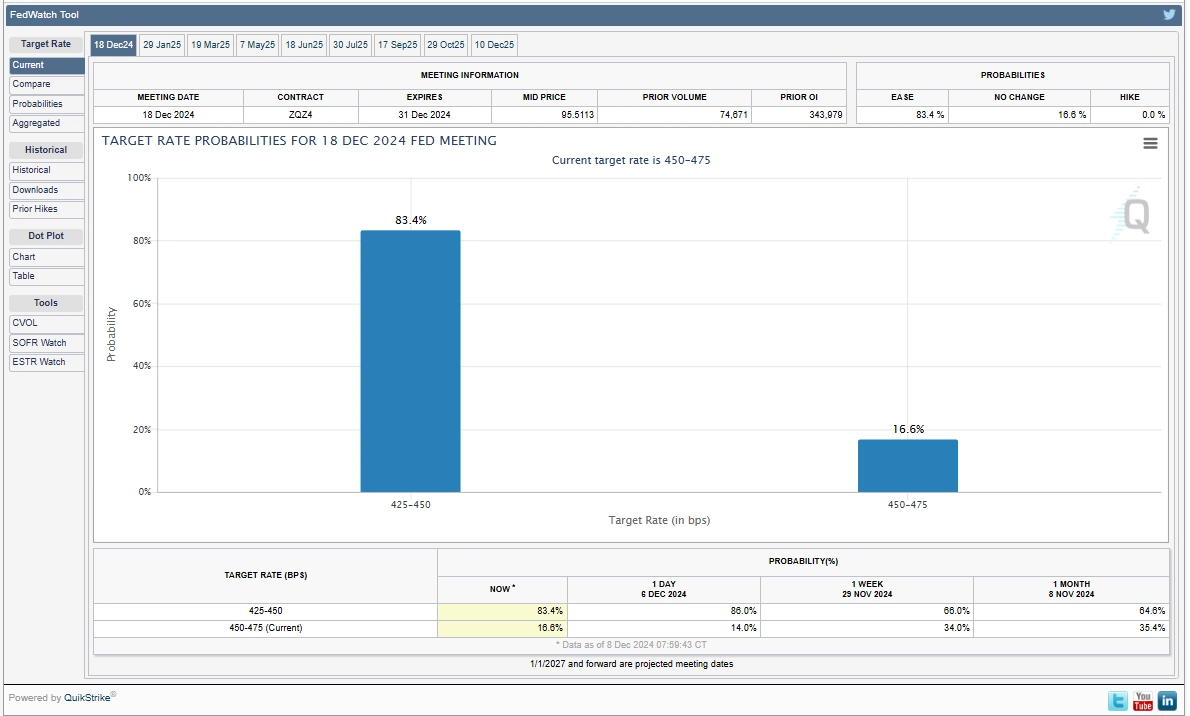

CME FedWatch, a tool specializing in forecasting changes in U.S. Federal Reserve (Fed) interest rates, has issued a noteworthy signal. The probability of the Fed cutting interest rates in December has surged to 83.4%, significantly higher than the 66% recorded on November 29.

Based on data from 30-day futures contracts, the market expects the Fed to reduce rates by 0.25% at its meeting on December 17-18. This would lower the target rate range to 4.25%-4.5%. Currently, the Fed’s rate is between 4.5%-4.75% following two cuts this year totaling 0.75%, down from the highest level seen in over 20 years.

Positive Signals from Fed Leadership

Confidence in a rate cut has been bolstered by remarks from Fed Governor Christopher Waller in Washington, D.C., on December 2. He stated:

At present, I lean toward supporting a rate cut.

However, he emphasized that the final decision would depend on fresh data on employment, consumer spending, and inflation leading up to the meeting.

Meanwhile, New York Fed President John Williams also expressed optimism about a potential future rate-cutting trend, though he stopped short of committing to the upcoming meeting. This contrasts with the cautious stance of Fed Chair Jerome Powell, who previously remarked, “There is no indication yet of an urgent need to lower interest rates.”

Related: Bitcoin Sets New All-Time High as FED Cuts Interest Rates

Bright Prospects for Bitcoin

Fed rate cuts often serve as a positive catalyst for Bitcoin. Lower borrowing costs tend to drive investors toward higher-risk assets, including cryptocurrencies, in pursuit of better returns.

Bitcoin has had an impressive year, gaining over 100% since the beginning of 2024, buoyed by optimistic sentiment in the U.S. market and expectations for regulatory reforms in the crypto space. Recently, the leading cryptocurrency successfully breached the $100,000 milestone and is now trading steadily around $99,500.