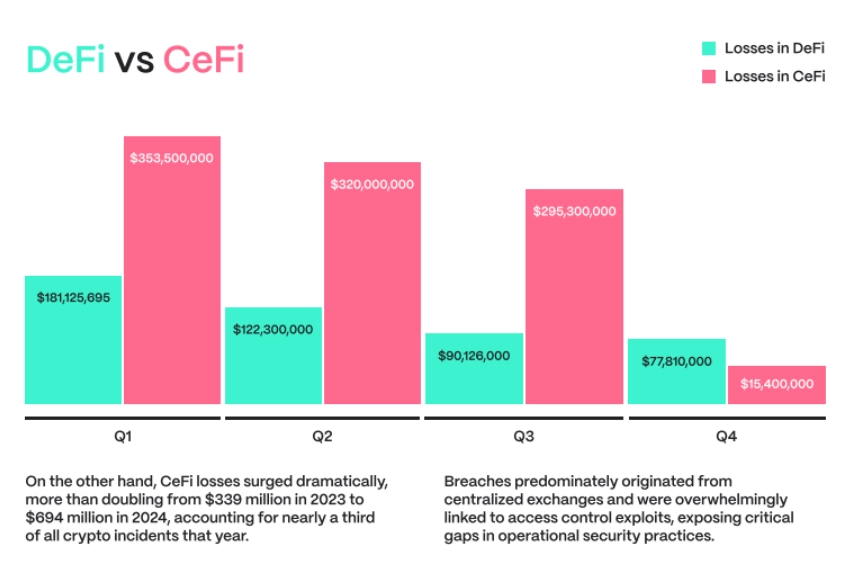

According to Hacken’s annual Web3 security report, the DeFi sector has made significant strides in security, with total losses dropping from $787 million in 2023 to $474 million in 2024—a 40% decrease. Notably, attacks on blockchain bridges, once a major vulnerability, have sharply declined from $338 million to just $114 million.

In contrast, centralized exchanges (CeFi) faced a challenging year, with losses doubling to $694 million. The two largest hacks targeted DMM and WazirX, resulting in losses of $305 million and $230 million, respectively, primarily due to vulnerabilities in private key management and weak multi-signature systems.

Related: WazirX Exchange Hacked, Over $230 Million Lost

Dyma Budorin, CEO of Hacken, emphasized:

CeFi is revealing critical weaknesses in operational security, from poor key management to fragile multi-signature setups.

This concern is amplified by Chainalysis’ findings, which report that North Korean hackers alone have stolen $1.3 billion in crypto through 47 attacks this year.

While DeFi has achieved notable advancements, such as multiparty computation and zero-knowledge proofs, challenges remain, as evidenced by the Radiant Capital hack, which resulted in a $55 million loss.