Crypto Market Highlights of the Past Week

The crypto market experienced a turbulent week, with Bitcoin, the leading digital currency, showcasing significant volatility. Early in the week, Bitcoin’s price plunged from a high of $64,200 to a low of $58,400, causing concerns among investors about a potential severe decline. However, by the end of the week, Bitcoin made a remarkable recovery, climbing back up to nearly $64,000 and erasing most of the earlier losses.

These sharp fluctuations are attributed to the influence of major market players, including governments from the U.S. and Germany, and notably, the Mt. Gox exchange, which was once the world’s largest Bitcoin exchange before its collapse in 2014.

Aside from Bitcoin’s rollercoaster ride, several noteworthy events occurred in the crypto space:

- Wall Street Giants Enter the Market: Major financial institutions on Wall Street began venturing into crypto with the launch of the Solana Spot ETF.

- SEC’s Ongoing Legal Actions: The U.S. Securities and Exchange Commission (SEC) continued its legal scrutiny of blockchain companies, specifically targeting Consensys and MetaMask.

- Blast Airdrop Disappointment: The much-anticipated airdrop by the Blast project ended in disappointment for many in the community.

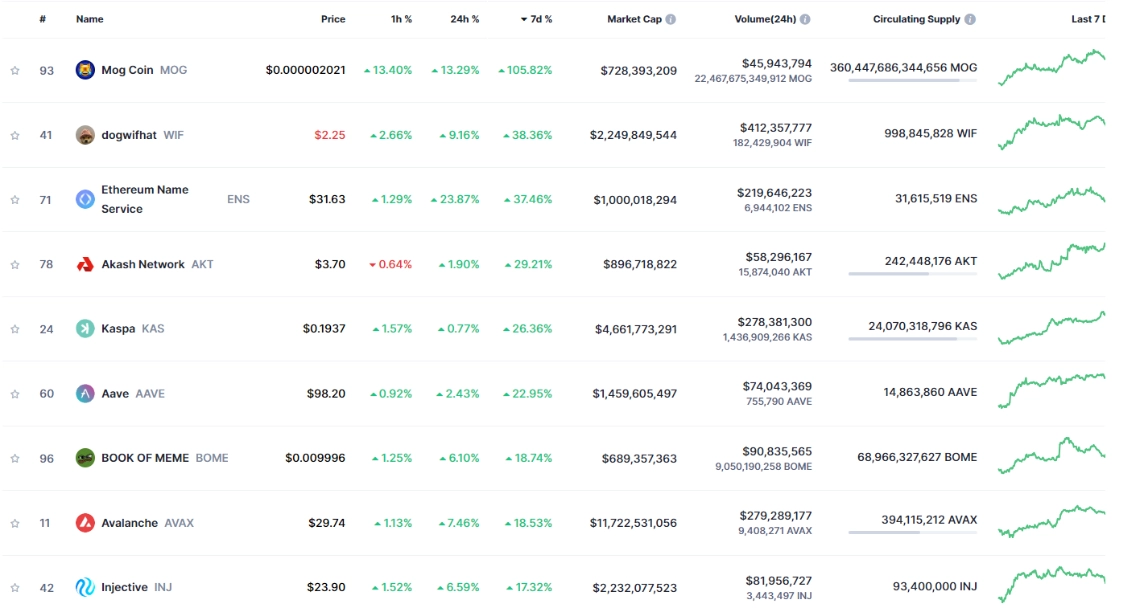

Top 10 Gainers of the Week

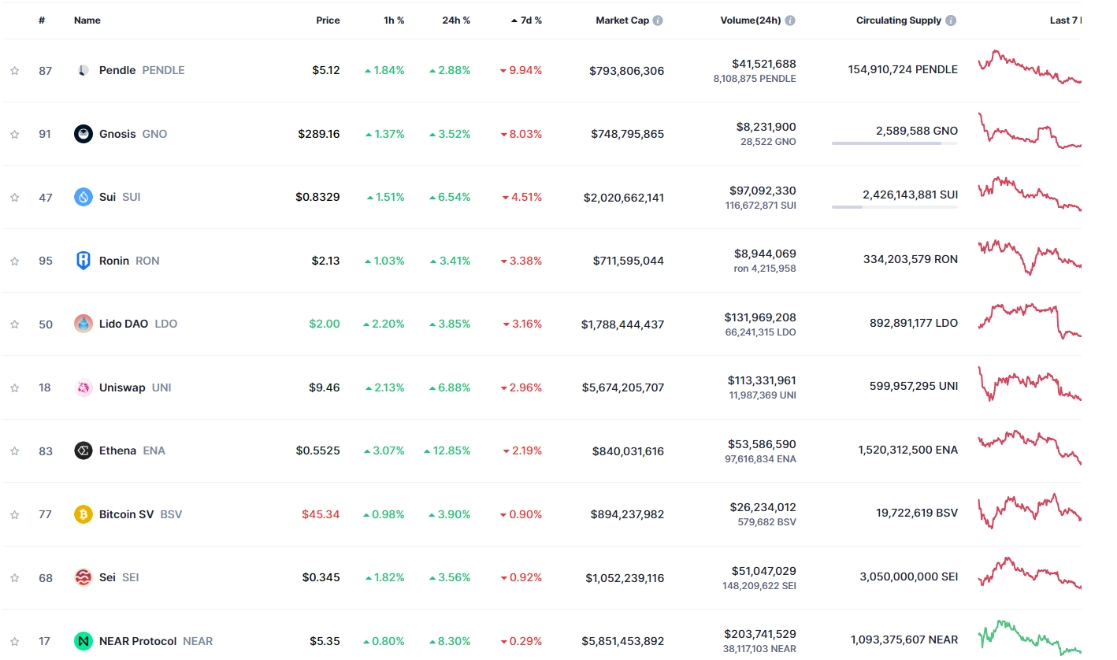

Top 10 Losers of the Week

Significant News of the Week

- The Crypto Fear & Greed Index Plunges into the “Fear” Zone

