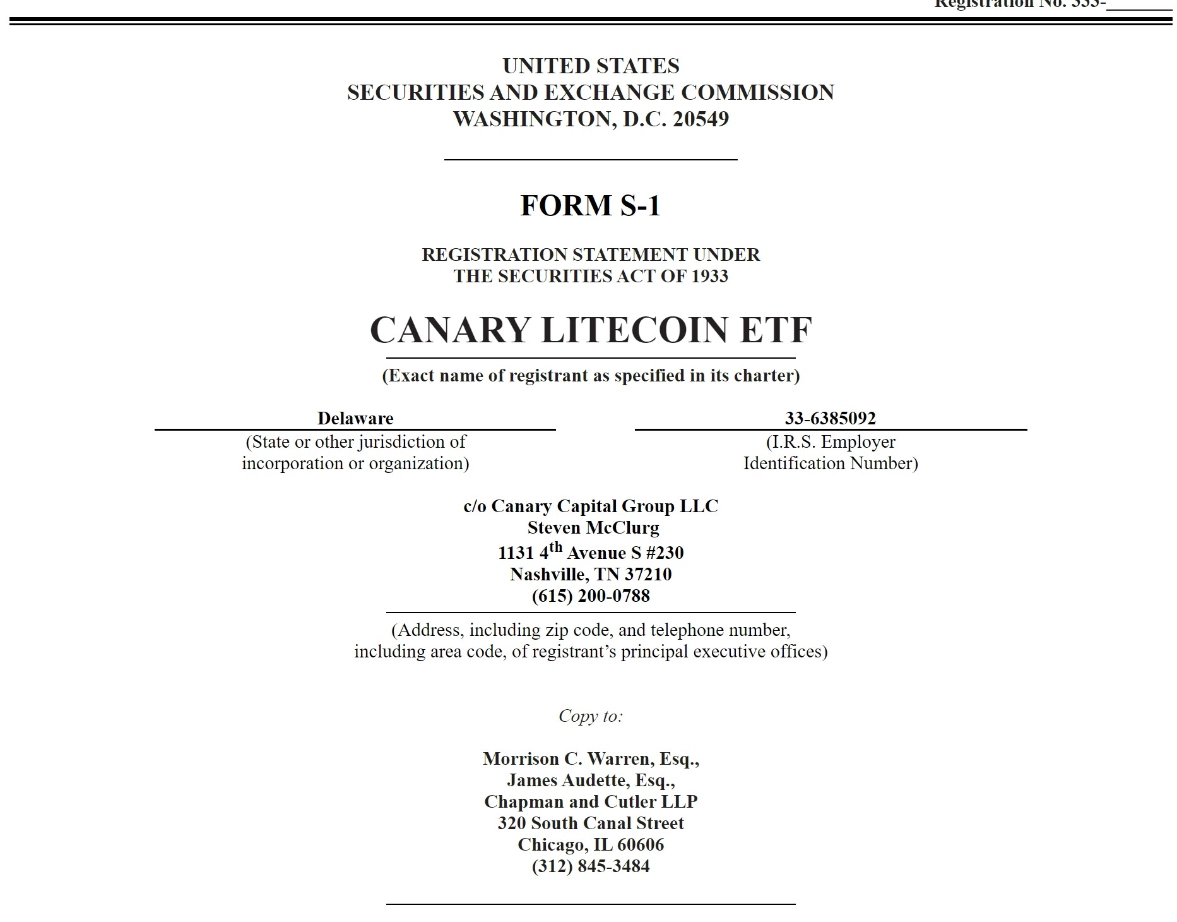

On October 15th, Canary Capital, a cryptocurrency investment firm, officially filed an S-1 form with the U.S. Securities and Exchange Commission (SEC), proposing the launch of the first-ever Litecoin spot ETF. This move came just days after the company submitted a filing to launch an XRP spot ETF.

The Litecoin spot ETF aims to provide investors with direct exposure to the value of Litecoin (LTC) held by the fund. According to the S-1 filing, the fund’s performance will track the price fluctuations of Litecoin, minus management and operational fees. However, Canary Capital has yet to disclose information about the trust manager, custodian, management fees, or the ticker symbol for this fund.

Canary Capital emphasized the importance of Litecoin:

Litecoin, with a 100% uptime since its inception, is one of the longest-standing and most reliable blockchains, with many enterprise applications. This ETF offers investors a chance to gain exposure to a proven digital asset, while mitigating the risks of holding cryptocurrency directly.

However, to list the Litecoin ETF on major stock exchanges, Canary Capital still needs to file a 19b-4 application to address the SEC’s additional regulatory requirements. If approved, the Litecoin spot ETF would mark a significant step in broadening the cryptocurrency market through traditional financial instruments.

Related: Asset Manager Bitwise Seeks to Register XRP ETF

James Seyffart, an ETF analyst at Bloomberg, noted that there are already some ETP products holding Litecoin, including the CoinShares fund in Switzerland and a trust from Grayscale in the U.S. He predicted that Litecoin could be viewed by the SEC similarly to Bitcoin from a legal standpoint, as Litecoin was developed from a fork of Bitcoin and is often referred to as “digital silver.” Seyffart believes the SEC might treat Litecoin as a commodity, similar to Bitcoin, rather than subjecting it to stricter securities regulations.

However, Seyffart also highlighted that for the Litecoin ETF to gain approval, the Litecoin futures market needs to reach a sufficient scale and liquidity level—conditions that the market has yet to fully meet.

Moreover, Seyffart stressed that the upcoming U.S. presidential election could significantly influence the SEC’s policy:

If former President Donald Trump is re-elected and makes leadership changes at the SEC, the agency could take a more open approach toward cryptocurrencies, potentially creating greater opportunities for the approval of ETFs like Litecoin and XRP.