

In addition to 21Shares, several leading financial institutions, including Franklin Templeton, VanEck, Ant Financial, and Grayscale, have also launched products or initiatives related to Sui since late 2024. SUI, the native token of the Layer-1 Sui blockchain, is built on the Move programming language and aims to address the multi-dimensional scalability issues of traditional blockchains, optimizing resource usage and enhancing transaction throughput.

Kevin Boon, President of Mysten Labs, stated:

Just two years after the mainnet launch, the proposal for a SUI ETF to be listed on Nasdaq is a significant milestone. 21Shares continues to assert its pioneering role in bringing digital asset investment opportunities closer to traditional investors.

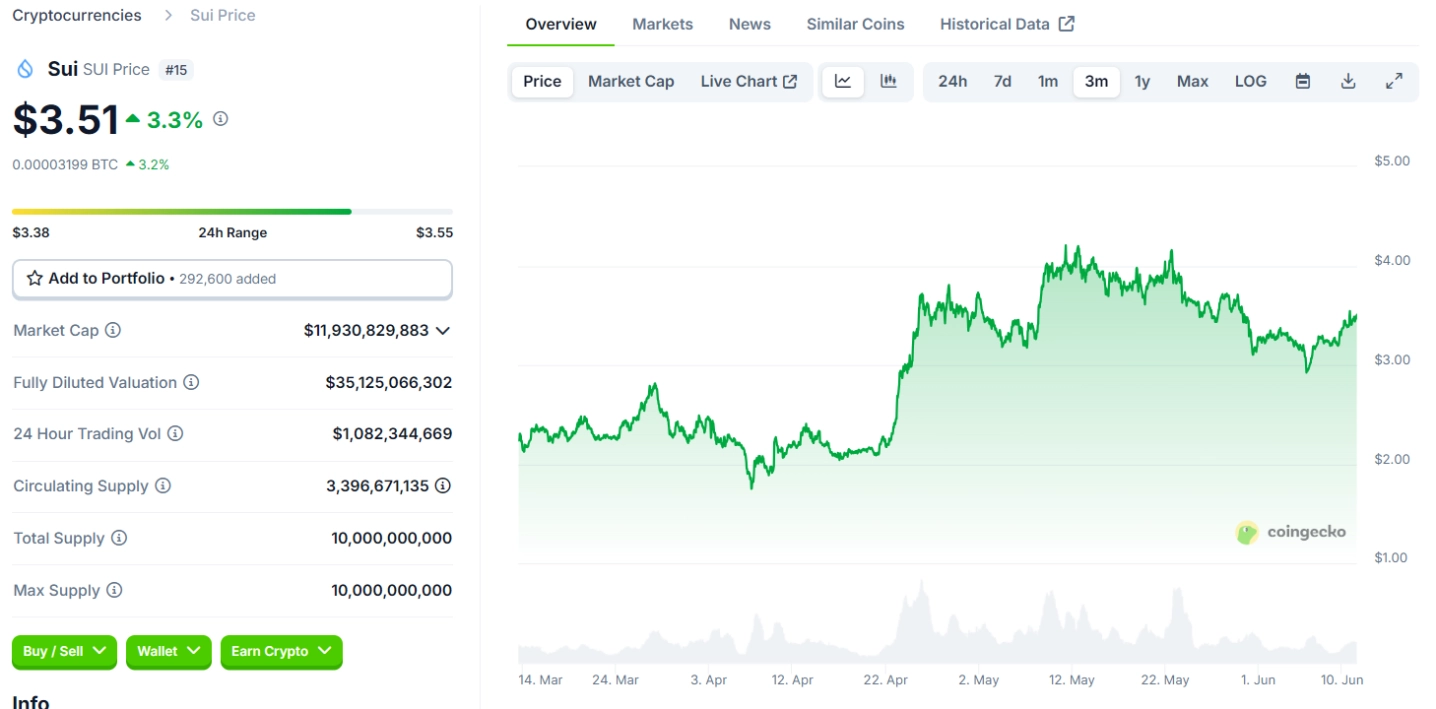

Following this news, the price of SUI remained stable, fluctuating around $3.47, with a slight increase of 2% in the past 24 hours.

Related: US SEC Delays Decision on Canary’s Spot SUI ETF

In a related development, the SEC recently requested organizations proposing Solana ETFs to resubmit their S-1 filings next week. This move indicates that Solana is emerging as a leading candidate to become the next token, after Bitcoin and Ethereum, to be approved for a spot ETF in the U.S.