Ethereum (ETH) is converging on key factors that are setting the stage for a strong price increase that investors have long anticipated. In June, positive signals have become increasingly clear, reinforcing confidence in the short-term growth potential of this cryptocurrency.

Here are four key factors laying the groundwork for ETH’s breakout:

Strong Accumulation by BlackRock: Since May 9, 2025, BlackRock has purchased 269,000 ETH, equivalent to approximately $673.4 million, without selling any. This indicates a determined long-term investment strategy. Previously, BlackRock’s massive capital inflows propelled Bitcoin’s price from $76,000 to $112,000 through ETF funds. Similar moves with ETH are leading many analysts to predict an upcoming breakout.

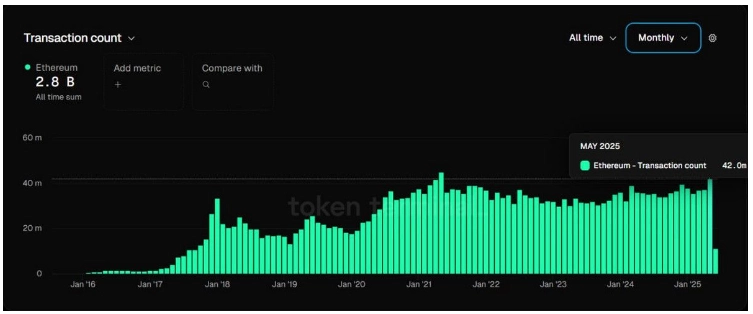

Surge in Ethereum Network Activity: Over the past month, the number of transactions reached 42 million, the highest since May 2021. Meanwhile, daily active addresses also hit 440,000, the highest in six months. This activity reflects the increasing demand for network usage, particularly in areas like decentralized finance (DeFi) and stablecoin transactions.

Low ETH/BTC Ratio: The ETH/BTC ratio is currently at its lowest in six years, with the weekly RSI hitting record lows, signaling that ETH is in an oversold state. This is often a sign of a potential trend reversal. In fact, the ETH/BTC pair has rebounded by 30% over the past month, further reinforcing the possibility of a positive turn.

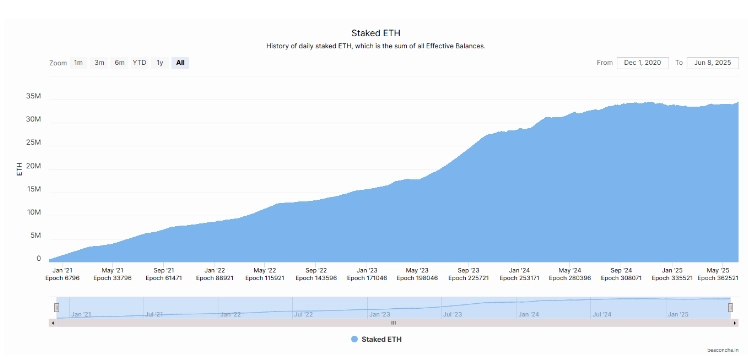

Increasing Institutional Demand for ETH: This is evidenced by SharpLink Gaming recently raising nearly half a billion dollars to purchase ETH. Additionally, the amount of ETH staked reached a new high in June, with 4.65 million ETH staked, accounting for nearly 30% of the circulating supply. This significantly reduces the supply of ETH on exchanges, creating upward price pressure as institutional demand continues to rise.

Related: Ethereum Records Strong Capital Inflows

Based on these developments, many analysts predict that ETH could reach $6,000–$6,500 by December 2025, before hitting $9,000 in Q1 2026. With strong catalysts and an increasingly scarce supply, ETH is poised for substantial growth in the near future.