Grayscale, the “giant” in crypto asset management, has just launched two new investment trusts, creating attractive opportunities for investors to access the TAO token of Bittensor and the SUI token of the Sui project. This move not only diversifies their investment portfolio but also reflects the trend of combining blockchain and artificial intelligence (AI) in the crypto world.

- Bittensor (TAO) is an open-source machine learning protocol based on blockchain, which allows the combination of AI models into a decentralized AI network. This approach helps to expand and share knowledge rapidly, resembling an unstoppable and exponentially growing knowledge library.

- Sui (SUI) is a blockchain project developed using the Move programming language, created by the Diem team (the stablecoin project that Facebook canceled). Sui aims to address the multi-dimensional scalability issues of traditional blockchains, optimizing resource usage and expanding operational throughput.

Before the launch of the Bittensor Trust and Sui Trust funds, Grayscale had introduced investment trusts for Near and Stack three months ago to provide diversified investment opportunities in various crypto assets.

Recently, Grayscale also introduced a new AI-focused fund named Grayscale Decentralized AI LLC, restructured its investment portfolio quarterly to boost AI-related investment efforts in the crypto sector. The decentralized AI projects included in the fund’s portfolio are Near (NEAR), Filecoin (FIL), Render (RNDR), Livepeer (LPT), and Bittensor (TAO). Among them, NEAR, FIL, and RNDR are the assets to which the “giant” has allocated the highest capital ratios in the fund.

