In September 2025, we witnessed an impressive trend as gold extended its winning streak for four consecutive weeks, reaching a new record of $3,659 per ounce. As the precious metal continues to “soar,” the Bitcoin community eagerly awaits a similar explosion based on the historical correlation between the two assets.

Strong Momentum Behind Gold

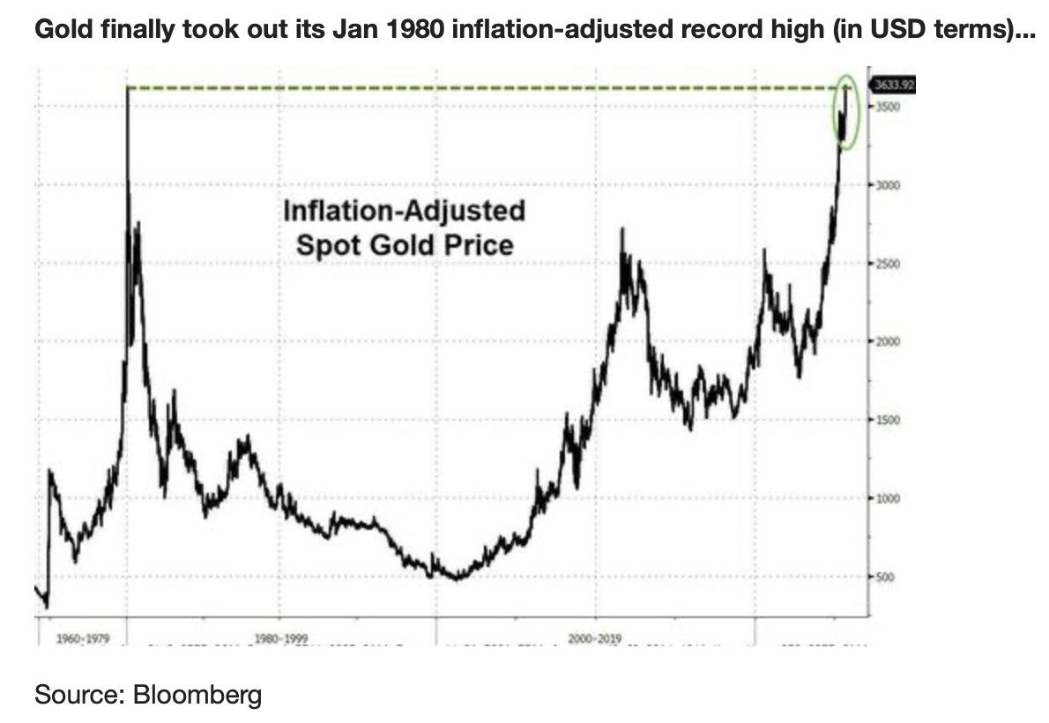

The significant rise in gold is not just a short-term rally. According to EndGame Macro, gold has officially surpassed its historical peak from 1980 (after adjusting for inflation), ending a long 45-year wait.

Key drivers include:

- Signals from Central Banks: Data from Crescat Capital shows that foreign central banks are now holding more gold than U.S. Treasury bonds for the first time since 1996.

- Crisis of Confidence: The growing burden of U.S. public debt has raised doubts about the Fed’s credibility.

- Geopolitical Tensions: Global instability is driving demand for safe-haven assets.

- Record Gold Purchases: Emerging market central banks are ramping up their gold reserves.

“Gold isn’t rising just because people suddenly like this shiny metal, but because trust in the financial system is gradually weakening,” EndGame Macro emphasized.

Experts Predict Even Higher Gold Prices

Ray Dalio, founder of Bridgewater Associates, warns of stagflation risks due to the global debt burden. He believes the current liquidity shortage makes the USD less attractive compared to other currencies, thereby bolstering gold’s outlook.

Crescat Capital even forecasts that gold could climb to $4,000 or higher, based on central banks prioritizing gold over U.S. bonds.

Bitcoin May Follow Gold’s Lead

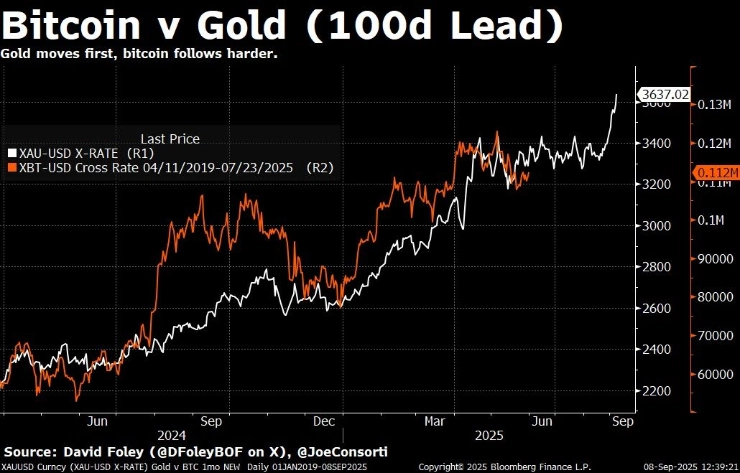

Joe Consorti, a well-known Bitcoin analyst, points out that gold typically leads BTC by about 100 days, as gold has:

- Liquidity 10 times that of Bitcoin

- Broader allocation in global investment portfolios

“BTC is an echo waiting to explode. The first maintenance rate cut will happen next week. Q4 looks promising,” Consorti remarked.

Tephra Digital provides deeper analysis on Bitcoin’s correlation with:

- Global M2 Supply: BTC trails with a 102-day lag

- Gold Prices: Bitcoin follows with a 200-day lag

“If Bitcoin’s lagged correlation with M2 and gold continues, the rest of the year promises to be extraordinary. Charts indicate a target price range between $167,000 and $185,000,” Tephra Digital predicts.

However… There Are Concerning Signs

Recently, silver surpassed $41—its highest level since 2012. This raises concerns that the precious metal is attracting more capital than Bitcoin.

Investor LBroad notes, “It seems that capital is starting to shift away from hot assets like Bitcoin and flow into traditional safe havens like precious metals.”

Economist Peter Schiff points out that Bitcoin’s value in terms of gold is currently about 16% lower than its peak in November 2021. This may signal a larger trend as investors prioritize precious metals over crypto.

Regardless of the final outcome, one thing is certain: the race between gold and Bitcoin amid the shifting global financial system will continue to be a hot topic in the final months of 2025.