Crypto Market Last Week

Last week, Bitcoin continued its impressive recovery from the $66,000 level at the start of the week, rising to the $71,000 zone (just over $1,000 away from the peak) and currently trading around $68,500. The reason for this strong price surge was the official approval of the Ethereum ETF by the U.S. Securities and Exchange Commission (SEC).

In a highly surprising and remarkable turn of events, within just a few days, the SEC completely reversed its stance on Ethereum, going from implying that this cryptocurrency is a security to preliminarily approving 8 proposals for Ethereum spot ETFs from major Wall Street names. This decision has become the driving force behind the remarkable growth of Ethereum and tokens in the Ethereum ecosystem last week, reviving investor enthusiasm after a relatively gloomy May.

Along with Ethereum, most other altcoins also experienced a strong recovery, thanks to the flow of money shifting from Bitcoin to altcoins.

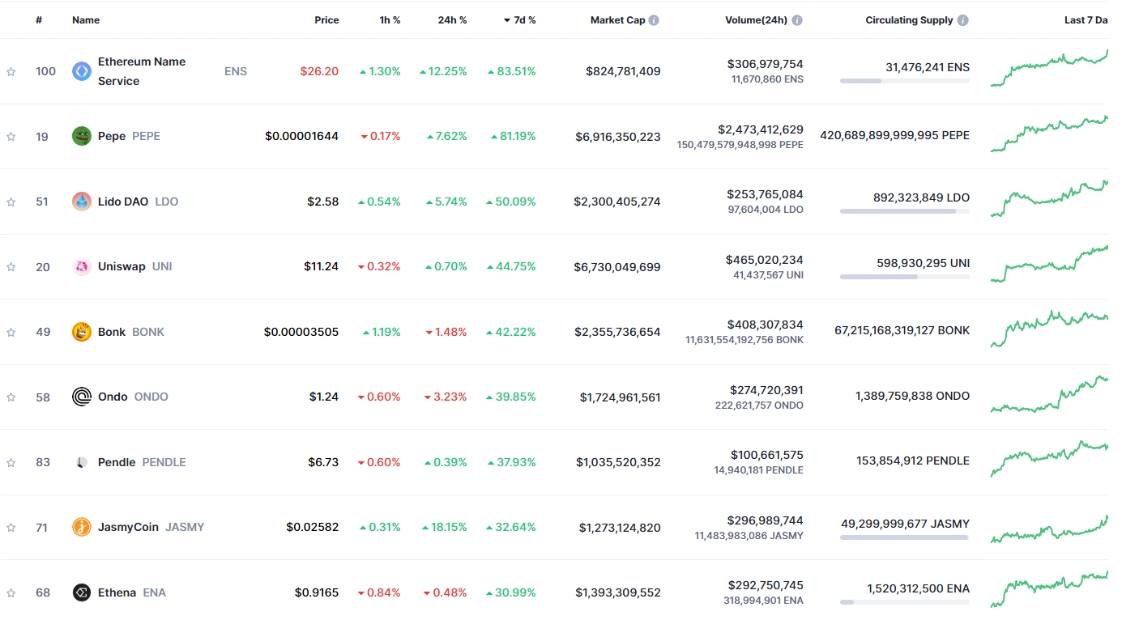

Top 10 Coins with Highest Gains Last Week

Source: Coinmarketcap

Top 10 Coins with Highest Losses Last Week

Source: Coinmarketcap

Important News Last Week

- ZkSync Airdrop Speculation Heats Up for Mid-June Launch

- Trump Campaign Accepts Crypto as Bitcoin Hits $70,000

- Standard Chartered Bank Forecasts Ethereum to Reach $8,000

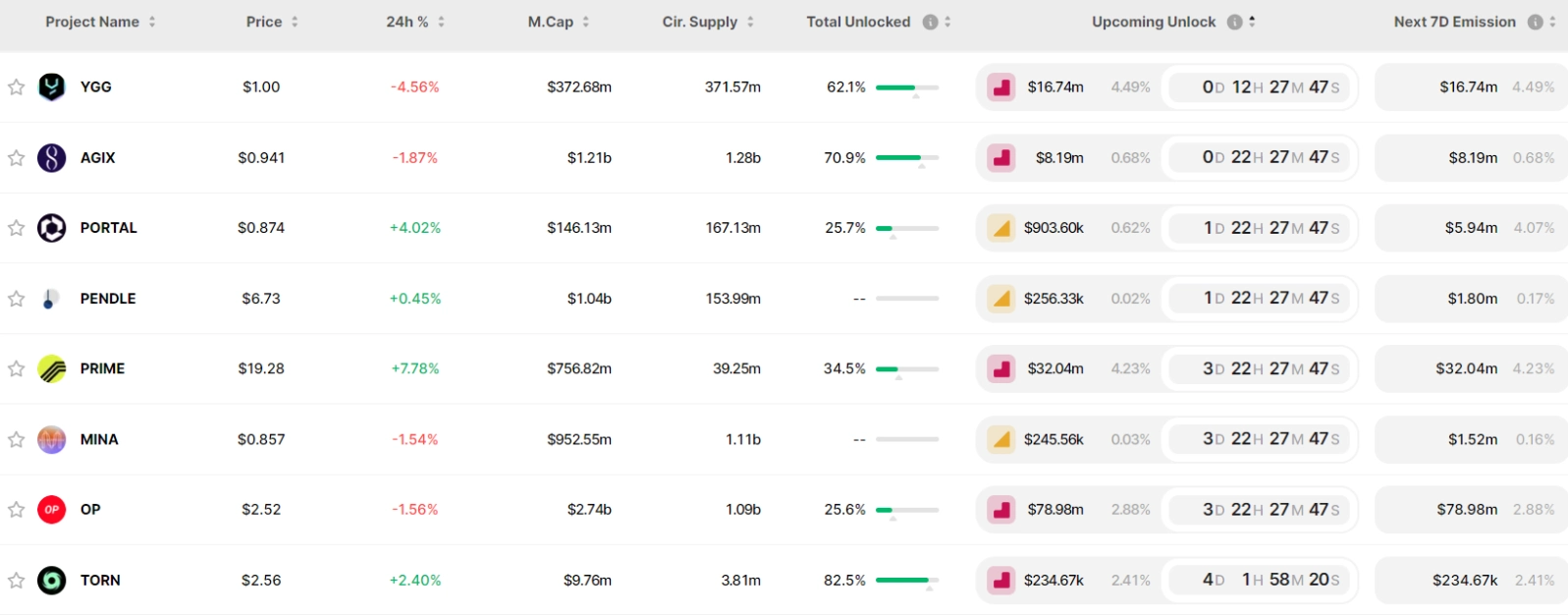

Token Unlocks This Week

This week, a few projects are unlocking large amounts, such as: OP unlocking $79M, DYDX unlocking $361M

Source: token.unlock

Macro News This Week

This week is expected to have little important information. However, as has become the norm, at 12:30 pm (UTC) on Thursday (May 30, 2024), the Initial Jobless Claims data will be released. If this number is higher than forecast, it will be a negative signal for the US dollar, and conversely, if it is lower than forecast, it will support the greenback.

Market reactions to such important economic data usually have a significant impact on exchange rate fluctuations, so investors and traders need to monitor it closely to make appropriate investment decisions.

Don’t forget to follow us to stay updated on the hottest crypto market news!

Greet