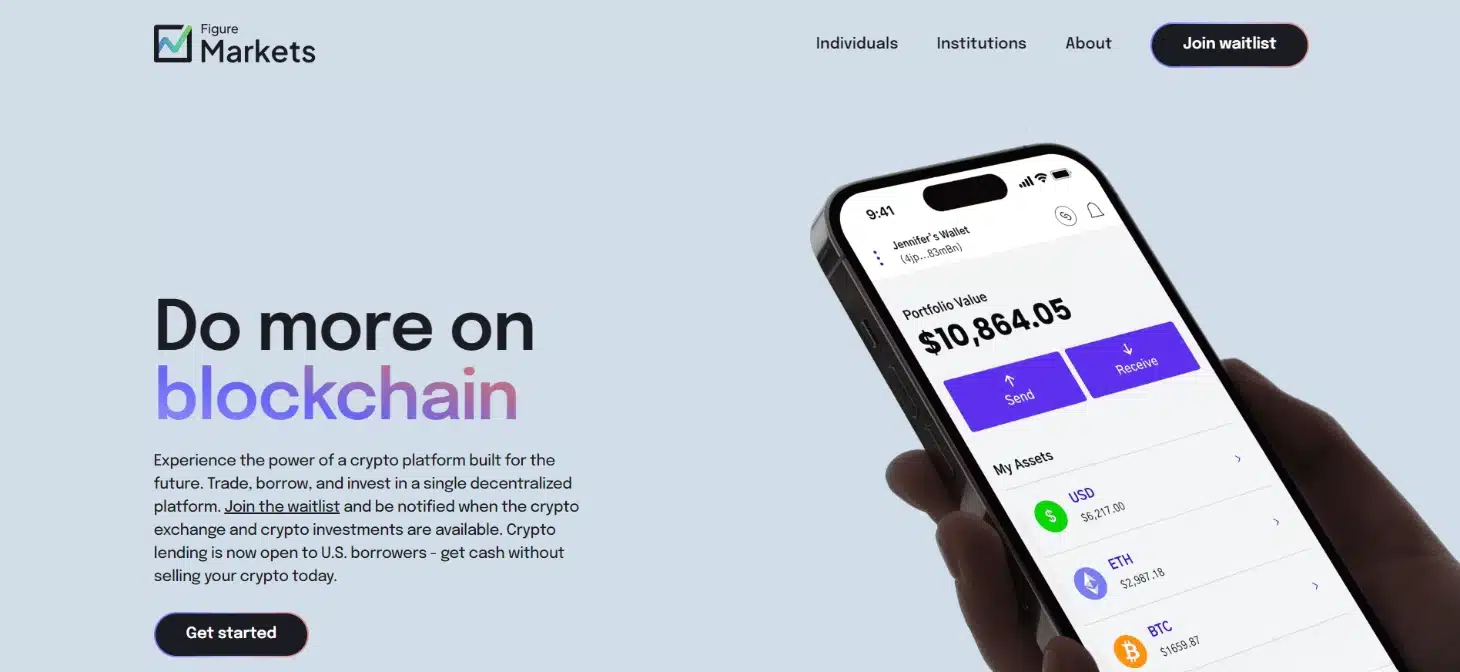

Figure Technologies has announced the launch of Figure Markets, aiming to build a “market for everything” – a platform for investors to trade most types of assets, including Crypto.

According to the latest announcement, Figure Markets has successfully raised $60 million in Series A funding. This round was led by Jump Crypto, Pantera Capital, and Lightspeed Faction, with participation from Distributed Global, Ribbit Capital, CMT Digital, and other partners. Dan Morehead, Founder and Managing Partner of Pantera Capital, will join the board of directors of Figure Markets.

Figure Markets secures over $60M in a Series A round, led by @jump_, @PanteraCapital, and @factionVC.

— Figure Markets (@FigureMarkets) March 18, 2024

How is Figure Markets designed?

Figure Markets will introduce a new decentralized cryptocurrency exchange and a secure marketplace based on blockchain integrating Multi-Party Computation (MPC) technology. The use of MPC technology in wallets will help eliminate risks inherent in many centralized exchanges.

With Figure Markets’ MPC wallets, private keys will be distributed across a decentralized network, requiring approval from multiple parties for every transaction. This method not only allows for the safe custody of decentralized assets but also minimizes the risk of losing private keys.

Related: Successful Fundraising of $69 Million USD by Berachain

Figure Markets will operate on the Provenance Blockchain – a blockchain specially designed for financial transactions. Over $30 billion in real-world assets have been recorded on the Provenance Blockchain since its launch in 2018. Figure Markets will operate independently from Figure Lending.

Figure Markets also stated that they are working to create a “registered security alternative” for stablecoins within their system.

Stablecoins are a type of cryptocurrency that maintains a 1:1 value ratio with a traditional currency such as the US dollar. Stablecoins like USD Coin and Tether maintain a stable value of $1 per token, making them equivalent to digital cash and useful for trading with other cryptocurrencies on exchanges due to their extremely low volatility.

Dan Morehead, Founder and Managing Partner of Pantera Capital, said:

I believe Figure Markets will be a disruptive force in the digital asset space. The company’s innovative use of MPC technology addresses critical pain points in the current market structure, contributing to creating a more efficient and secure future for digital assets.