On June 24, 2024, Tree News, a crypto news aggregator, reported via Bloomberg that Mt. Gox is set to begin repaying debts in Bitcoin and Bitcoin Cash in early July.

This move, while not entirely unexpected, is an unavoidable shock to the market. Signs of this event surfaced in May when Mt. Gox transferred its entire holding of Bitcoin, worth $9.6 billion, to a new address. According to the former CEO of the exchange, this transfer was to facilitate the upcoming asset distribution process.

In a report from September 2023, the trustee of Mt. Gox announced that creditors would be repaid with 142,000 Bitcoin and 143,000 Bitcoin Cash, along with fiat currency totaling 69 billion Japanese yen (approximately $510 million), by October 2024.

A portion of the debt in yen was already repaid on April 23, so the upcoming repayments will be in Bitcoin (BTC) and Bitcoin Cash (BCH). The auditing and transfer processes are being expedited, allowing users to receive their assets by early July, rather than waiting until October as initially scheduled.

Related: Experts Predict Bitcoin Could Fall to $50,000

Bitcoin and Bitcoin Cash Price Volatility

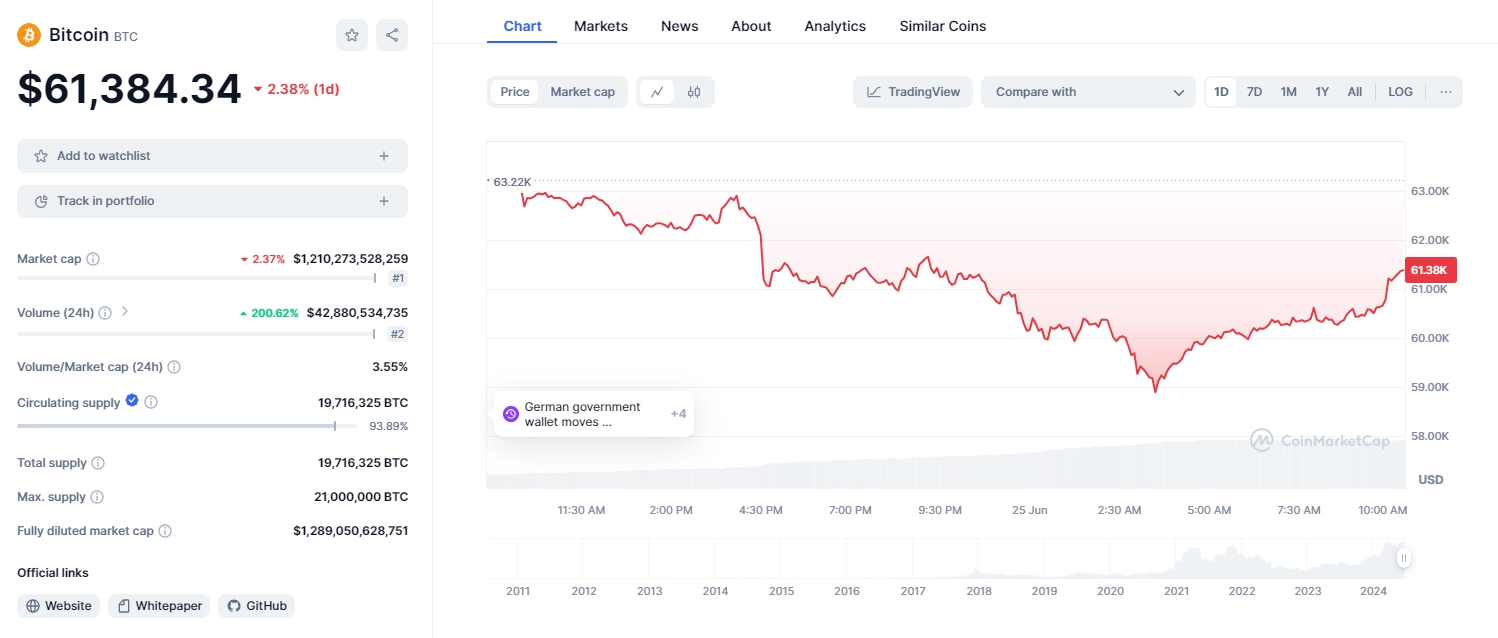

This news has hit the market hard, compounding the declines seen at the start of the week. Currently, BTC is trading around $61,300, showing no signs of recovery as the price chart has formed a double-top pattern, which suggests it could potentially drop to $50,000.

