The cryptocurrency market witnessed a remarkable phenomenon when the memecoin Test (TST) on the BNB Chain platform suddenly skyrocketed – increasing nearly 100-fold – following a post by former Binance CEO Changpeng Zhao (CZ) on X social media on February 6th. Shortly afterward, TST reached a peak market capitalization of nearly $500 million upon the announcement of its listing on Binance.

The investment wave in TST created a positive domino effect throughout the BNB Chain ecosystem. The widespread FOMO (Fear of Missing Out) sentiment pushed BNB’s price to $720 on the morning of February 13th, marking an impressive 24.8% increase in a week, before slightly adjusting down to $697. This achievement helped BNB Chain surpass Solana, becoming the fifth-largest cryptocurrency by market capitalization, with a total value exceeding $103 billion.

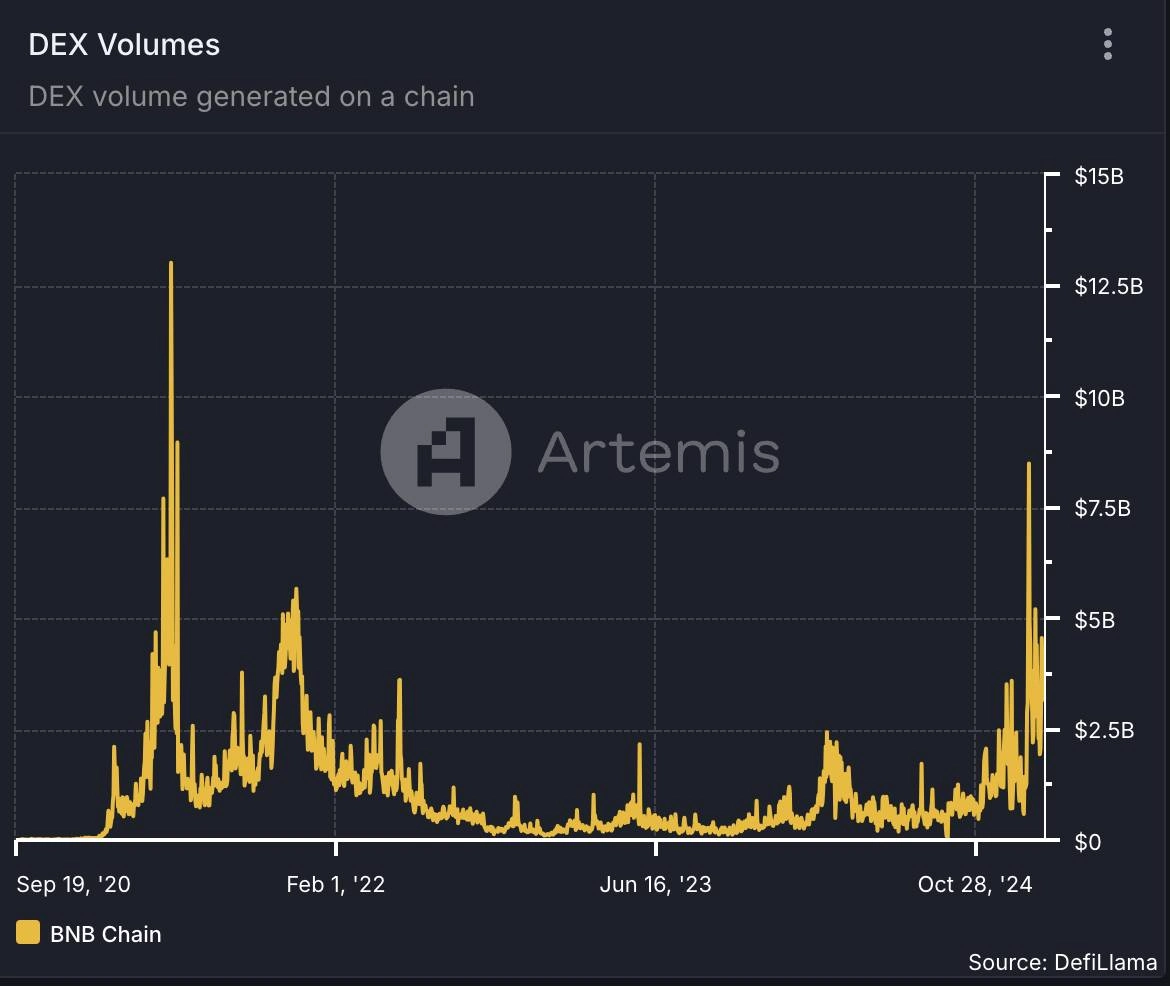

The surge wasn’t limited to BNB alone. Many ecosystem tokens such as CAKE, BAKE, XVS, and THE also recorded impressive growth, leading the daily price increase rankings on Binance. Notably, while the number of transactions didn’t spike dramatically, the trading volume on BNB Chain’s decentralized exchanges (DEX) consistently reached impressive levels above $3 billion daily for three consecutive days.

Most prominently, PancakeSwap – the DEX with the largest trading share on BNB Chain – achieved a record trading volume of $3.03 billion in 24 hours, surpassing its competitor Uniswap by more than $200 million.

Related: CZ Reaffirms $500 Million Support for Elon Musk

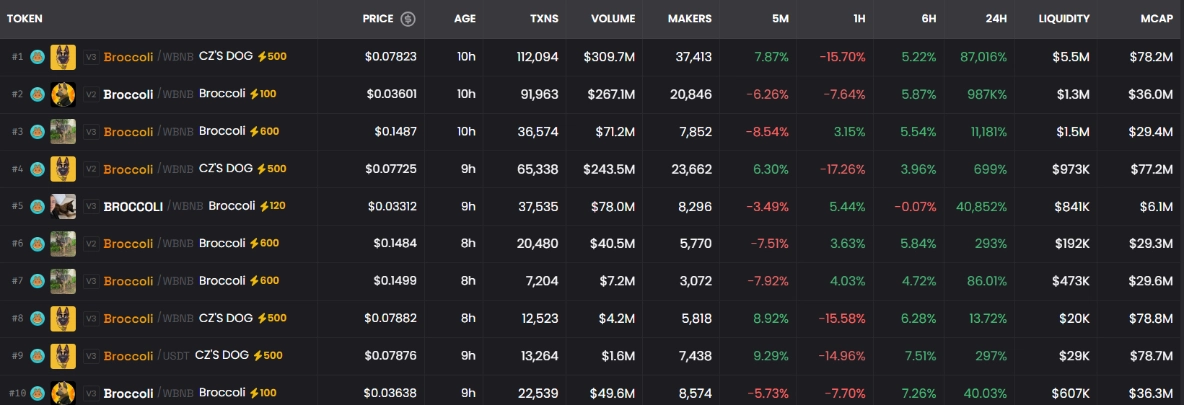

Another interesting development occurred after CZ revealed his dog’s name as “Broccoli,” which triggered the creation of hundreds of memecoin tokens bearing this name. However, most of these coins fell into pump-and-dump schemes, causing many investors to lose money and sparking new controversies within the cryptocurrency community. This was particularly noteworthy given that CZ had previously stated he neither supported nor opposed these types of assets.