Crypto Market Recap of Last Week

In the second week of April, the cryptocurrency market witnessed significant developments. Bitcoin, the leading cryptocurrency, experienced a sharp decline compared to the previous week. The price of Bitcoin plummeted from $72,500 to $61,800, representing a decrease of approximately 15% from its peak.

The primary reason for this decline is believed to be the impact of macroeconomic factors on the financial markets. Analysts suggest that political, economic, and geopolitical developments at this time have raised concerns among investors, leading them to withdraw capital from risky assets such as cryptocurrencies.

However, there were some positive signs as the price of Bitcoin later recovered to around $65,500. Although Bitcoin only experienced a 15% decline from its peak, many altcoins lost up to half of their value from their highs.

The significant decline in the value of altcoins has left many investors puzzled and forced to liquidate assets. This is a challenging period for the cryptocurrency market, but it also presents an opportunity for investors to adjust their investment portfolios and seek new opportunities in the future.

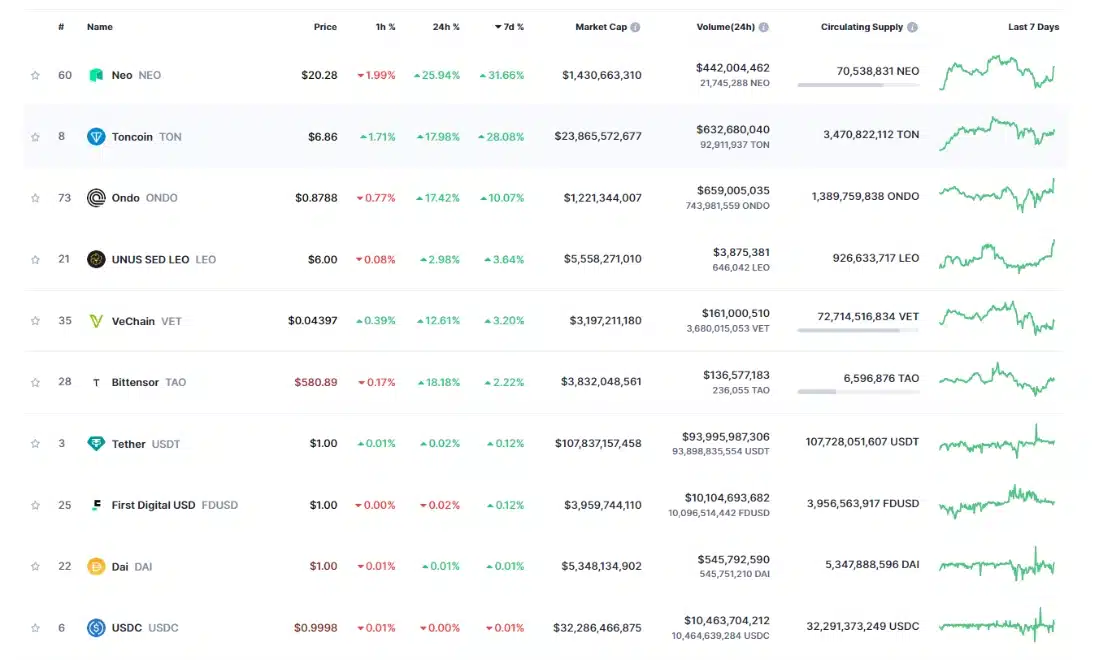

Top 10 Strong Performers of the Week

Source: Coinmarketcap

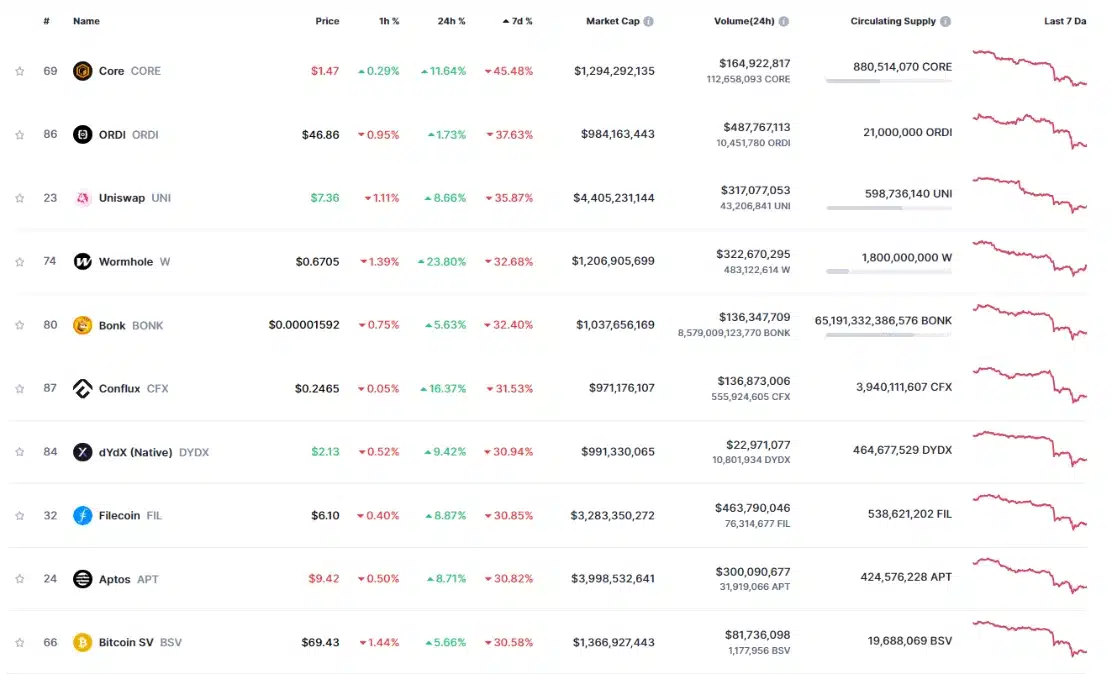

Top 10 Losers of the Week

Source: Coinmarketcap

Key News Highlights of Last Week

Macro News for This Week

There will be some important news events this week:

- On Wednesday, April 16, 2024, at 17:15, Federal Reserve Chairman Jerome Powell will deliver a speech. As usual, Powell’s speech will carry significant weight as it reflects some of the expected monetary policies in the future, especially amid increasing inflation in the United States, raising concerns about the Fed’s potential interest rate cuts.

- On Thursday, at 12:30, the first-time unemployment claims data will be released. As usual, if the actual data is higher than forecasted, this could negatively impact the USD, and vice versa.