Crypto Market Update of the Week

The past week has been eventful for the cryptocurrency market, with several positive news driving Bitcoin’s significant rise. Despite a shaky start to the week, where Bitcoin dipped from a high of $68,300 to a low of $63,500, the market became more vibrant towards the weekend. Bitcoin ended the week at $68,800, showing minimal change in price compared to the beginning of the week.

However, while Bitcoin attracted most of the capital flow, other cryptocurrencies struggled, with their prices continuing to plummet.

Notably, Ethereum has now joined the “club” of cryptocurrencies allowed to trade via stock ETFs, following in Bitcoin’s footsteps. However, similar to Bitcoin’s initial ETF days, the Ethereum ETF has seen a wave of capital outflows in its early trading days. This is attributed to investors shifting from Grayscale’s fund to other lower-cost options.

BTC Chart

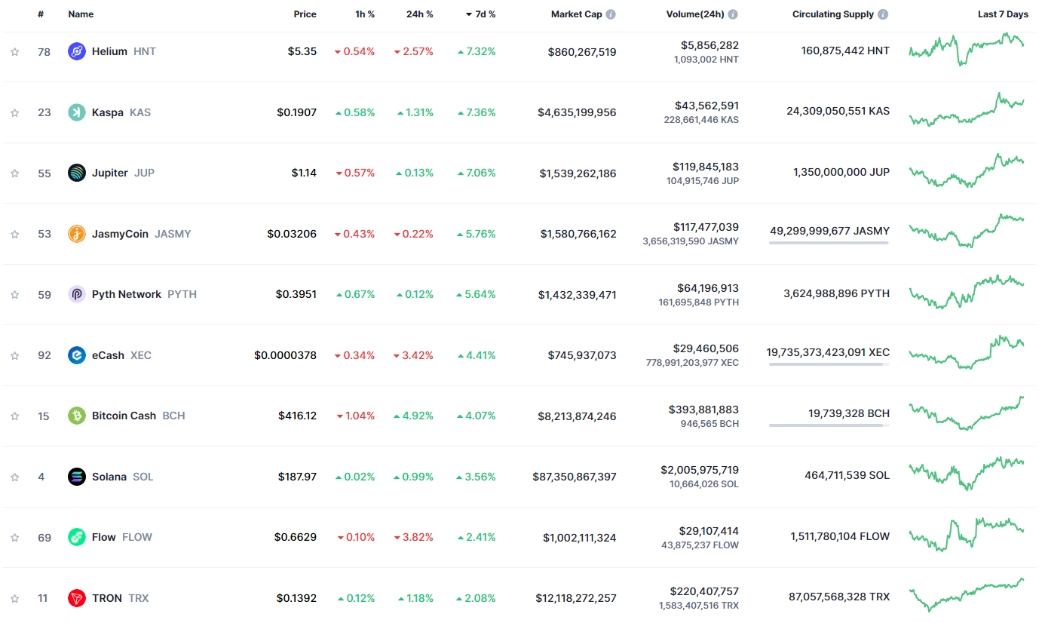

Top 10 Gainers of the Week:

Sources: CoinMarketCap

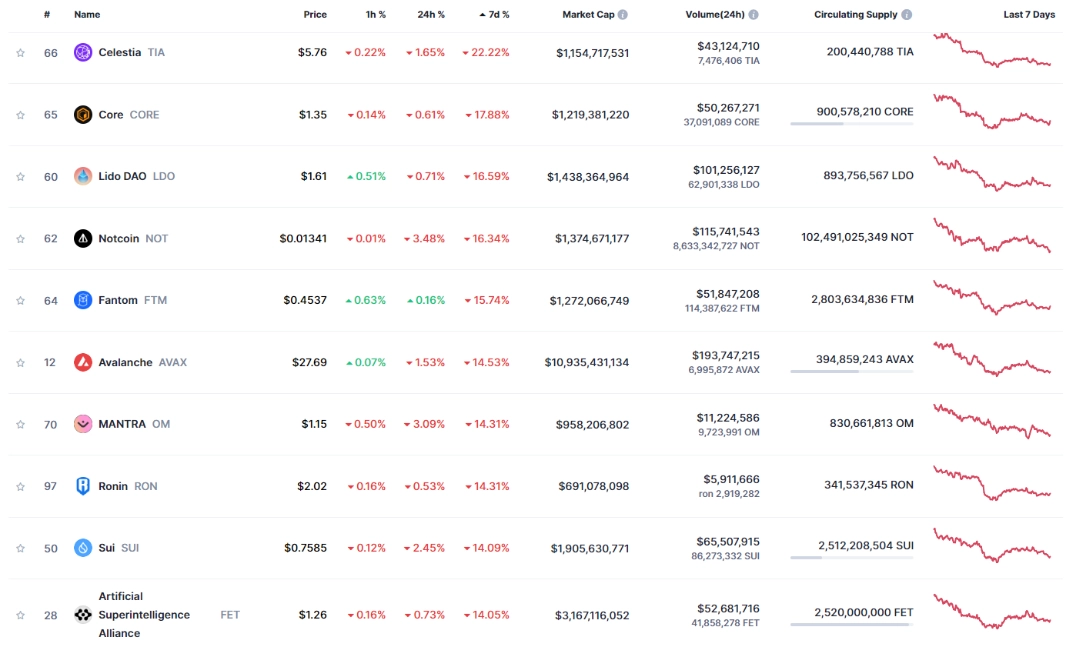

Top 10 Losers of the Week:

Sources: CoinMarketCap

Important News of the Week:

- Donald Trump speaks at Bitcoin 2024 conference

Token Unlocks This Week:

This week’s token unlocks feature some notable projects: Optimism unlocking $54 million, SUI unlocking $52 million, and Wormhole unlocking $175 million.

Macroeconomic News This Week

Investors should pay attention to three key economic events this week that could impact the U.S. dollar exchange rate:

- Wednesday (07/31/2024): The U.S. will release the ADP Non-Farm Employment Change report, an important indicator of labor market health. If the actual figures exceed expectations, the USD may strengthen, and vice versa.

- Thursday (08/01), at 12:30 UTC: Initial Jobless Claims data will be released. This indicator shows short-term employment conditions. If the number of claims is higher than expected, it could signal a negative outlook for the USD, and vice versa.

- Friday (08/02), at 12:30 UTC: The Non-Farm Payrolls report, one of the most closely watched economic indicators, will be released. Higher-than-expected figures typically support a stronger USD, while lower-than-expected figures could weaken the currency.

Don’t forget to follow us for the latest updates on the crypto market!