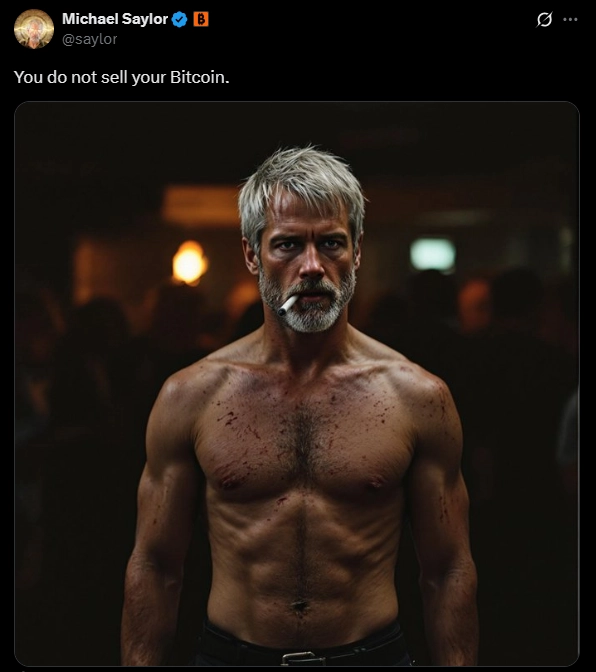

Michael Saylor, known as one of the most ardent supporters of Bitcoin, has recently caught attention on social media with a brief yet meaningful message:

“You do not sell your Bitcoin”.

The Executive Chairman of MicroStrategy posted this tweet alongside an AI-generated image of himself resembling the character Tyler Durden from the classic film “Fight Club”—a symbol of rebellion that challenges traditional social norms.

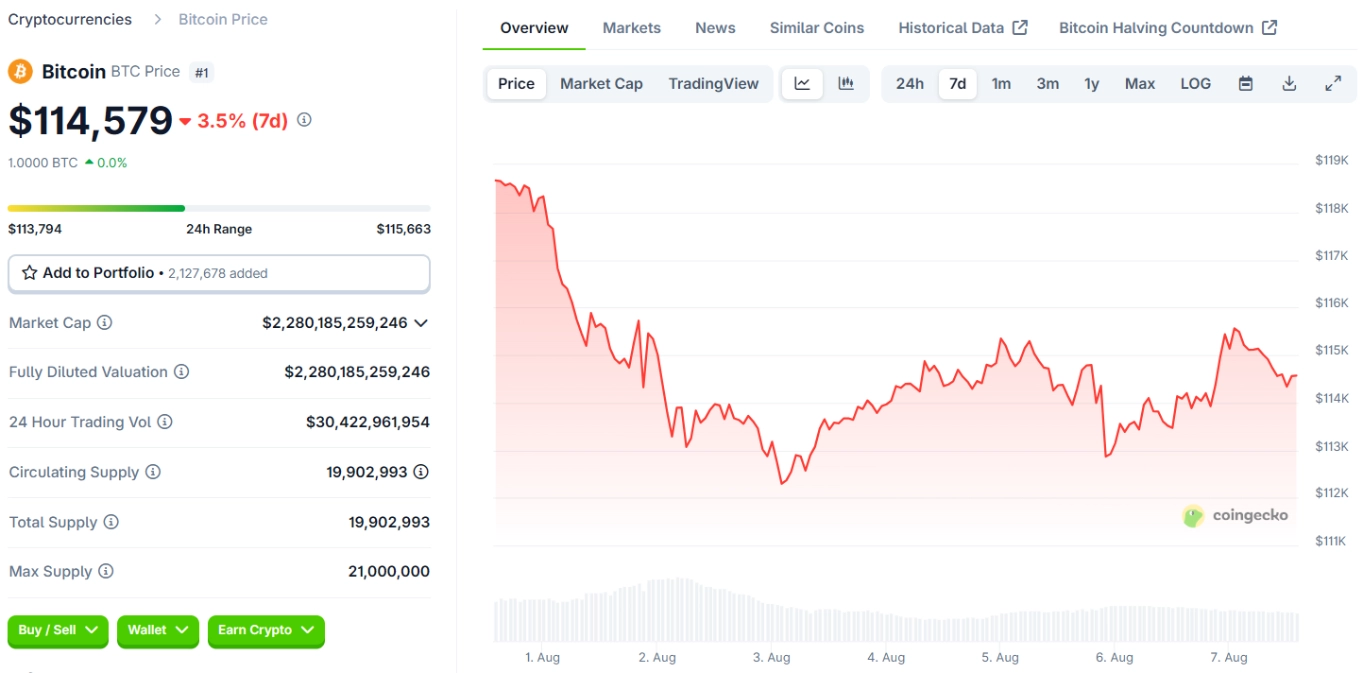

Timely Message Amid Market Volatility

Although Saylor did not specify the exact reason, the timing of this message is significant as Bitcoin’s price is dropping to around $114,000. This move is seen as a strong reminder to investors to maintain their confidence during turbulent market conditions.

The use of Tyler Durden’s image adds weight to the message, evoking the spirit of “going against the grain” and not succumbing to pressure from the traditional financial system.

MicroStrategy “All-In” on Bitcoin

Not stopping at advice, Saylor also shared impressive statistics about MicroStrategy’s asset portfolio. According to him, the company currently holds $71 billion in Bitcoin, with only $50 million in traditional cash left.

This figure reflects MicroStrategy’s unprecedented commitment to Bitcoin, with an asset allocation heavily skewed towards cryptocurrency. This strategy illustrates Saylor’s absolute faith in Bitcoin’s long-term growth potential, despite short-term market fluctuations.

Robert Kiyosaki Shares a Similar View

At the same time, Robert Kiyosaki, author of the famous book “Rich Dad Poor Dad,” also expressed a positive outlook on Bitcoin. He referred to Bitcoin as a “genius asset design” with a simple investment approach:

“Simple, no stress. Just buy and hold.”

Kiyosaki shared his personal experience comparing investment returns between real estate and Bitcoin. According to him, earning his first million from real estate took years, money, and effort. In contrast, with a small investment in Bitcoin, he made millions with almost no additional effort.

“That was the easiest money I’ve ever made,” Kiyosaki candidly admitted.

Related: Binance Achieves Record Futures Trading Volume of $2.55 Trillion in July

The “Hodling” Strategy in the Current Market

Both Saylor and Kiyosaki’s messages emphasize the “hodling” strategy, holding Bitcoin long-term rather than trading it short-term. This perspective is particularly meaningful in the context of the cryptocurrency market experiencing strong volatility.

The positive messages from influential figures in the crypto community could help stabilize market sentiment and encourage investors to maintain their faith in Bitcoin’s long-term potential.