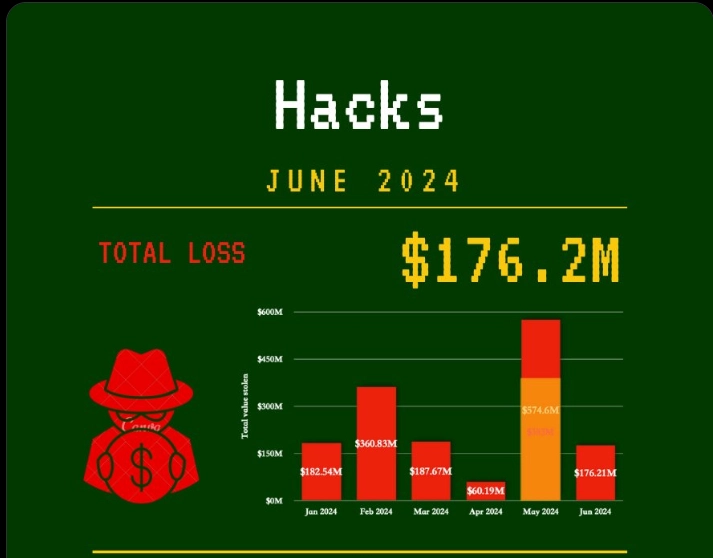

According to recent data from PeckShield, crypto hacks declined sharply in June, with total losses amounting to $176 million. This figure represents a 54.2% decrease compared to the staggering $385 million lost in May.

PeckShield revealed that over 20 security breaches occurred in June.

Crypto Hacks Declined in June

The largest hack in June targeted the BtcTurk crypto exchange, with over $100 million in assets stolen. Following this was the hack at the centralized exchange Lykke in the UK, with losses of $22 million.

The decentralized finance (DeFi) sector also suffered, with the lending protocol UwU being hacked for $19.4 million, ranking third in terms of losses for the month.

In contrast, May saw approximately $385 million in losses, the highest figure so far in 2024. The hack of the DMM crypto exchange in Japan resulted in losses of up to $305 million, making it the largest case in May.

The primary attack vectors included flash loan exploits, exit scams, and other technical vulnerabilities.

Despite these losses, blockchain security experts managed to recover approximately $96.2 million, providing some reassurance to the crypto community.

Related: Binance Freezes $5 Million USD in Relation to BtcTurk Exchange Hack

Crypto Hack Trends in 2024 Compared to 2023

Crypto hacks continue to plague the industry, resulting in significant losses of digital assets to scammers.

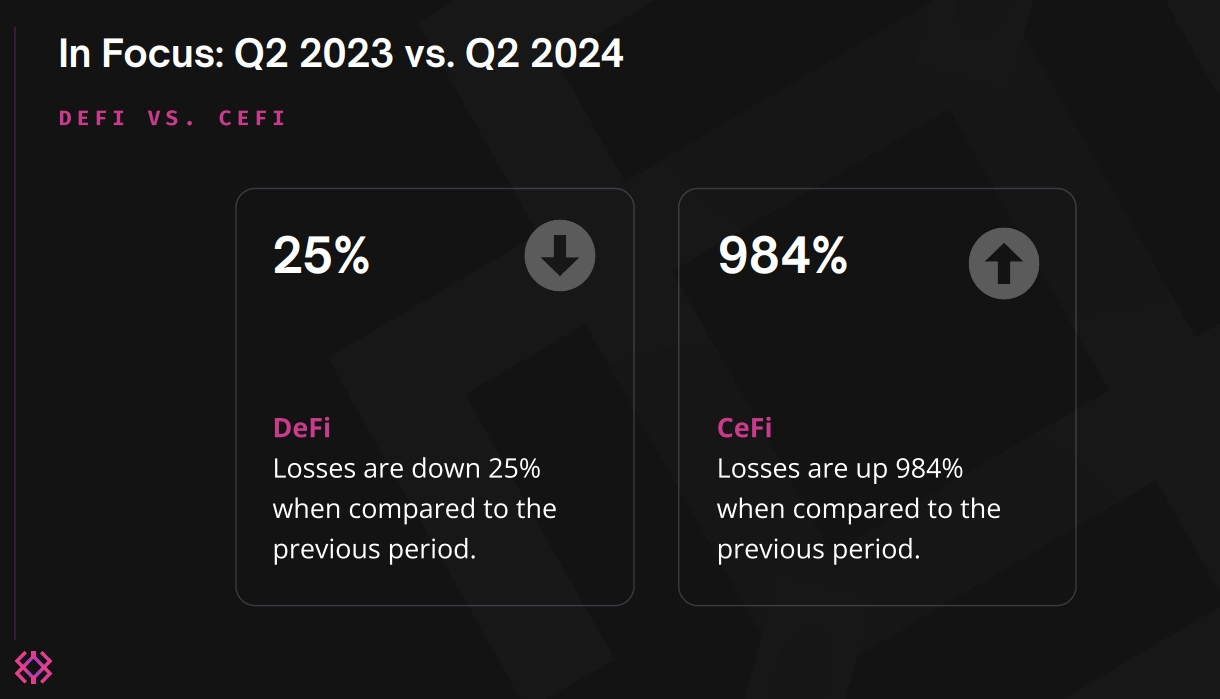

According to research from the blockchain security platform Immunefi, Q2 2024 witnessed a staggering $572 million in losses from crypto scams, more than doubling the $220 million lost in the same period in 2023.

Centralized exchanges were the primary targets, accounting for most of the losses. The DMM Bitcoin and BtcTurk hacks accounted for over 62% of the quarter’s total losses.

CeFi suffered $401 million in losses in Q2 this year, an insane 984% increase compared to the same period in 2023.

While DeFi protocols experienced a higher frequency of incidents, losses were lower at $171 million, down 25% from Q2 2023.

The Ethereum and BNB Smart Chain networks were the two main targets, accounting for 71% of the total losses.

Notably, Arbitrum became the third most targeted network, accounting for 5.5% of the total losses.

Despite the grim outlook, some stolen funds were recovered. Protocols such as Gala Games, Alex Labs, Bloom, and Yolo Games managed to reclaim most of their lost assets.

These recoveries, though encouraging, only accounted for about 5% of the total losses for the quarter.