Grayscale Investments recently announced the launch of a new decentralized AI fund called LLC, aimed at capturing the growth of AI in the cryptocurrency ecosystem and providing accredited investors with access to AI-driven blockchain projects.

The New Fund Targets AI Cryptocurrency Protocols

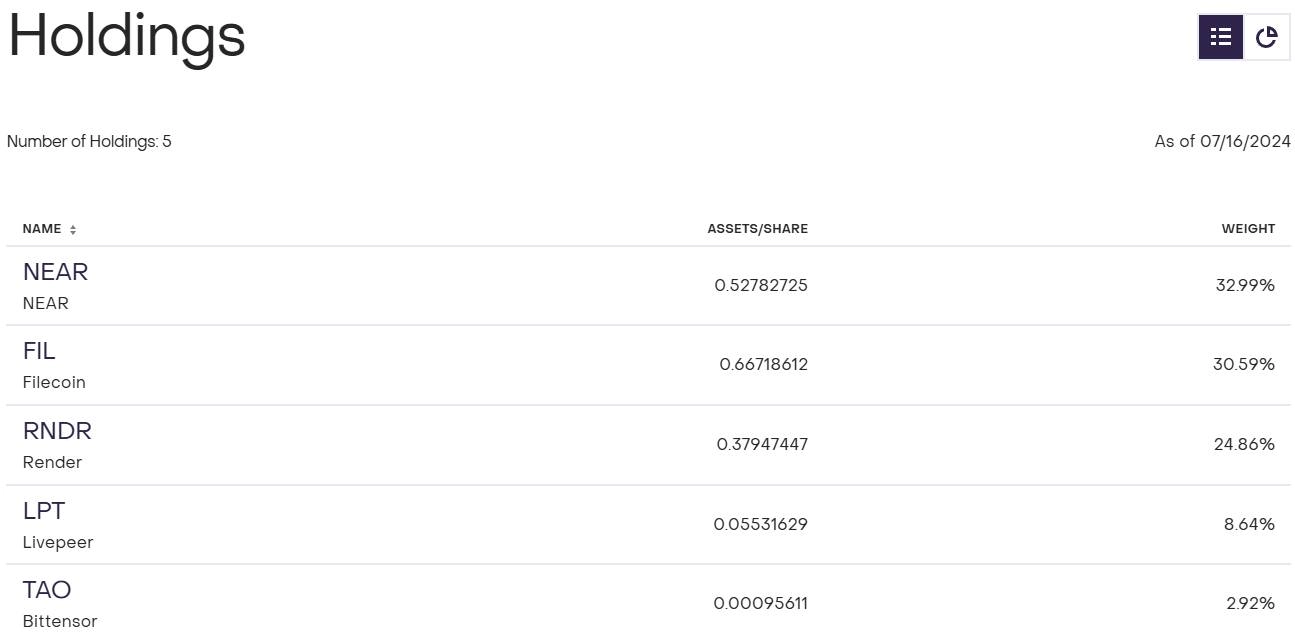

The fund will focus on protocols such as Bittensor (TAO), Filecoin (FIL), Livepeer (LPT), Near (NEAR), and Render (RNDR). The portfolio will be rebalanced quarterly to leverage the decentralized, accessible, and transparent principles of blockchain.

The Fund Targets Three Main Categories:

- Decentralized AI Services: Protocols developing decentralized AI services, such as chatbots and image generation.

- AI-related Issues: Protocols addressing AI-related issues, such as authenticity checks against bots and deepfakes.

- AI Infrastructure: Investments in essential AI infrastructure, including decentralized platforms for data storage, GPU computation, and 3D rendering.

Statement from Rayhaneh Sharif-Askary, Grayscale’s Head of Product & Research

The development of breakthrough technologies has created exciting opportunities for Grayscale’s investors since our founding in 2013. We believe that the launch of the Decentralized AI Fund offers an opportunity to invest in decentralized AI at its earliest stages, said Sharif-Askary.

She emphasized, Blockchain-based AI protocols embody the principles of decentralization, accessibility, and transparency. The Grayscale team strongly believes that these protocols can help mitigate the inherent risks associated with the widespread adoption of AI technology.

Related: AI Captivates Cryptocurrency Investors

Grayscale Launches Dynamic Income Fund

Previously, in May, Grayscale launched the Dynamic Income Fund (GDIF), a proof-of-stake investment fund for millionaire investors with a net worth of at least $2.2 million.

GDIF aims to capitalize on the growing proof-of-stake token ecosystem by employing flexible strategies to optimize returns. The fund’s primary goal is to leverage staking rewards generated by proof-of-stake digital assets.