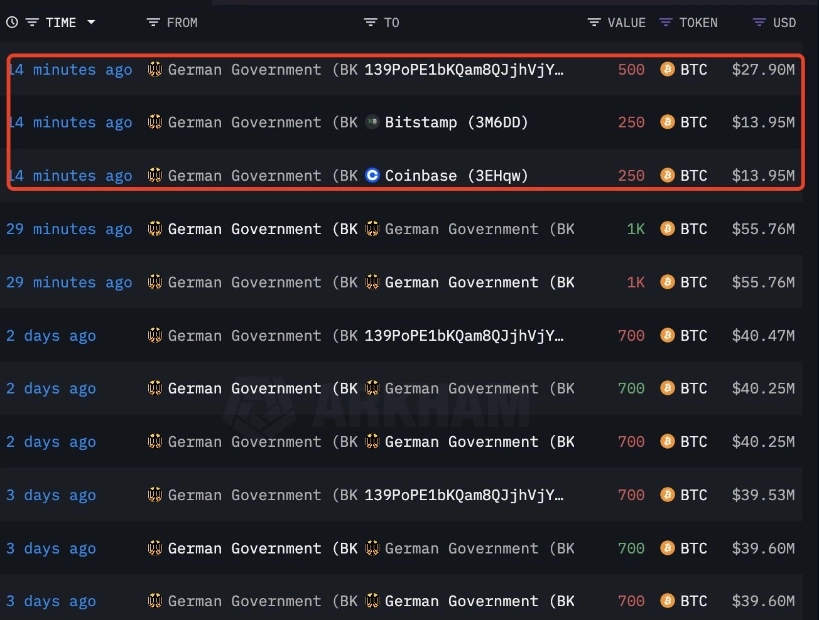

According to data from Arkham Intelligence, Germany, the largest economy in the Eurozone, currently holds 39,826 BTC, valued at approximately $2.2 billion. This significant amount of unsold Bitcoin represents about 9% of BTC’s 24-hour trading volume, which is around $25.3 billion. Such a large holding can potentially cause significant price fluctuations in the market.

Germany’s Massive Bitcoin Reserve

Germany’s substantial Bitcoin reserve, worth around $3 billion, was seized from Movie2k.to, a website involved in movie piracy. In January, German police confiscated 50,000 BTC from this site, marking “the largest Bitcoin seizure by law enforcement in the Federal Republic of Germany to date,” according to a press release.

Since mid-June, the German government has been gradually liquidating over 10,000 BTC, exerting downward pressure on the cryptocurrency market.

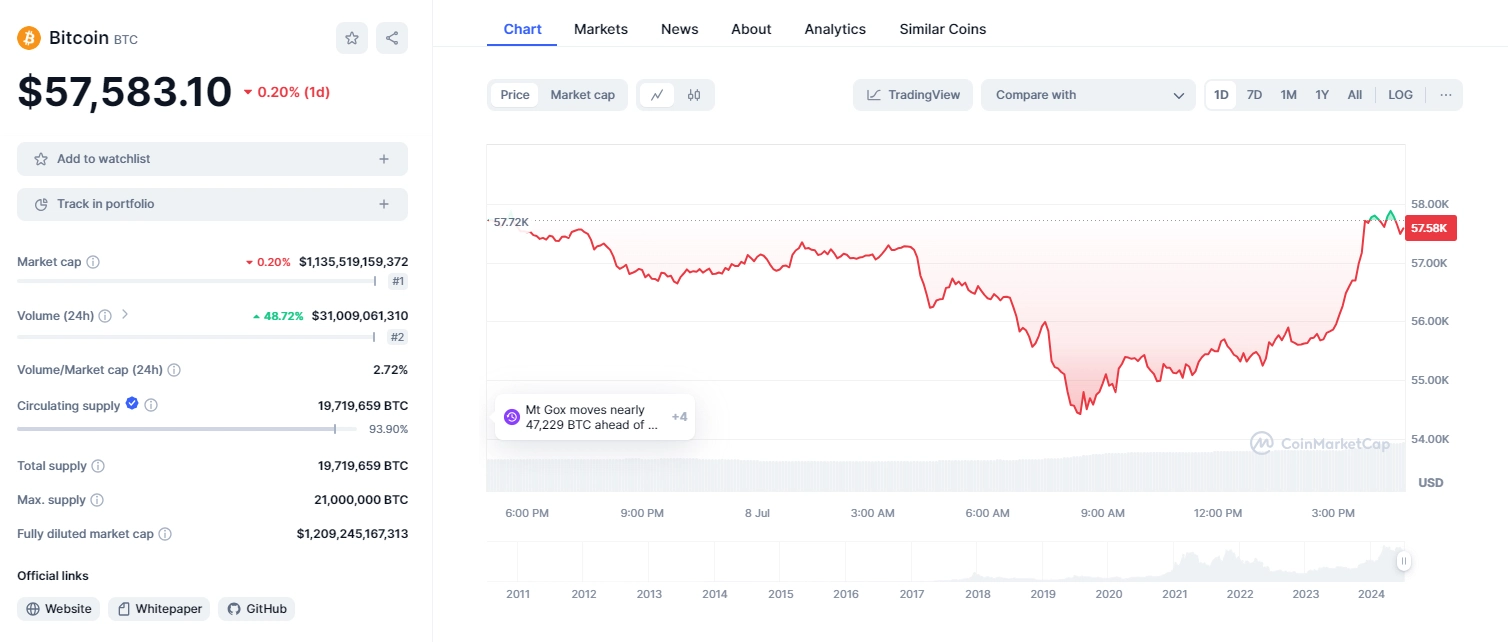

The impact of Germany’s BTC sales has been evident in recent weeks. The spot price of Bitcoin has dropped nearly 20%, falling to $55,490. Over the past 7 days, the price has decreased by about 13%.

Aware of the potential negative consequences, Justin Sun, the founder of Tron, proposed purchasing BTC directly from the German government outside the open market. Sun’s proposal aims to mitigate the adverse effects on the spot price caused by large-volume sales. However, it remains uncertain whether German authorities will consider such a deal.

Related: Justin Sun Offers to Buy German Government’s Bitcoin

Critics argue that Germany’s decision to sell BTC for fiat currency is a strategic mistake with geopolitical implications. A Blockware Intelligence newsletter dated July 5th raised concerns, suggesting that any nation selling Bitcoin for fiat is unwise, as fiat currency can be printed in unlimited quantities. In contrast, Bitcoin is scarce and requires significant energy to mine, making it a valuable and finite asset.

Nice job

Good work