- Mt. Gox to Begin Repaying Debts in BTC and BCH in July 2024

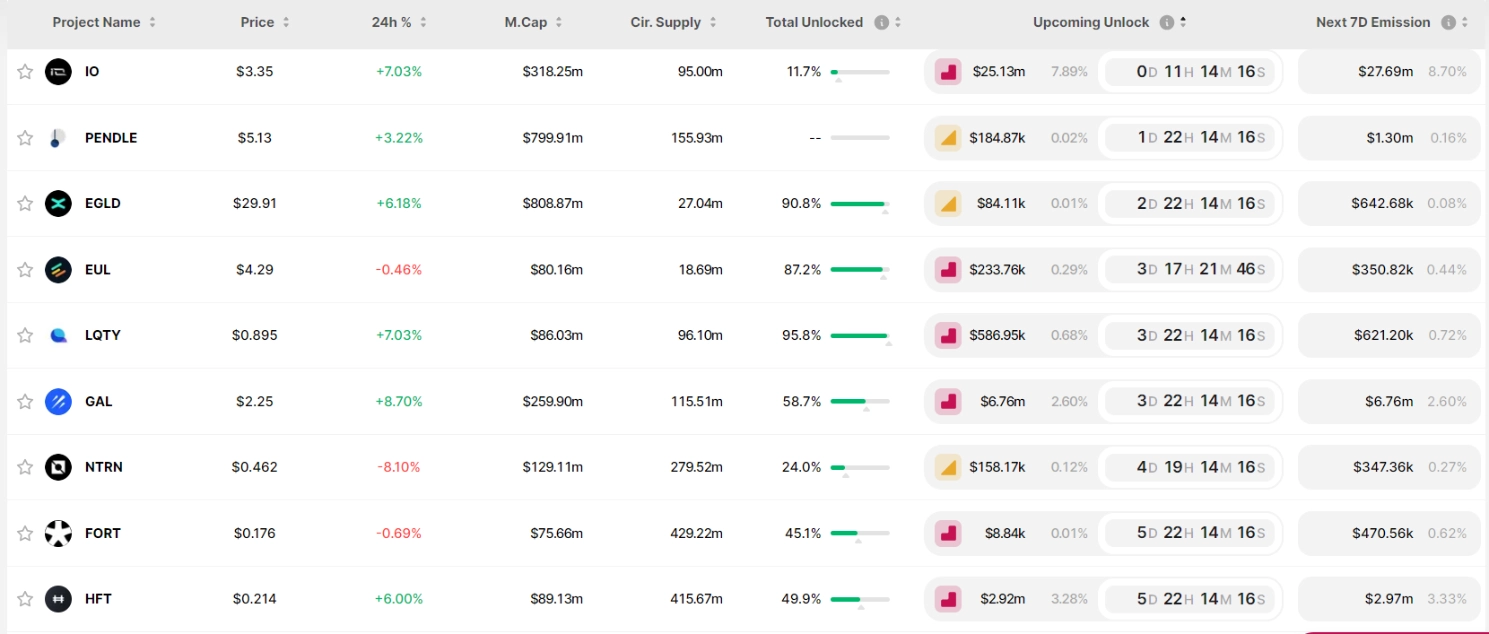

Token Unlocks This Week

This week, several projects are set to unlock significant amounts of tokens:

- io.net will unlock approximately 7.5 million IO (valued at $25 million).

- Ethena will release around 15 million ENA (valued at $8 million).

Source: token.unlock

Key Macro Events This Week

Investors and financial market enthusiasts should keep a close eye on three critical economic events this week:

- Fed Chairman Jerome Powell’s Speech (Tuesday, 02/07, 13:30):

- Jerome Powell’s insights on upcoming interest rate policies can significantly impact market movements. His speech is a prime opportunity to gauge the Federal Reserve’s future policy direction and anticipate market volatility.

- Initial Jobless Claims Report (Wednesday, 03/07, 12:30):

- This report provides crucial insights into the U.S. labor market. Higher-than-expected jobless claims could signal economic weakness, negatively affecting the USD. Conversely, lower claims could bolster the dollar’s strength.

- Non-Farm Payrolls (Friday, 05/07, 12:30):

- As a critical economic indicator, this report reflects the health of the U.S. economy. A higher-than-expected increase in non-farm jobs could be positive for the USD, while a lower number may apply downward pressure.

Don’t miss out on the latest developments in the crypto market. Follow us for up-to-the-minute news and updates!

Solana is a much watch in this coming bullrun