In the first six months of 2025, public companies worldwide have aggressively purchased 245,510 Bitcoin (BTC), more than double the amount accumulated by trading ETFs (118,424 BTC) during the same period. According to CryptoSlate, this figure not only marks an impressive milestone but also indicates a growing trend of Bitcoin adoption among traditional businesses, signaling a significant shift in the financial market.

Data shows that the amount of Bitcoin purchased by listed companies surged by 375% compared to the same period last year, from 51,653 BTC to over 245,000 BTC. Meanwhile, Bitcoin ETFs recorded a sharp decline in buying power, achieving only 44% of their peak when they launched in 2024. On average, for every 1 BTC absorbed by ETFs, businesses have purchased up to 2.1 BTC. Demand from enterprises increased from 19% to 207% within six months, confirming the growing importance of public companies in shaping Bitcoin prices, gradually replacing ETFs.

Unlike ETFs, which reflect the sentiment of individual investors, hedge funds, or institutional investors, businesses incorporating Bitcoin into their treasury demonstrate a long-term strategic vision from leadership. This move reinforces the belief that Bitcoin is increasingly being recognized as a legitimate reserve asset in the corporate finance world.

Related: When Does Altcoin Season Occur?

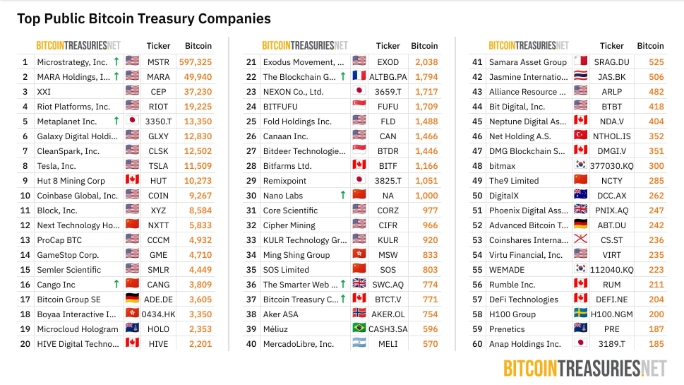

In the first half of 2025, Strategy continued to lead the “Bitcoinization” trend of balance sheets with 135,600 BTC, accounting for 55% of the total Bitcoin purchased by businesses. However, this ratio has decreased from 72% the previous year, indicating the increasing participation of other companies such as DDC Enterprise, The Smarter Web Company, Bitcoin Treasure Corporation, Fold Holdings Inc, Parataxis Holdings, and most recently, Figma.

Notably, Metaplanet, a financial company from Japan, has gained significant attention by increasing its Bitcoin holdings from 3,350 BTC to 13,350 BTC in just three months (from March to June 2025). With this figure, Metaplanet surpasses major players like Galaxy Digital (12,830 BTC) and CleanSpark (12,502 BTC), entering the top 5 companies with the most Bitcoin holdings globally. This trend indicates that the wave of Bitcoin accumulation is no longer limited to a few major names but is spreading across various sectors, from technology and finance to manufacturing.