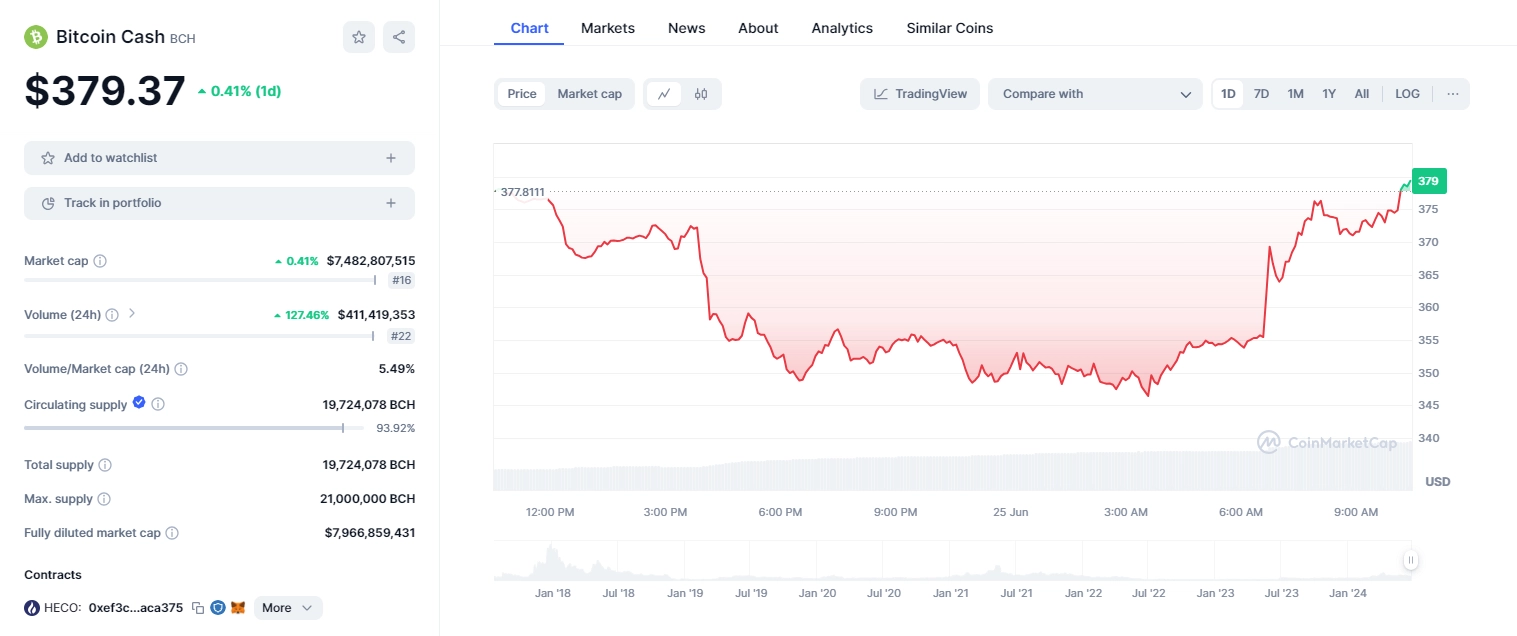

Meanwhile, BCH has experienced a 9% drop over the past 24 hours, now hovering around $380 after briefly touching $345.

The upcoming repayment event by Mt. Gox could cause significant market turmoil, potentially driving further volatility in Bitcoin and Bitcoin Cash prices in the near future.

This is Amazing

Rất ok