Michael Saylor, the head of MicroStrategy, has announced a “gift” for shareholders. The company generated $299 million in Bitcoin profits (equivalent to 3,177 BTC) over the past week. Saylor described this as a “Christmas present” for shareholders.

This achievement reaffirms MicroStrategy’s leadership in leveraging Bitcoin as part of its strategy to create shareholder value. Recently, the company announced an additional $561 million investment in Bitcoin at an average purchase price of $107,000 per BTC.

MicroStrategy now holds 444,262 BTC, with a total investment of $27.7 billion, equating to an average cost of $62,257 per BTC.

Related: MicroStrategy Continues to Buy Bitcoin, Boosting Reserves to $40 Billion

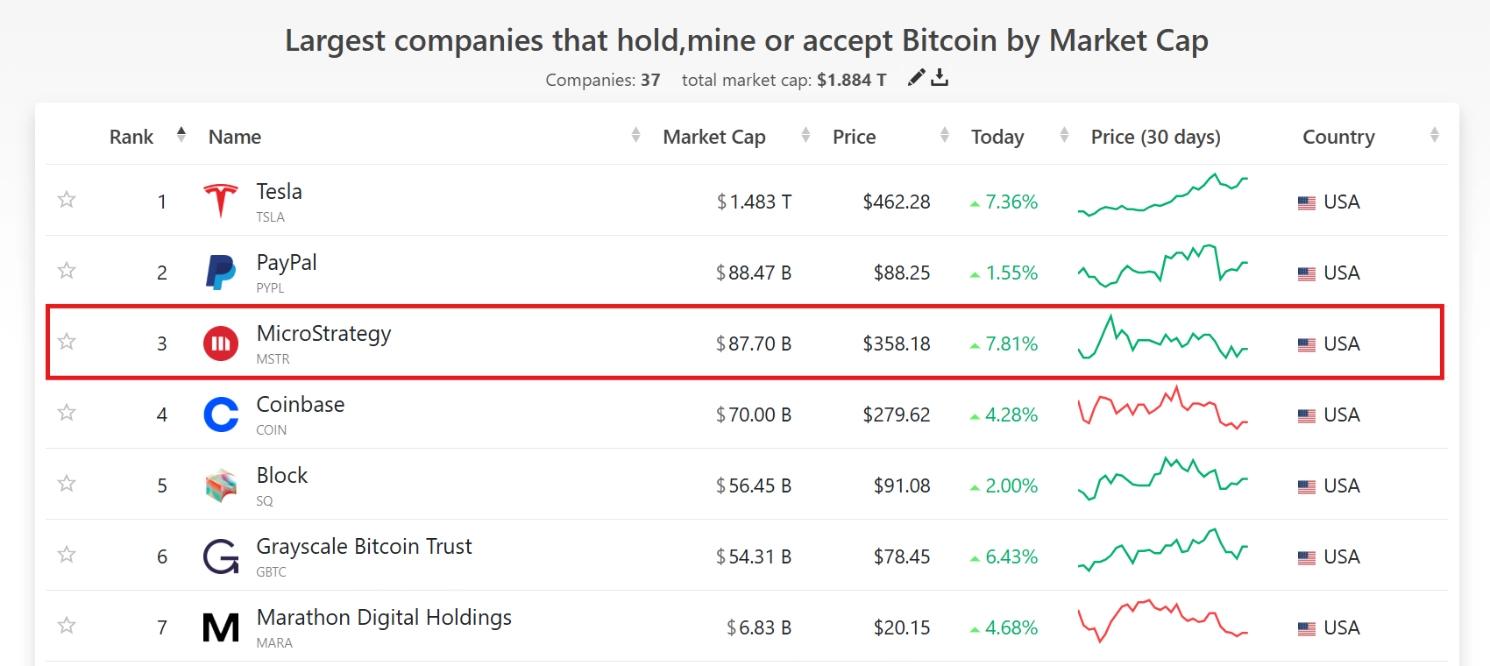

However, rumors have surfaced that MicroStrategy plans to issue $10 billion in shares to purchase $3 trillion worth of Bitcoin. Jeff Park, Head of Alpha Strategy at Bitwise Asset Management, quickly dismissed this as unrealistic. He noted that Bitcoin’s total market cap is currently below $2 trillion, while MicroStrategy’s own market valuation is only about $85 billion.

Park also analyzed the strong correlation between MSTR stock and Bitcoin prices. He argued that even if Bitcoin were to drop to $30,000, MicroStrategy’s stock is unlikely to plummet to zero. He emphasized that the company still has multiple strategies for capital diversification and leveraging opportunities to grow within the broader market.