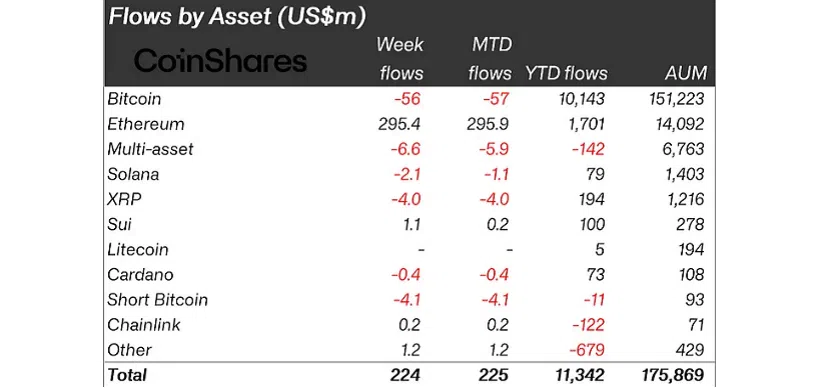

Last week, the cryptocurrency market recorded an investment inflow of $224 million, with Ethereum standing out despite a slowdown due to regulatory concerns in the U.S.

Ethereum continued to be the focal point with $295.4 million flowing in, marking its seventh consecutive week of gains and accounting for 10.5% of total assets under management. Notably, Ethereum ETFs attracted $815 million in just 20 days, reflecting growing confidence from institutional investors.

Ethereum maintains its appeal due to its role as a decentralized infrastructure platform, supporting stablecoins and asset tokenization. The iShares Ethereum fund reported impressive inflows of $330 million. Meanwhile, funds from Fidelity and Grayscale experienced outflows, indicating a shift in investor priorities.

Bitcoin faced its second consecutive week of outflows, with $56.5 million withdrawn, reflecting short-term caution among investors. However, this is not a sign of a long-term downtrend but rather a temporary adjustment phase.

Related: Truth Social Registers Bitcoin and Ethereum ETF in Nevada

In addition to Bitcoin and Ethereum, the altcoin market showed mixed trends. Sui and Chainlink recorded modest but steady inflows, while XRP and Solana continued to face outflows. Although the pace of capital inflow into the market appears to be slowing, institutions still prioritize investments in digital assets with solid foundations. Among these, Ethereum continues to assert its position as a strategic investment hub, leading optimism in a volatile market environment.