Crypto Market Recap for the Past Week

In the third week of March, the market witnessed a strong selling wave from Grayscale. Each day, Grayscale sold approximately 500 – 600 million USD worth of cryptocurrencies. However, the buying pressure from ETFs like BlackRock and others also began to significantly diminish, with trading no longer as vigorous as before. Nonetheless, this did not deter MicroStrategy from completing a new Bitcoin purchase round worth 600 million USD. Additionally, many large investors continued to withdraw Bitcoin from exchanges.

Currently, the price of Bitcoin is fluctuating around 66,800 USD, recovering 6,000 USD from the bottom in the third week of March. This is a positive sign, promising a new week filled with optimism for the entire market.

As for Ethereum, a concerning piece of news is that the Ethereum Foundation is being requested to cooperate in an investigation, possibly by the Securities and Exchange Commission (SEC). This diminishes the likelihood of an Ethereum ETF being approved in the near future. Due to the influence of Bitcoin’s decline and related negative news, the price of ETH has dropped significantly, approximately 20% from its peak, currently fluctuating around 3,450 USD.

However, there are still bright spots in the market, such as the meme coin frenzy on Solana (SOL) and Ton, as well as the rise of Real World Asset ecosystems.

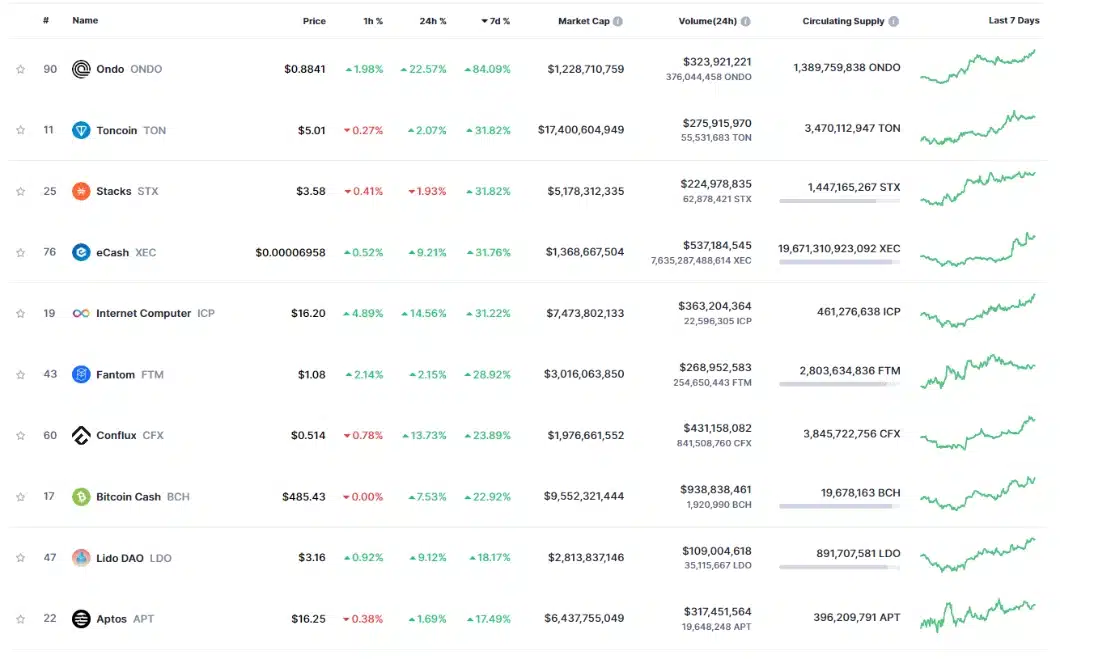

Top 10 Performing Coins of the Week

Source: CoinMarketCap

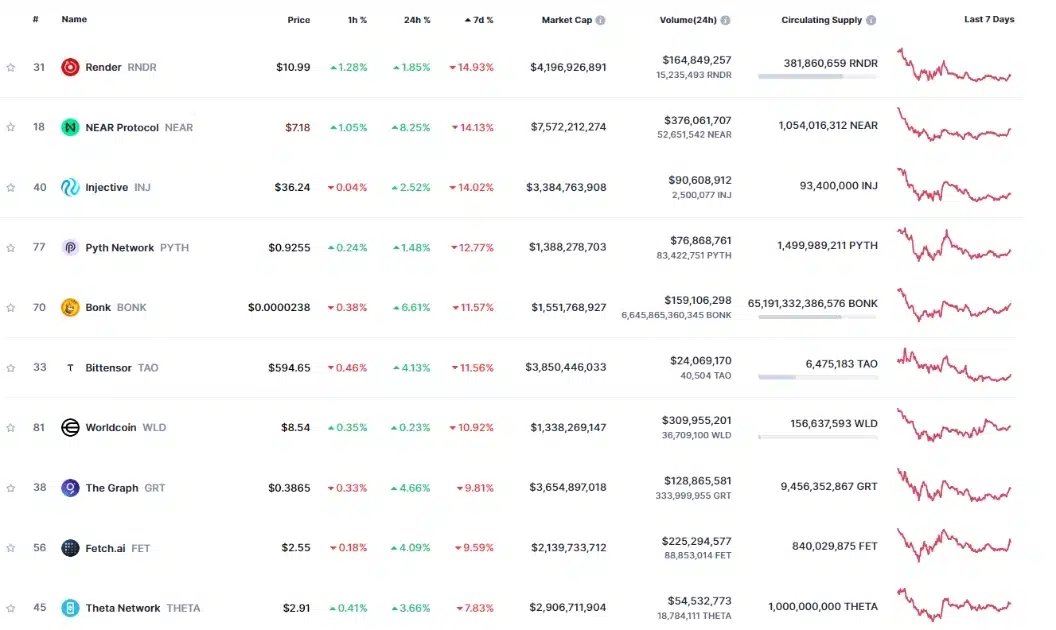

Top 10 Declining Coins of the Week

Source: CoinMarketCap

Highlighted News of the Week

- Founder of NFT Collection Milady Targeted by Hacker Attack

- Former Binance CEO CZ Announces Upcoming Plans

Macro Events this Week

This week will see a series of significant economic announcements that could significantly impact the crypto market:

At 1:30 PM on Thursday (03/28/2024), Initial Jobless Claims data will be released. Traditionally, actual numbers higher than forecasts are seen as negative signals for the USD, and vice versa.

Additionally, the US will also release Gross Domestic Product (GDP) figures during the same timeframe. However, unlike unemployment figures, if actual GDP exceeds forecasts, it will be viewed as positive news, boosting the value of the greenback.

Furthermore, at 3:30 PM on Friday (03/29/2024), a speech by Federal Reserve Chairman Jerome Powell will also receive special attention, potentially outlining future monetary policy directions.