EigenLayer TVL Surpasses $10 Billion

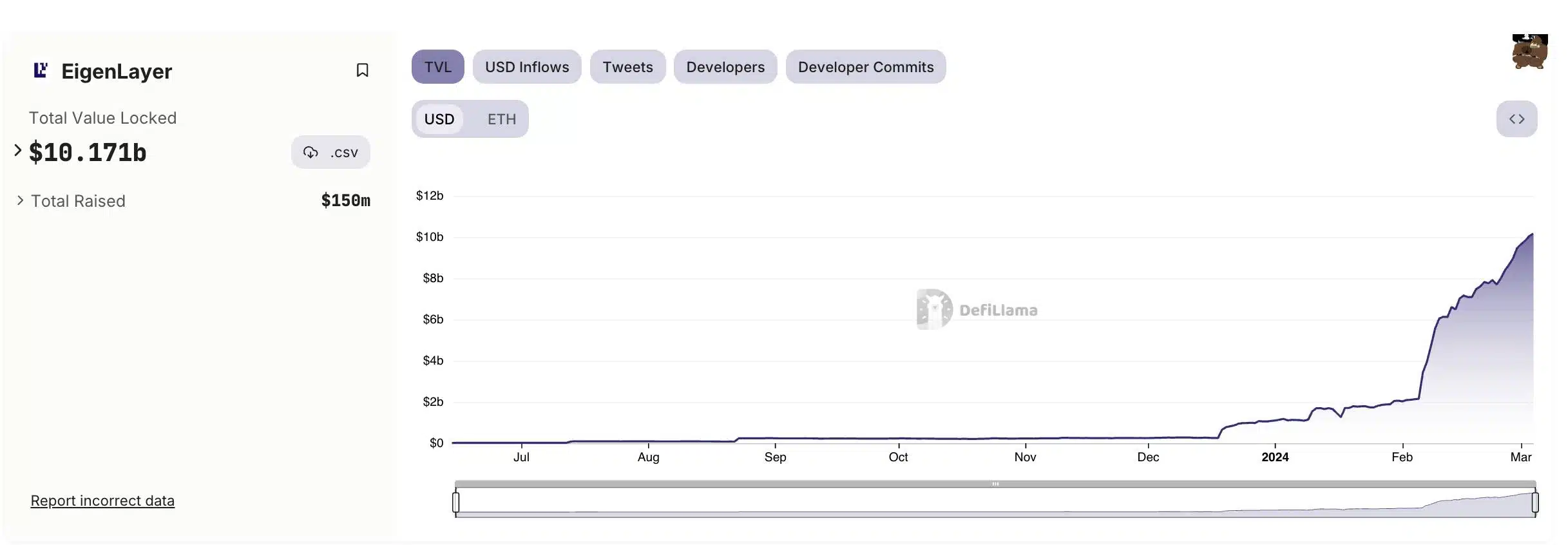

According to DefiLlama data, assets deposited in EigenLayer have surpassed the $10 billion threshold, increasing by $8 billion in the past month alone. This reflects the impressive growth rate of the restaking project.

