Hong Kong has made a significant stride in its efforts to regulate cryptocurrencies by introducing the Stablecoin Bill to the Legislative Council. The bill’s journey began on December 6, when it was published in the Official Gazette of the Special Administrative Region. On December 18, it was officially presented to the Legislative Council for its first reading.

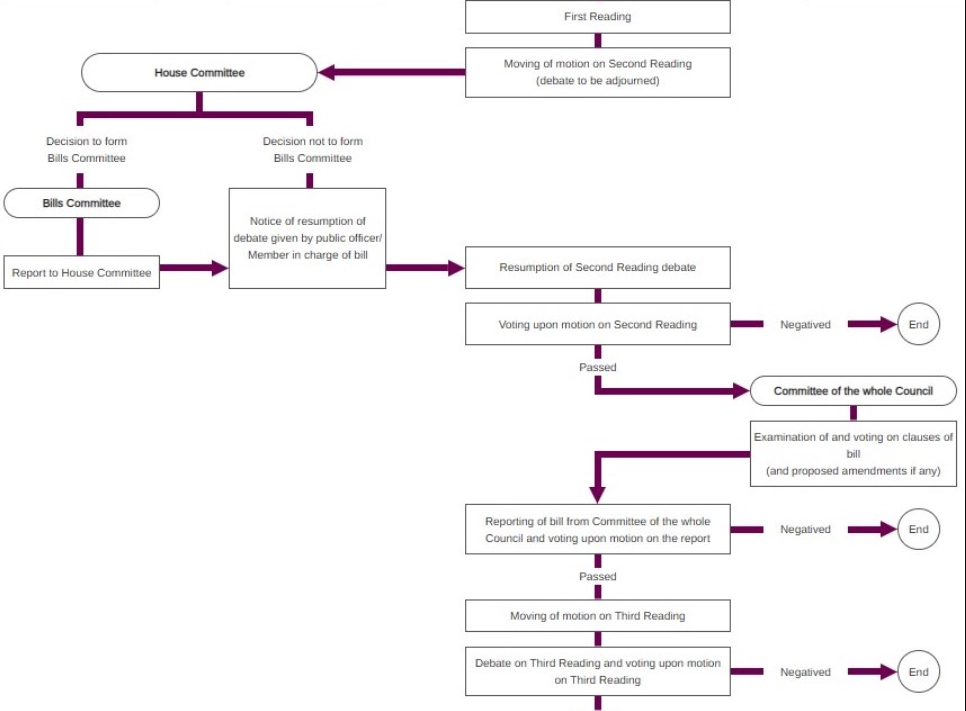

Before becoming law, the draft will undergo three rounds of thorough scrutiny, including debates, reviews, and necessary amendments. Once it passes the final evaluation, the bill will be forwarded to the region’s Chief Executive for signing into law.

The bill focuses on three main pillars: licensing regulations for issuers, stablecoin issuance processes, and user protection measures along with marketing guidelines. Once enacted, any organization wishing to issue stablecoins in Hong Kong must obtain a license from the Hong Kong Monetary Authority (HKMA). To qualify, issuers must meet stringent requirements regarding competency, reserve assets, and price stabilization mechanisms.

Related: Hong Kong Exempts Crypto Taxes, Following Donald Trump’s Lead

This bill could bring transformative changes to the market, akin to the impact of MiCA regulations in Europe. According to a December 18 report by research firm Kaiko and exchange Bitvavo, MiCA has dramatically reshaped the stablecoin landscape in Europe. While issuers like Tether have withdrawn from Euro-denominated stablecoin issuance, MiCA-compliant organizations have thrived. By November 2024, three entities—Circle, Societe Generale, and Banking Circle—held 91% of the MiCA-compliant stablecoin market share.