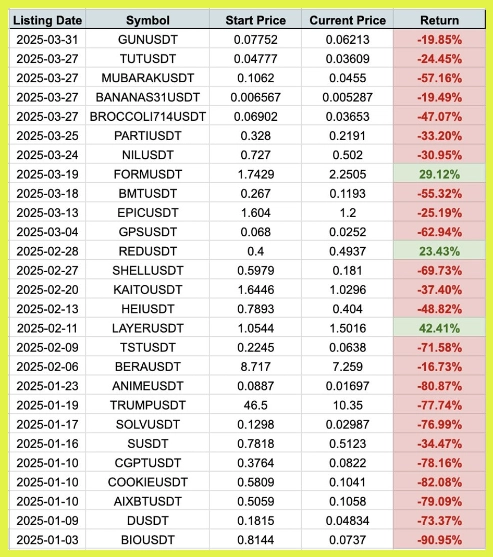

Listing on Binance was once seen as a “golden ticket” for cryptocurrency projects, but by 2025, among the 27 tokens listed on Binance since the beginning of the year, 24 tokens are trading below their listing prices, with an average loss of about 44% compared to the listing price. Only three rare projects, FORM, RED, and LAYER, have reported positive results, while the majority of the remaining tokens have suffered significant losses.

If you invested $100 in each project listed on Binance since the beginning of the year, your total capital of $2,700 would now be around $1,500. This shows that being listed on Binance no longer guarantees the “auto pump” effect it once did. The golden era when a token listed on Binance immediately attracted attention and experienced strong growth seems to be over.

Part of the reason is market saturation. Currently, the total number of altcoins in the market has reached 36 million, causing investors’ attention to be diluted. A newly listed token is now no different from a grain of sand in a vast desert. The influx of new tokens into the market is too rapid, diminishing the allure and ability to create the “hype” seen in the past.

Related: The Trump Family Has Pocketed Over $620 Million from Crypto

Many seasoned investors believe that Binance is increasingly prioritizing the listing of lower-quality projects. Some opinions suggest that the motivation behind this may be for Binance, the projects, and market makers to quickly offload tokens right after listing, without needing to invest much in building long-term value. In this context, retail investors find it difficult to “make it back” if they hold tokens blindly.