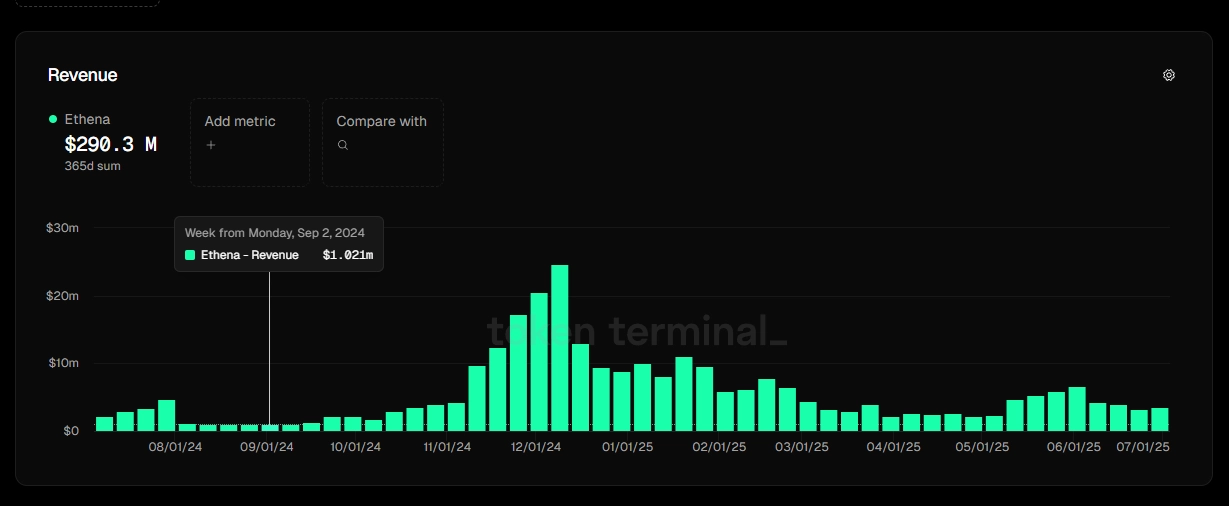

On July 9, Ethena Labs, a stablecoin issuance protocol, achieved impressive revenue of $290.2 million, ranking just behind giants like Tether, Circle, and Sky in this sector. This remarkable accomplishment is even more significant as Ethena took only 251 days since its launch to reach a cumulative revenue of $100 million, making it the second-fastest protocol to achieve this milestone.

According to the data, Ethena’s average daily transaction fees reached $3.1 million, thanks to traders’ preference for the USDe token. The core revenue of the protocol comes from maintaining futures positions across various exchanges. Currently, 94% of Ethena’s collateral assets are stored on centralized platforms, and 20% of the total fees collected are used to buy back ENA tokens on the open market.

Related: Bitcoin Surpasses Google to Become the Sixth Most Valuable Asset Globally

However, Ethena is facing some legal hurdles in the U.S. The protocol has met with the U.S. Securities and Exchange Commission (SEC) to clarify issues related to the “synthetic dollar” token, USDe. While awaiting official guidance from the SEC, Ethena is currently prohibited from distributing USDe to retail investors in this market.

Ethena’s rapid rise in the stablecoin space demonstrates the significant potential of this protocol, but the legal challenges in the U.S. could impact their future expansion strategy.