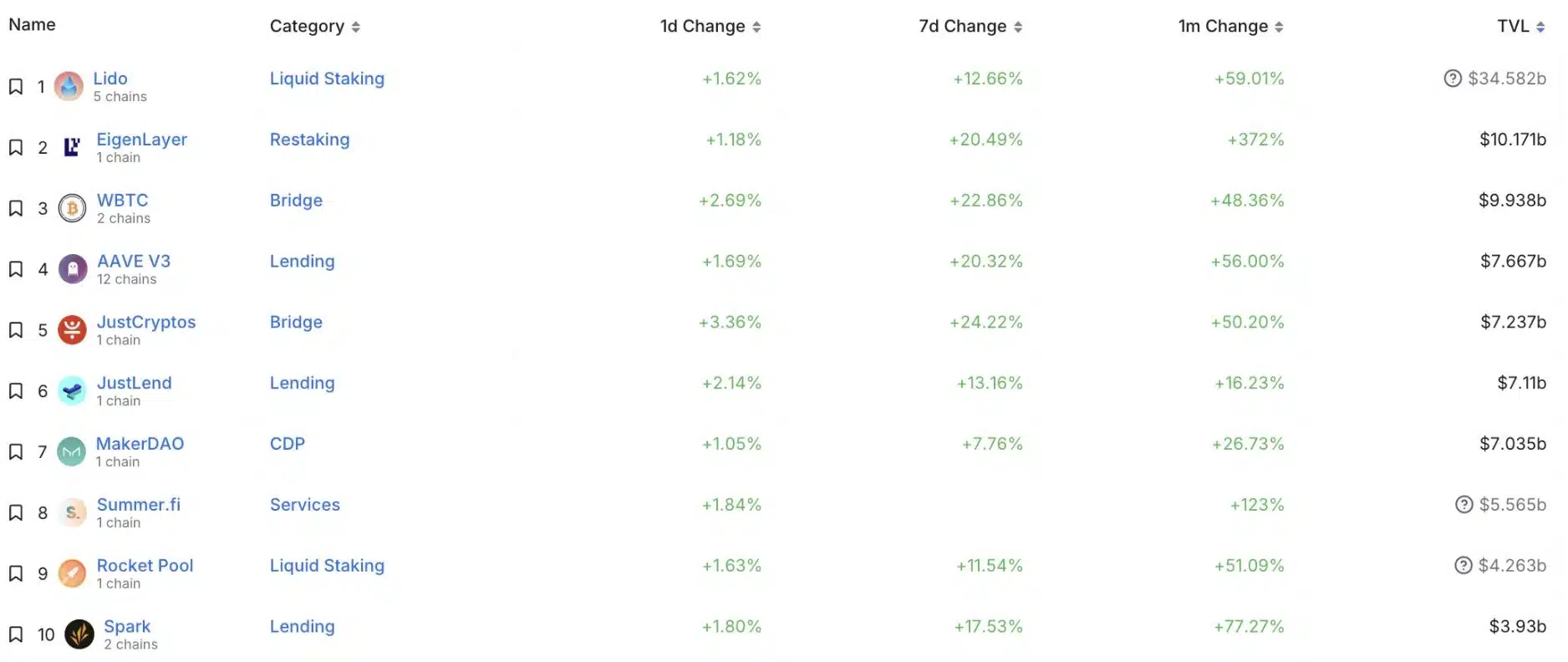

This surge has also propelled EigenLayer to rise in the ranks among the largest DeFi protocols by TVL. According to DefiLlama, the project is currently ranked second, trailing only behind Lido Finance ($34.5 billion) in the liquid staking space.

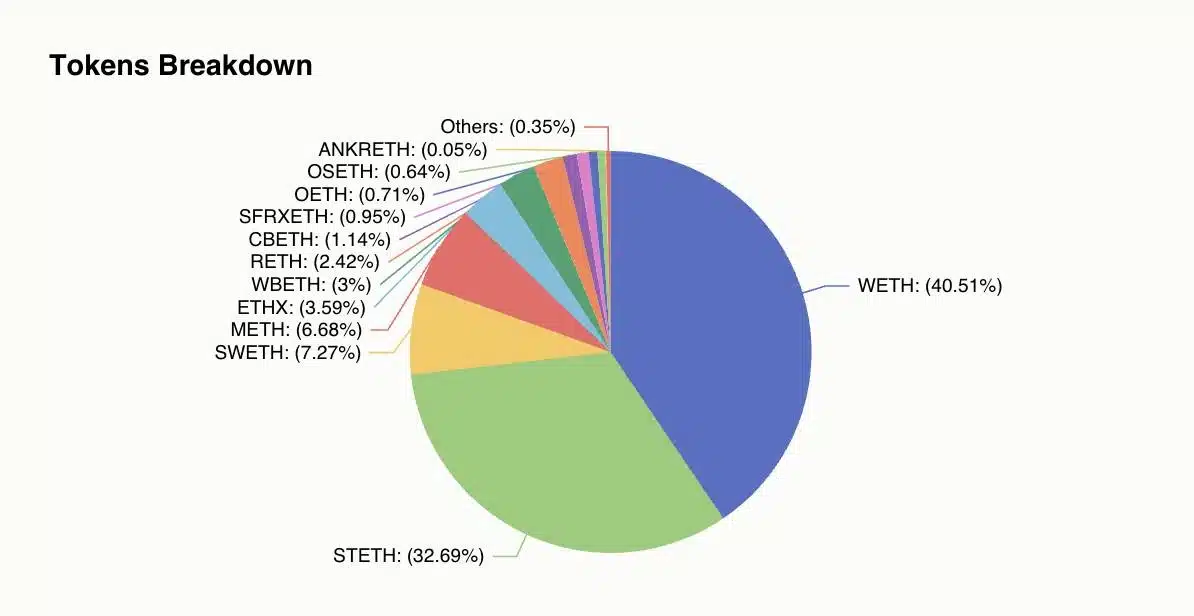

Taking a closer look at the assets deposited in EigenLayer, WETH currently holds the largest market share at 40%, followed by stETH at 32%, with the remaining consisting of various other smaller tokens as depicted below.

Reasons for EigenLayer TVL Surpassing $10B

EigenLayer, particularly in the restaking space, has emerged as one of the most prominent trends since the beginning of this year. Simply put, this protocol allows users to utilize ETH and Ethereum’s liquid staking tokens to participate in verifying other blockchains, essentially restaking these tokens.

Currently, EigenLayer supports tokens such as stETH from Lido, rETH from RocketPool, cbETH from Coinbase, sETH from Stakewise, mETH from Mantle, sfrxETH from Frax, ankrETH from Ankr, and wBETH from Binance.

The popularity of EigenLayer has also led to the emergence of projects orbiting around it, such as ether.fi, Kelp DAO, and Puffer Finance. Recently, Kelp DAO even airdropped tokens to EigenLayer users based on reward points earned through activities on the protocol.

Related: What is Renzo Protocol? LRT Project on EigenLayer

On February 22nd, the project announced a successful $100 million Series B funding round led by a16z. Prior to that, in March 2023, EigenLayer raised $50 million from Blockchain Capital, Coinbase Ventures, Polychain Capital, and several other funds.

When asked about the possibility of token issuance by Bloomberg, EigenLayer leaders stated that they are still considering this possibility.

Ok