Yesterday morning (15/08), the U.S. Securities and Exchange Commission (SEC) officially approved the first leveraged MicroStrategy ETF, issued by Defiance ETFs under the stock ticker MSTX. This fund offers a long leverage of up to 175%, targeting institutions and professional investors seeking to increase their exposure to Bitcoin.

Sylvia Jablonski, CEO of Defiance ETFs, shared:

We are expanding opportunities for investors who want to access higher leverage with Bitcoin. With the inherent volatility of MicroStrategy compared to Bitcoin, MSTX presents a unique opportunity to optimize leverage in the Bitcoin market through an ETF.

The inflow of capital into ETFs has significantly contributed to the price increase in the cryptocurrency market. As of February 15, ETFs accounted for approximately 75% of new capital flowing into Bitcoin, helping the “king coin” surpass the $50,000 mark.

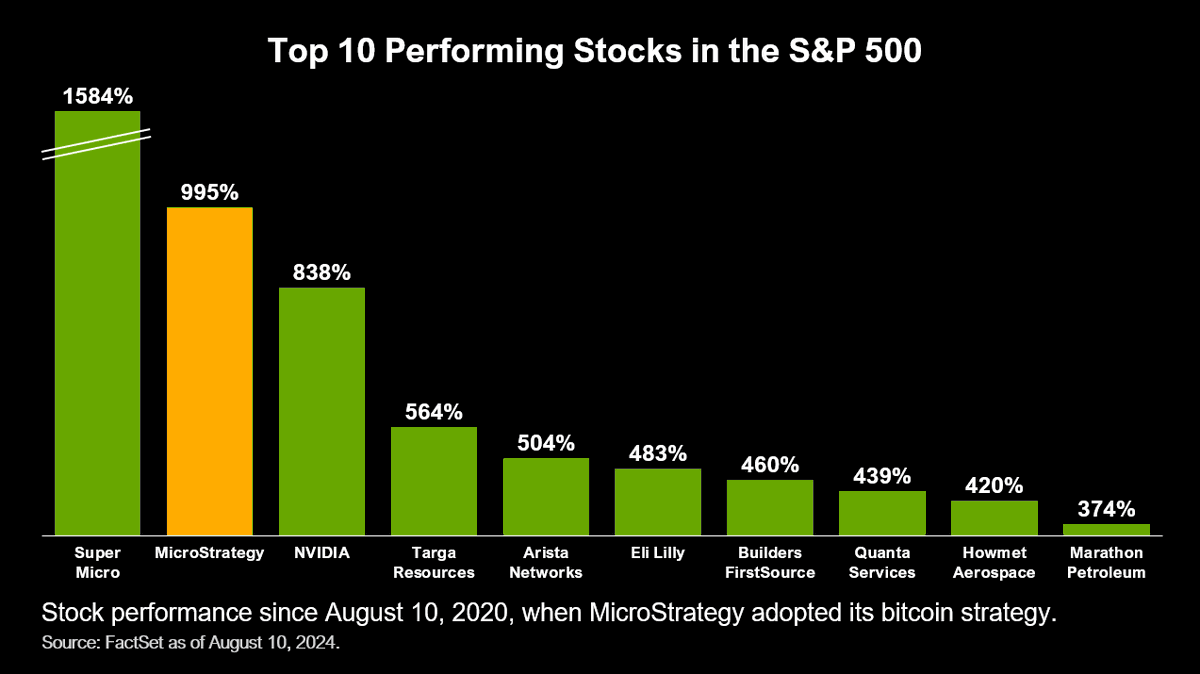

MicroStrategy is one of the pioneering public companies to openly hold Bitcoin. Currently, the company owns 226,500 Bitcoins, with an average purchase price of $35,158 per coin. Michael Saylor, founder of MicroStrategy, proudly stated that the company has outperformed 99% of the firms in the S&P 500 index.

He emphasized in an article on August 11:

Four years ago, MicroStrategy chose Bitcoin as its primary reserve asset; since then, $MSTR has outperformed 499 out of the 500 stocks in the S&P 500 index.

This new leveraged ETF could attract significant interest due to the impressive price performance of MicroStrategy stock, which has also outperformed Bitcoin in recent months. Over the past six months, MicroStrategy stock has risen by more than 70%, while Bitcoin has only increased by 13%.

Related: MicroStrategy Holds Over 1% of Total Bitcoin Supply

Due to the high-risk nature of leveraged investments, the new ETF is not aimed at individual investors but rather at “sophisticated investors” – those with experience and the ability to manage the risks associated with complex financial products.

When I originally commented I clicked the -Notify me when new feedback are added- checkbox and now each time a remark is added I get 4 emails with the identical comment. Is there any method you possibly can remove me from that service? Thanks!