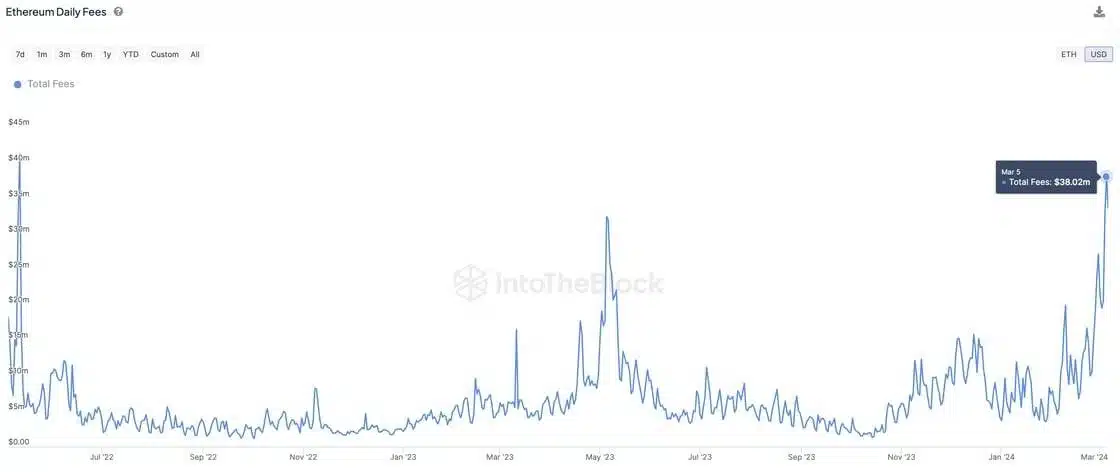

Gas transaction fees on Ethereum have surged to their highest level in over two years, coinciding with a resurgence in network activity driven by the rise in ETH prices, particularly fueled by the trading frenzy of memecoins.

This week, revenue from gas fees on the Ethereum blockchain reached $193 million, hitting a peak since May 2022 – the time of the LUNA/UST crash – and rising by 78% compared to the previous week.

On average, gas fees on Ethereum have ranged from $40 to $60 for a token transfer/swap transaction, marking the highest level since May 2023, posing challenges for users.

The main driver behind this phenomenon is the trading activity of memecoins. Since the beginning of March, a significant number of cryptocurrency investors have shifted capital into memecoins such as Shiba Inu (SHIB), Floki Inu (FLOKI), and Pepe (PEPE), resulting in doubling the prices of these tokens in a short period.

Another evidence of the bustling trading activity on the Ethereum network is the trading volume of the DEX Uniswap, which has surged by 40%, reaching $20 billion this week, according to DefiLlama data.

The significant increase in gas fees also brings some benefits to ETH token holders, as the EIP-1559 mechanism burns a portion of the transaction fees. According to statistics from ultrasound.money, in the past 30 days, the Ethereum network has burned more than 148,735 ETH, valued at over $580 million. During that time, Ethereum only generated an additional 73,570 ETH from transaction confirmation rewards, resulting in an inflation rate on the network of 0.76% per year.

The applications consuming the most gas fees include the DEX Uniswap and 0x, MetaMask wallet, layer-2 solutions Arbitrum and Optimism, ETH and USDT transfers, as well as trading bots BananaGun and Maestro.

Since the implementation of EIP-1559 in August 2022, over 4.1 million ETH has been burned through this mechanism.

Gas fees on Ethereum’s layer-2 solutions have also risen sharply, sometimes reaching $1 on Arbitrum. However, with the Dencun upgrade scheduled for March 13th, Ethereum developers hope to reduce fees on layer-2 solutions to just a few cents, alleviating fee pressure for users and enhancing scalability for the world’s leading smart contract network.

Many investors are hopeful that Ethereum will receive ETF support similar to Bitcoin, opening up more growth opportunities for the cryptocurrency. However, the prospects for an Ethereum ETF are considered less promising than Bitcoin’s, as the SEC continues to delay decisions on proposals from BlackRock and Fidelity.

Related: Ethereum’s Dencun Upgrade Set to Launch March 13

Ethereum Chart

While Bitcoin has established a new ATH, Ethereum still needs further momentum to surpass the $4,868 peak of November 2021.

ETH/USDT chart on TradingView at 06:39 on March 10, 2024 (UTC)

C’est sur

It s a c’est opportunity

We want