Related: Grayscale Establishes Decentralized AI Fund LLC

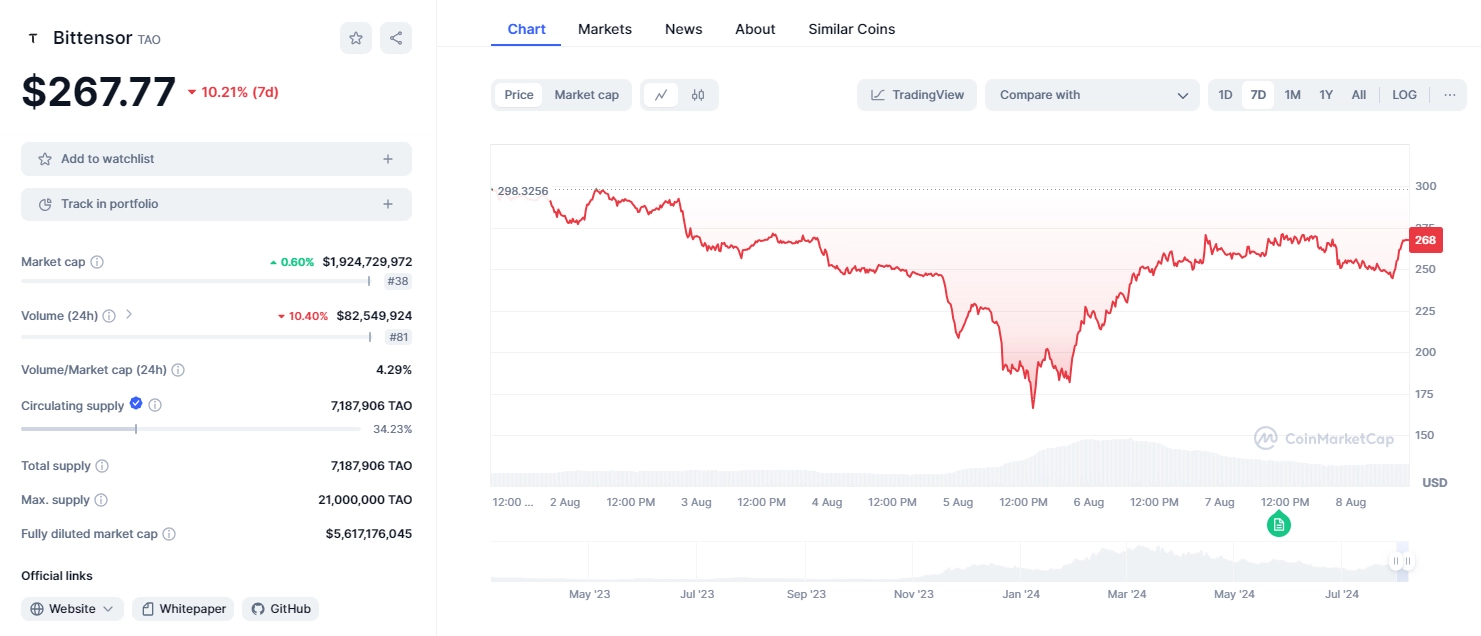

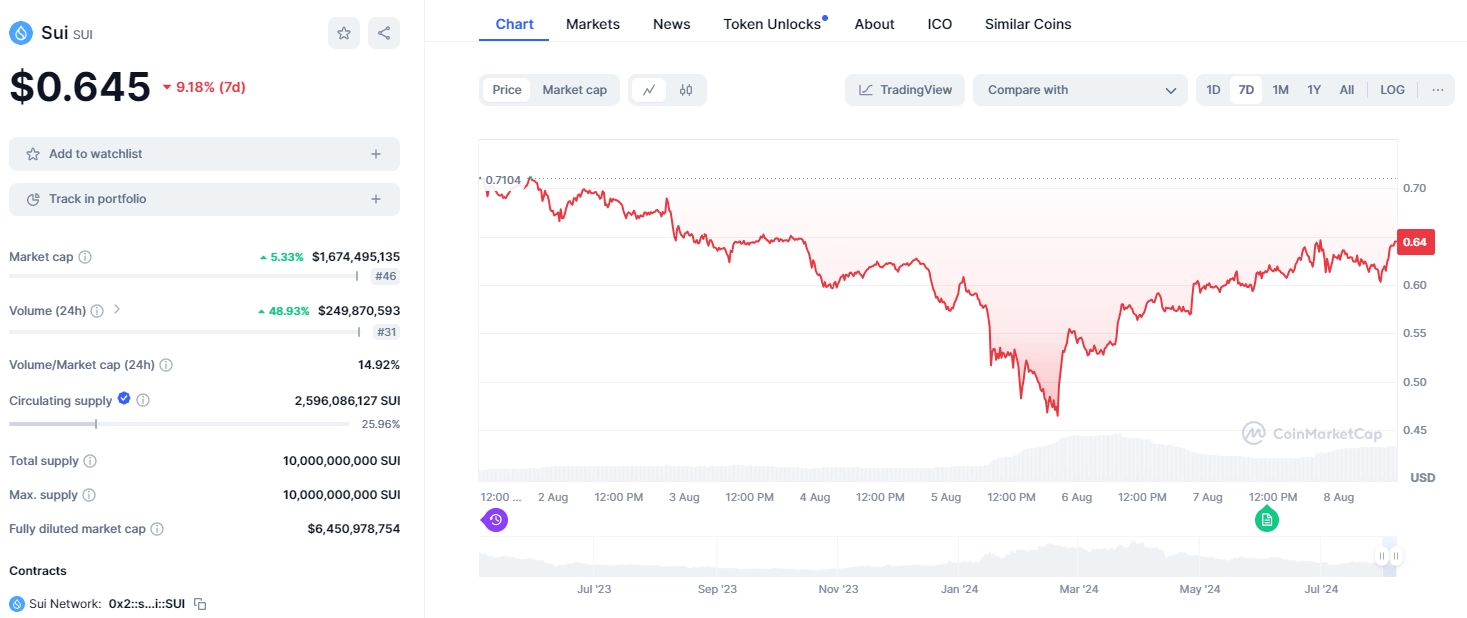

Price Movements of Bittensor (TAO) and Sui (SUI)

Overall, these two tokens are still on a recovery trajectory after Bitcoin’s crash last Monday.