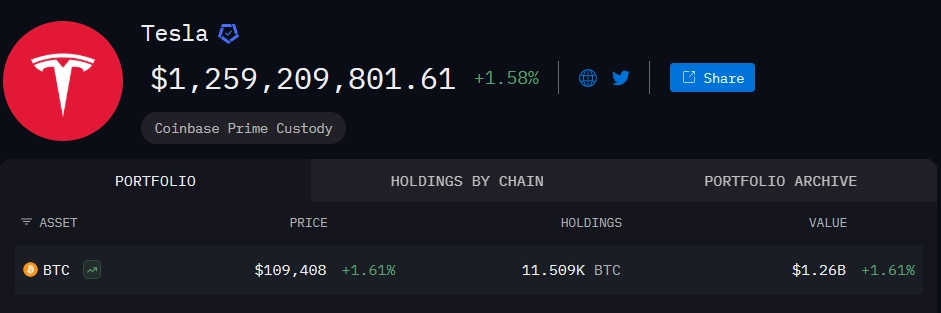

Tesla currently holds 11,900 BTC, equivalent to approximately $1.2 billion, according to data from Arkham Intelligence. The company began investing in Bitcoin in Q1 2021, acquiring a total of 43,200 BTC ($1.5 billion) and previously accepted Bitcoin as a payment method for electric vehicles.

However, Tesla stopped supporting BTC payments in May 2021 due to concerns about the environmental impact of Bitcoin’s proof-of-work (PoW) mechanism, which is energy-intensive and heavily reliant on fossil fuels. To manage its large Bitcoin holdings, Tesla uses Coinbase Prime Custody for vaulting services and has adjusted its investment strategy to prioritize sustainability.

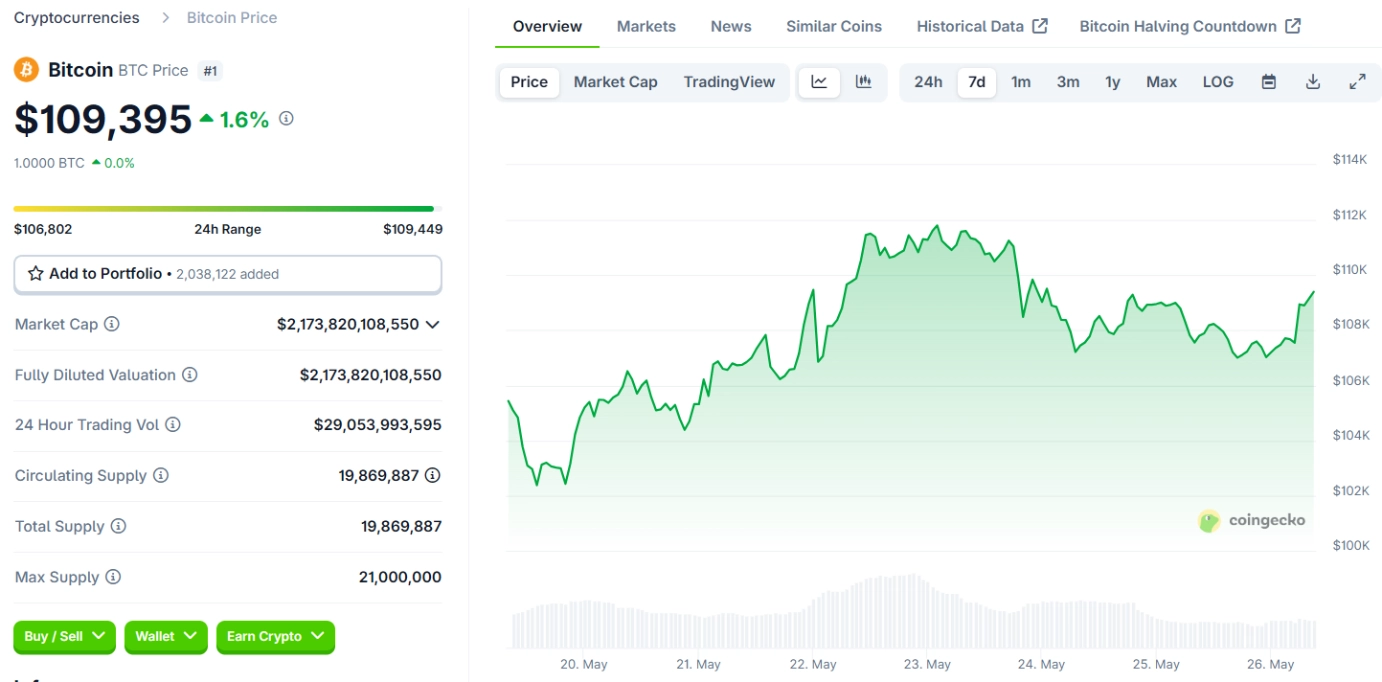

In 2021, Elon Musk oversaw the purchase of $1.5 billion in Bitcoin, but Tesla later sold part of its holdings to ensure liquidity. As of April 22, 2025, Tesla’s Bitcoin holdings reached 11,509 BTC, valued at approximately $1.05 billion, which has now increased to $1.2 billion due to a significant rise in Bitcoin prices.

In Q1 2021, Tesla sold 10% of its Bitcoin holdings, raising $272 million, leaving it with 9,720 BTC. Elon Musk explained that this sale was to meet cash demands, but if Tesla had retained the full 43,000 BTC, its Bitcoin value could have approached nearly $5 billion.

Related: Swedish and Chinese Companies Spark Market Attention with Bitcoin Investment Plans

Currently, the community is speculating that Musk may integrate Bitcoin or Dogecoin into his business operations, especially as the value of these cryptocurrencies contributes to enhancing Tesla’s balance sheet assets.