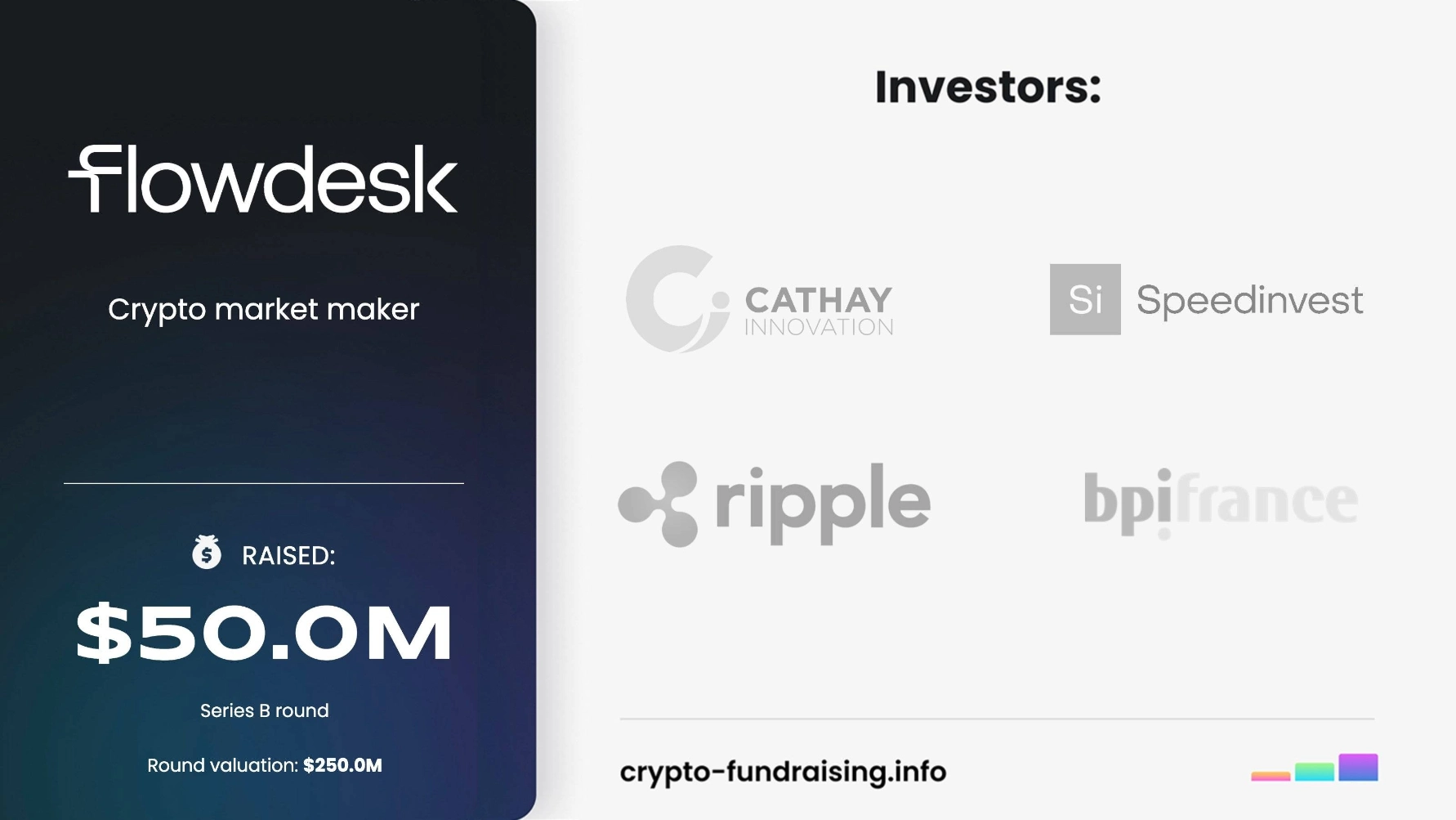

Flowdesk, a market-making entity, has recently emerged as the primary liquidity provider for Grayscale’s Bitcoin Exchange Traded Fund (ETF), securing a successful $50 million Series B funding round that propelled the company’s valuation to $250 million.

Flowdesk has secured a $50M Series B round led by @Cathayinnov and with the support of its existing investors.

The funds will be used to broaden market-making and OTC services with a strong focus on improving trust and efficiency in digital assets markets.

Read more here :… pic.twitter.com/8cUgLC6JJJ

— Flowdesk (@flowdesk_co) January 18, 2024

Leading the funding round is the venture capital firm Cathay Innovation, with participation from Ripple, Eurazeo, ISAI, Speedinvest, and BPI. Additionally, Jacky Abitbol, Managing Partner of Cathay Innovation, will join the board of directors at Flowdesk.

Flowdesk Successfully Raises $50M in Series B Funding

The Series B round comes a year and a half after Flowdesk raised $30 million in a Series A round in June 2022. According to the announcement on January 18, Flowdesk plans to utilize the new capital to expand its Over-the-Counter (OTC) services, recruit new personnel (50-100 positions), and extend its operational footprint in Singapore and the United States.

Established in 2020, Flowdesk initially provided fund management and decentralized trading services. To date, Flowdesk has gained prominence as a market maker for the Grayscale Bitcoin Trust (GBTC), recently listed as a Bitcoin spot ETF following SEC approval last week.

Related: The US SEC Officially Approves Spot Bitcoin ETF

The company also serves as a liquidity provider for Societe Generale’s stablecoin pegged to the euro (GLE) and EUR CoinVertible (EURCV). Additionally, Flowdesk is actively exploring collaborations with other ETF issuers.

As of January 2024, the company’s revenue has tripled compared to the same period last year, according to Guilhem Chaumont, Co-founder and CEO of Flowdesk. While specific figures were not disclosed, Chaumont revealed that the company attracts a daily trading volume ranging from $150 million to $400 million, supporting approximately 130 exchanges, both centralized and decentralized.