FTX, the crypto exchange currently undergoing bankruptcy proceedings, is expected to distribute over $5 billion to creditors on May 30. This marks one of the largest single-day payouts in the history of crypto-related bankruptcies, representing a major milestone in the aftermath of the platform’s dramatic collapse.

To be eligible for the payment, creditors must have had their claims approved by April 11, 2025. They are also required to complete identity verification (KYC), submit the necessary tax forms, and select a distribution service provider. This round of payouts prioritizes claims valued over $50,000. Creditors who missed earlier distributions but completed the required steps before the April deadline will also be included.

Those selecting Kraken or BitGo as their distribution partner will receive funds within 1–3 business days after May 30. Previously, FTX disbursed around $800 million to creditors with claims under $50,000, and another $400 million payout to this group is expected by the end of 2025.

All payouts are based on asset valuations as of November 2022, when FTX filed for bankruptcy, not current market prices. As a result, many analysts believe this influx of capital could trigger a new “altcoin season” as creditors reinvest to recover losses.

FTX has so far recovered between $14.7 billion and $16.5 billion in total assets. The bankruptcy estate estimates that 98% of eligible creditors will receive at least 118% of their original claim value, in cash — though still calculated based on the 2022 asset prices.

FTX has warned that creditors who do not complete the necessary procedures by June 1 risk forfeiting their claims. The platform urges all involved parties to check their status via the official claims portal.

Related: Bitcoin and the Retail Investor Wave: Is It Time for Takeoff?

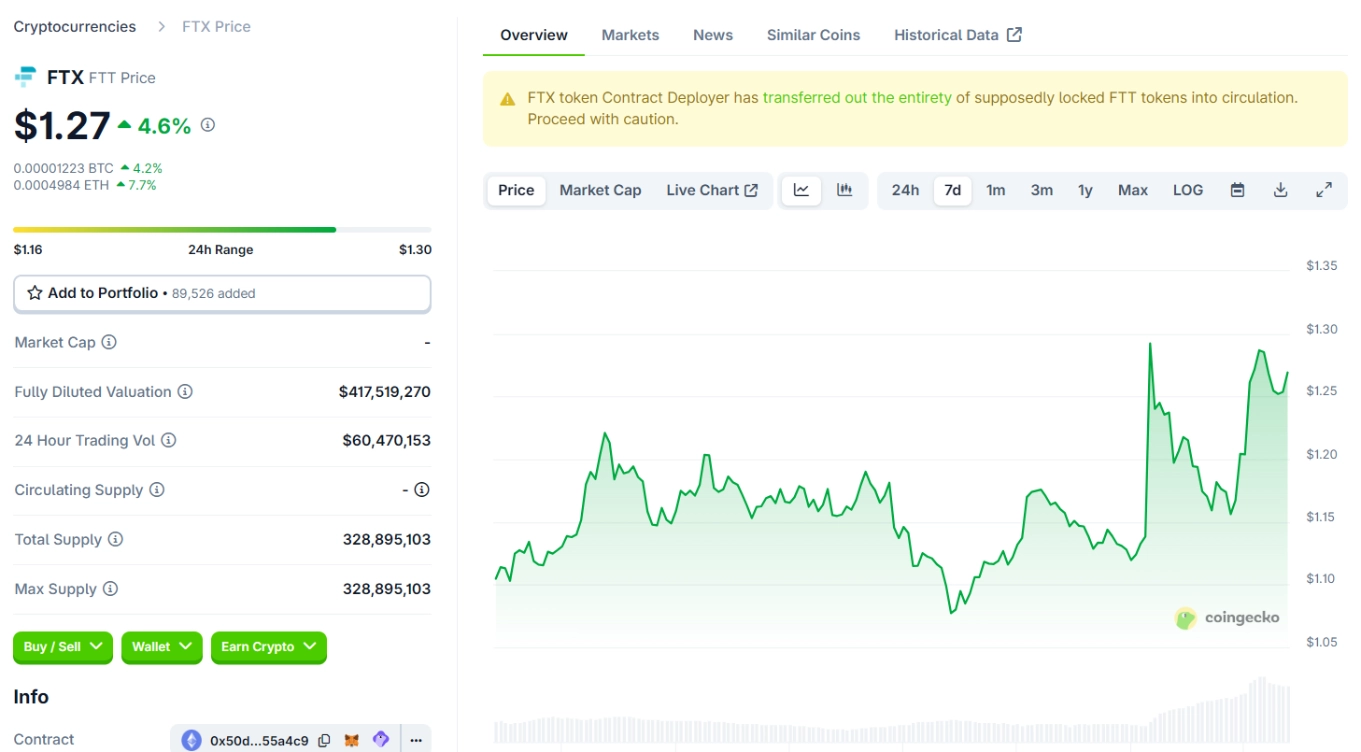

This upcoming distribution is not only a key step in closing the book on one of crypto’s most damaging collapses, but also a potential spark for renewed market momentum. Following the announcement, the price of FTX’s native token FTT surged nearly 12%, reflecting growing investor interest.

In related news, Netflix is reportedly working on a documentary about the fall of FTX and the life of its founder, Sam Bankman-Fried, promising an in-depth look at one of the most shocking events in modern financial history.