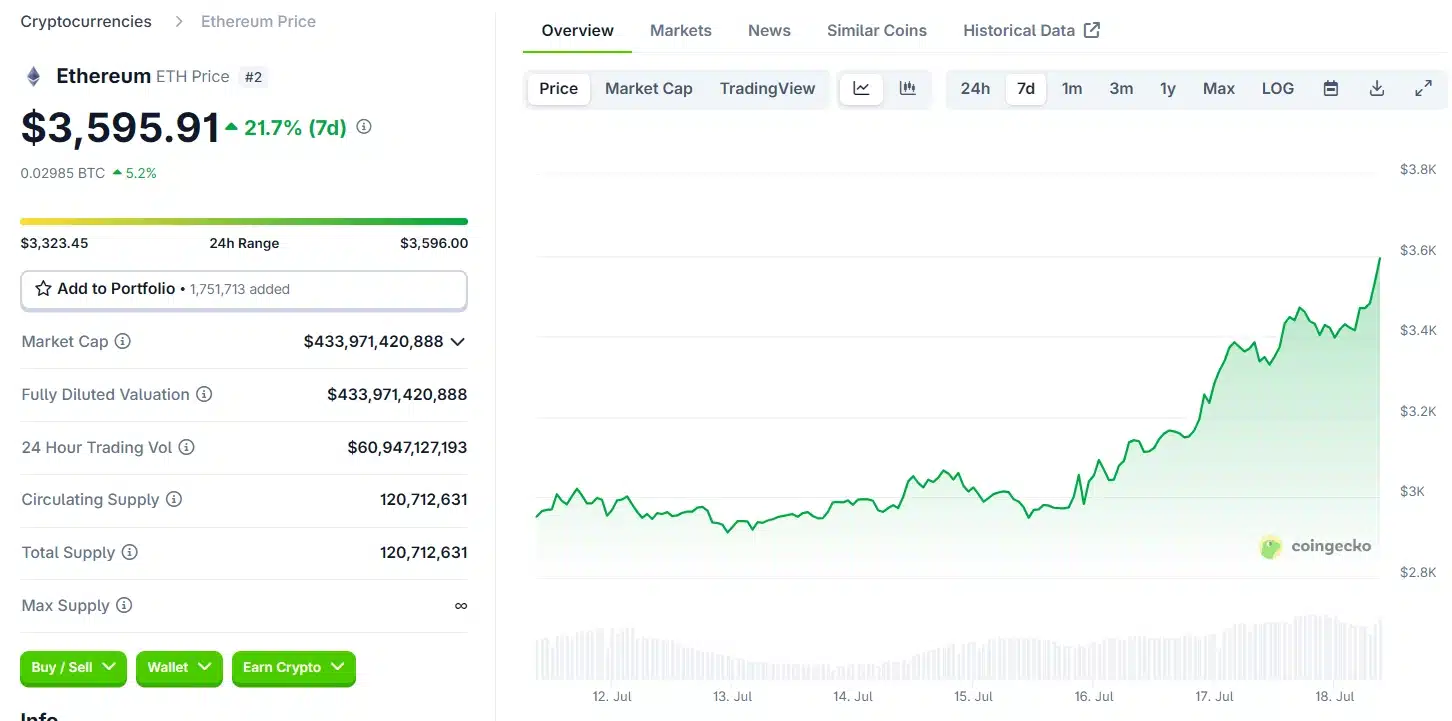

In the past 24 hours, the price of Ethereum (ETH) has surged, increasing by 8.6% and currently trading around $3,432, the highest level since mid-January 2025. Since April 2025, ETH has risen over 118%, marking an impressive recovery after a challenging period. Previously, Ethereum experienced its most difficult phase since the “crypto winter” of 2018, when the price dropped by as much as 45% in Q1 2025, the worst quarter for ETH in over six years.

This explosion is primarily due to record capital inflows into Ethereum ETF funds. On July 16 alone, these funds attracted $726 million, the highest amount since their launch in July 2024.

According to data from SoSoValue, 8 out of 9 Ethereum ETF funds recorded inflows on this day. Leading the charge was BlackRock’s ETHA fund with $499 million—accounting for nearly 70% of the total inflow for the day. Following close behind were Fidelity’s fund with $113.31 million and Grayscale’s ETH fund with $54.18 million. The only fund without any inflow was the CETH fund from 21 Shares.

Since the beginning of July, the total net inflow into Ethereum ETF funds has reached $2.27 billion, far surpassing previous months and setting a record since these funds were established. Moreover, the trend of accumulating ETH has also spread to listed companies. Many businesses are beginning to view ETH as a reserve asset, similar to how they previously accumulated Bitcoin.

Related: Could Donald Trump Soon Launch a Game Featuring His Brand?

Along with Ethereum’s rise, several other cryptocurrencies have also recorded notable increases in the past 24 hours:

- XRP increased by 5%, reaching $3.05.

- Solana (SOL) rose by 5.16%, hitting $170.96.

- BNB climbed by 3.44%, to $710.